Question: QUESTION ONE (a) What is a triangular currency arbitrage? Briefly explain the concept with an example. (5 Marks) (b) If the last month's exchange rate

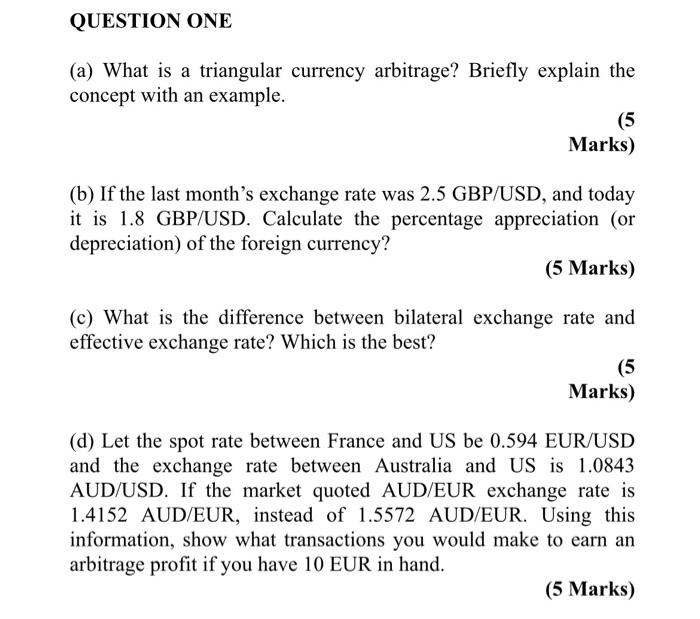

QUESTION ONE (a) What is a triangular currency arbitrage? Briefly explain the concept with an example. (5 Marks) (b) If the last month's exchange rate was 2.5 GBP/USD, and today it is 1.8 GBP/USD. Calculate the percentage appreciation (or depreciation) of the foreign currency? (5 Marks) (c) What is the difference between bilateral exchange rate and effective exchange rate? Which is the best? (5 Marks) (d) Let the spot rate between France and US be 0.594 EUR/USD and the exchange rate between Australia and US is 1.0843 AUD/ USD. If the market quoted AUD/EUR exchange rate is 1.4152 AUD/EUR, instead of 1.5572 AUD/EUR. Using this information, show what transactions you would make to earn an arbitrage profit if you have 10 EUR in hand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts