Question: &&& && &&&&&&&&&& Question One: - Amman Company purchased a new equipment on October 1, 2020. The cost of the equipment is $160,000 with an

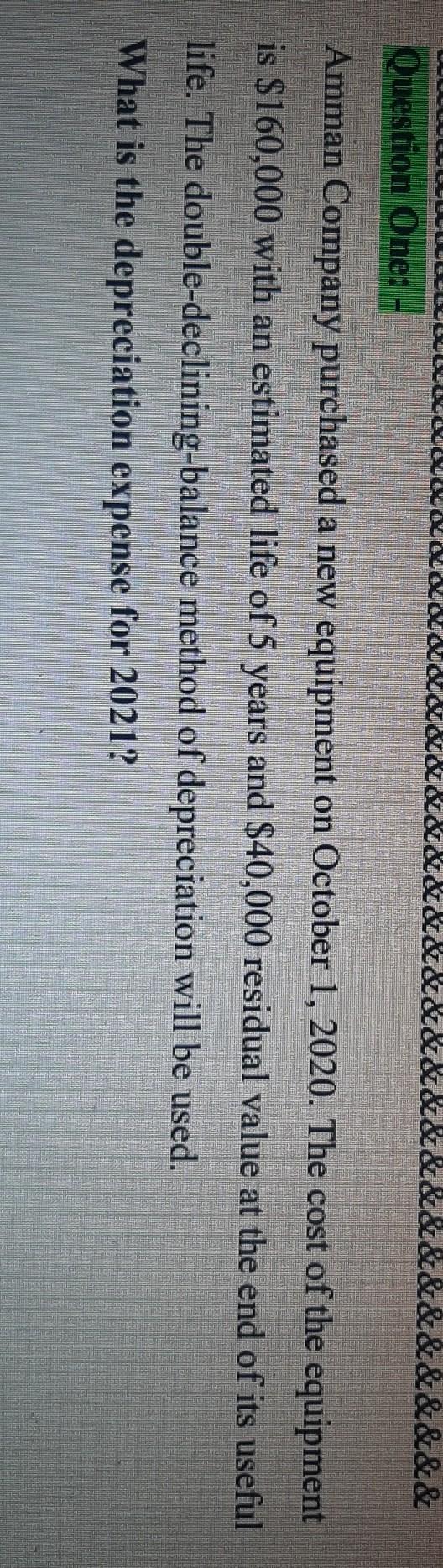

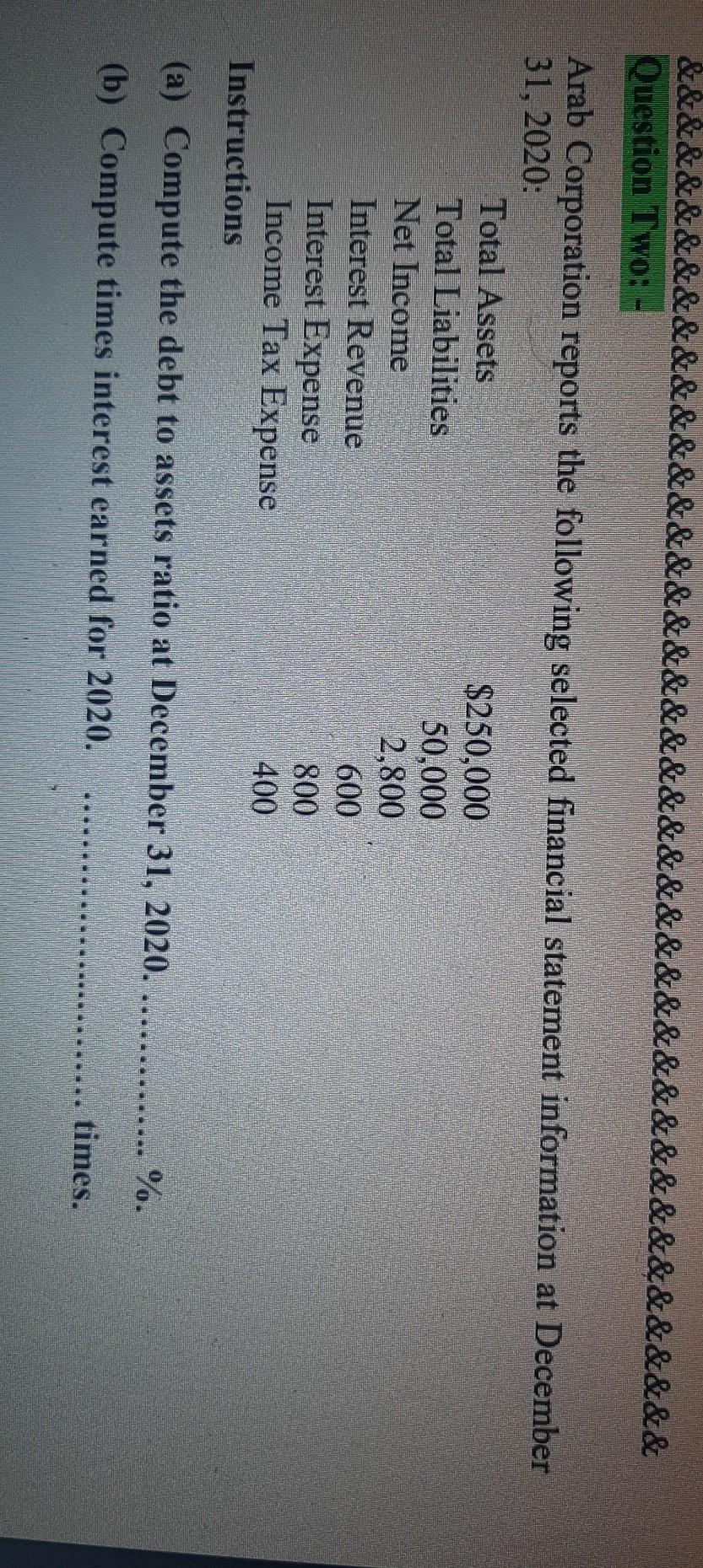

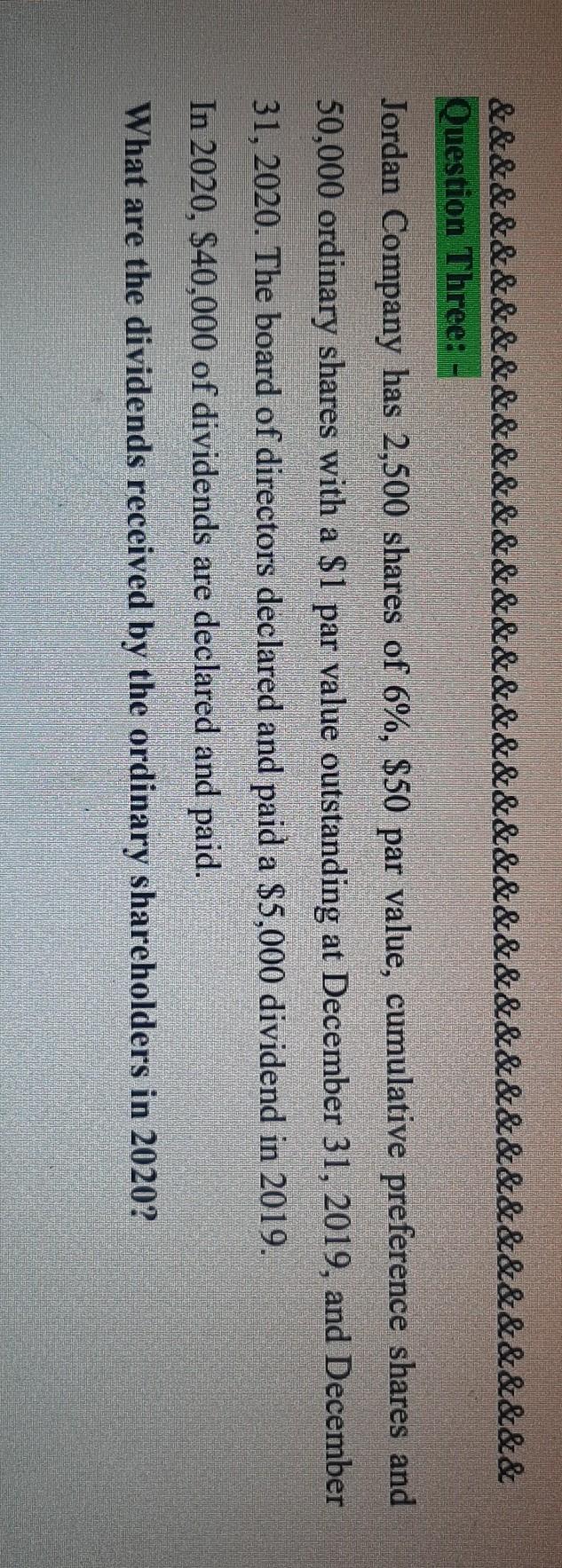

&&& && &&&&&&&&&& Question One: - Amman Company purchased a new equipment on October 1, 2020. The cost of the equipment is $160,000 with an estimated life of 5 years and $40,000 residual value at the end of its useful life. The double-declining-balance method of depreciation will be used. What is the depreciation expense for 2021? &&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&& Question Two: Arab Corporation reports the following selected financial statement information at December 31, 2020: Total Assets $250,000 Total Liabilities 50,000 Net Income 2,800 Interest Revenue 600 Interest Expense 800 Income Tax Expense 400 Instructions (a) Compute the debt to assets ratio at December 31, 2020. (b) Compute times interest earned for 2020. %. times. &&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&&& Question Three: Jordan Company has 2,500 shares of 6%, $50 par value, cumulative preference shares and 50,000 ordinary shares with a $1 par value outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $5,000 dividend in 2019. In 2020, $40,000 of dividends are declared and paid. What are the dividends received by the ordinary shareholders in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts