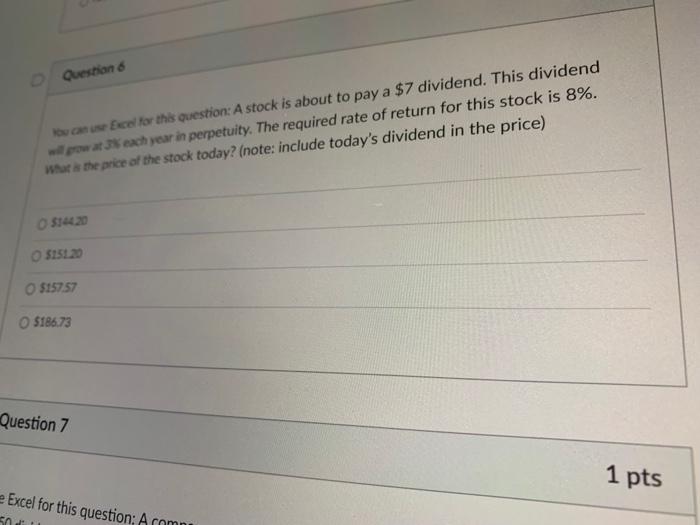

Question: Question one Bcel for this question: A stock is about to pay a $7 dividend. This dividend wil grow at each year in perpetuity. The

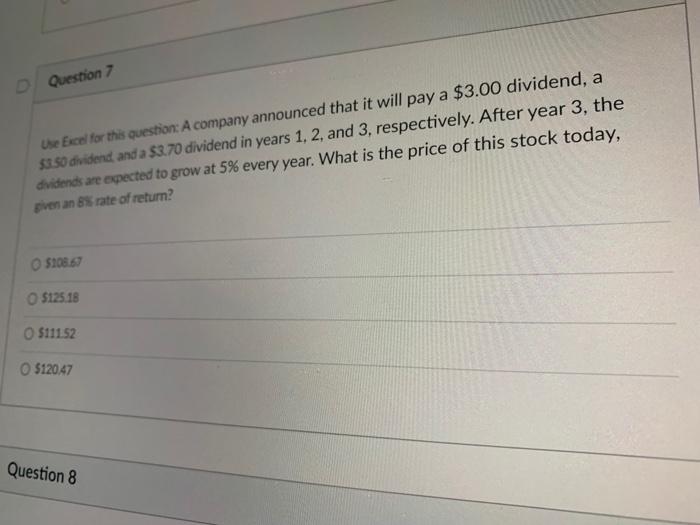

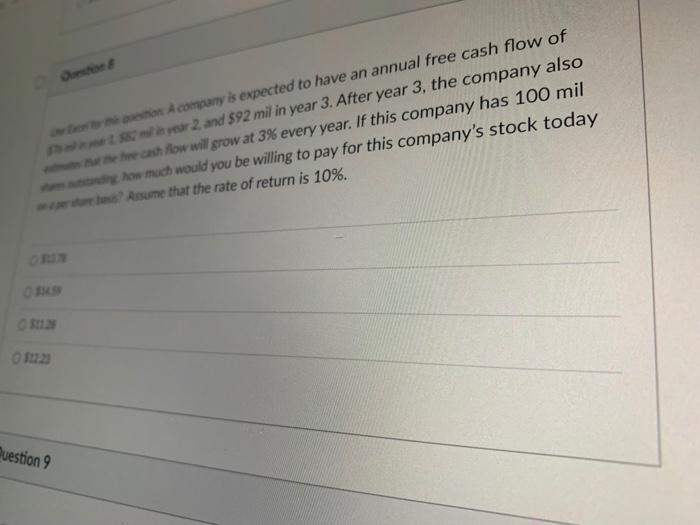

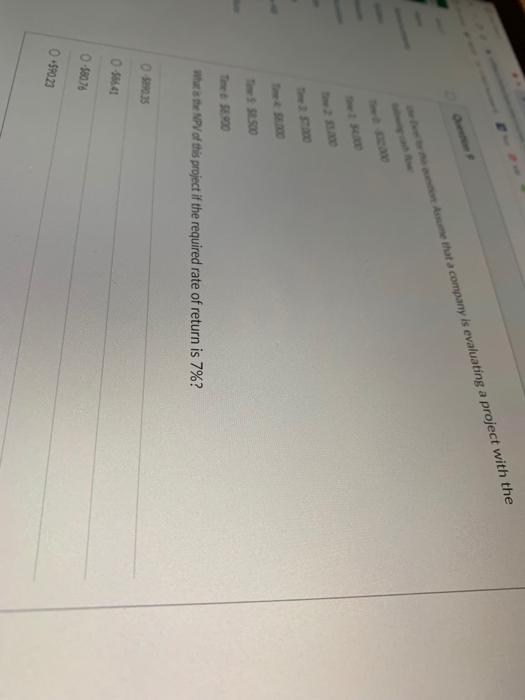

Question one Bcel for this question: A stock is about to pay a $7 dividend. This dividend wil grow at each year in perpetuity. The required rate of return for this stock is 8%. What the price of the stock today? (note: include today's dividend in the price) 514420 51512 $157.57 $186.73 Question 7 1 pts Excel for this question: A como D Question 7 Use Excel for this question: A company announced that it will pay a $3.00 dividend, a $350 dividend and a $2.70 dividend in years 1, 2, and 3, respectively. After year 3, the dividends are expected to grow at 5% every year. What is the price of this stock today, piven an 8% rate of return? $108.67 O $125 18 O $111.52 O $120.47 Question 8 A company is expected to have an annual free cash flow of per 2 and $92 mil in year 3. After year 3, the company also the cash flow will grow at 3% every year. If this company has 100 mil how much would you be willing to pay for this company's stock today Assume that the rate of return is 10%. 1423 Question 9 me that a company is evaluating a project with the what the NPV of this project if the required rate of return is 7%? Os 0-580.76 +590.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts