Question: QUESTION ONE (40 MARKS) You are presented with the monthly stock prices of five (5) listed companies labeled Stock Prices. You are also presented with

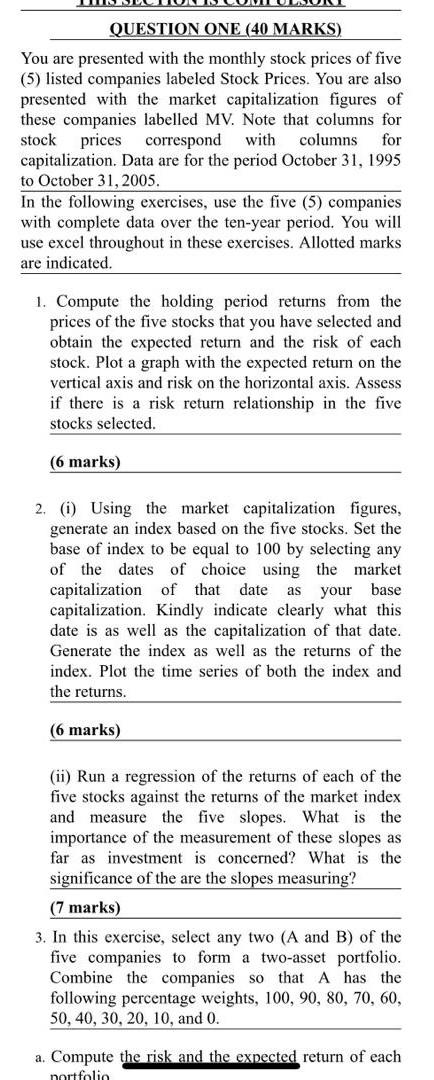

QUESTION ONE (40 MARKS) You are presented with the monthly stock prices of five (5) listed companies labeled Stock Prices. You are also presented with the market capitalization figures of these companies labelled MV. Note that columns for stock prices correspond with columns for capitalization. Data are for the period October 31, 1995 to October 31, 2005. In the following exercises, use the five (5) companies with complete data over the ten-year period. You will use excel throughout in these exercises. Allotted marks are indicated. 1. Compute the holding period returns from the prices of the five stocks that you have selected and obtain the expected return and the risk of each stock. Plot a graph with the expected return on the vertical axis and risk on the horizontal axis. Assess if there is a risk return relationship in the five stocks selected. (6 marks) as 2. (1) Using the market capitalization figures, generate an index based on the five stocks. Set the base of index to be equal to 100 by selecting any of the dates of choice using the market capitalization of that date capitalization. Kindly indicate clearly what this date is as well as the capitalization of that date. Generate the index as well as the returns of the index. Plot the time series of both the index and the returns. your base (6 marks) (ii) Run a regression of the returns of each of the five stocks against the returns of the market index and measure the five slopes. What is the importance of the measurement of these slopes as far as investment is concerned? What is the significance of the are the slopes measuring? (7 marks) 3. In this exercise, select any two (A and B) of the five companies to form a two-asset portfolio. Combine the companies so that A has the following percentage weights, 100, 90, 80, 70, 60, 50, 40, 30, 20, 10, and 0. a. Compute the risk and the expected return of each nortfolio QUESTION ONE (40 MARKS) You are presented with the monthly stock prices of five (5) listed companies labeled Stock Prices. You are also presented with the market capitalization figures of these companies labelled MV. Note that columns for stock prices correspond with columns for capitalization. Data are for the period October 31, 1995 to October 31, 2005. In the following exercises, use the five (5) companies with complete data over the ten-year period. You will use excel throughout in these exercises. Allotted marks are indicated. 1. Compute the holding period returns from the prices of the five stocks that you have selected and obtain the expected return and the risk of each stock. Plot a graph with the expected return on the vertical axis and risk on the horizontal axis. Assess if there is a risk return relationship in the five stocks selected. (6 marks) as 2. (1) Using the market capitalization figures, generate an index based on the five stocks. Set the base of index to be equal to 100 by selecting any of the dates of choice using the market capitalization of that date capitalization. Kindly indicate clearly what this date is as well as the capitalization of that date. Generate the index as well as the returns of the index. Plot the time series of both the index and the returns. your base (6 marks) (ii) Run a regression of the returns of each of the five stocks against the returns of the market index and measure the five slopes. What is the importance of the measurement of these slopes as far as investment is concerned? What is the significance of the are the slopes measuring? (7 marks) 3. In this exercise, select any two (A and B) of the five companies to form a two-asset portfolio. Combine the companies so that A has the following percentage weights, 100, 90, 80, 70, 60, 50, 40, 30, 20, 10, and 0. a. Compute the risk and the expected return of each nortfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts