Question: question one Assignment 1. Given the sales assumptions for 1996 and 1997, project the rest of the income statement and balance sheet. a. Add as

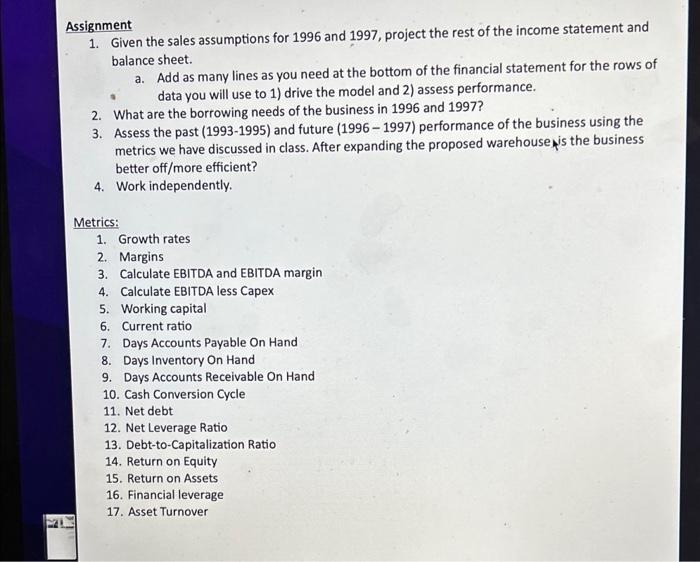

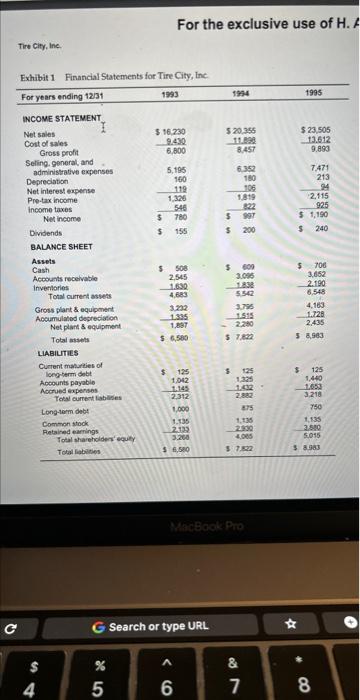

Assignment 1. Given the sales assumptions for 1996 and 1997, project the rest of the income statement and balance sheet. a. Add as many lines as you need at the bottom of the financial statement for the rows of data you will use to 1 ) drive the model and 2) assess performance. 2. What are the borrowing needs of the business in 1996 and 1997 ? 3. Assess the past (1993-1995) and future (1996 - 1997) performance of the business using the metrics we have discussed in class. After expanding the proposed warehouse is the business better off/more efficient? 4. Work independently. Metrics: 1. Growth rates 2. Margins 3. Calculate EBITDA and EBITDA margin 4. Calculate EBITDA less Capex 5. Working capital 6. Current ratio 7. Days Accounts Payable On Hand 8. Days Inventory On Hand 9. Days Accounts Receivable On Hand 10. Cash Conversion Cycle 11. Net debt 12. Net Leverage Ratio 13. Debt-to-Capitalization Ratio 14. Return on Equity 15. Return on Assets 16. Financial leverage 17. Asset Turnover For the exclusive use of H Tire city, Ine. Assignment 1. Given the sales assumptions for 1996 and 1997, project the rest of the income statement and balance sheet. a. Add as many lines as you need at the bottom of the financial statement for the rows of data you will use to 1 ) drive the model and 2) assess performance. 2. What are the borrowing needs of the business in 1996 and 1997 ? 3. Assess the past (1993-1995) and future (1996 - 1997) performance of the business using the metrics we have discussed in class. After expanding the proposed warehouse is the business better off/more efficient? 4. Work independently. Metrics: 1. Growth rates 2. Margins 3. Calculate EBITDA and EBITDA margin 4. Calculate EBITDA less Capex 5. Working capital 6. Current ratio 7. Days Accounts Payable On Hand 8. Days Inventory On Hand 9. Days Accounts Receivable On Hand 10. Cash Conversion Cycle 11. Net debt 12. Net Leverage Ratio 13. Debt-to-Capitalization Ratio 14. Return on Equity 15. Return on Assets 16. Financial leverage 17. Asset Turnover For the exclusive use of H Tire city, Ine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts