Question: QUESTION ONE CASE STUDY 45 MARKS READ THE CASE STUDY AND ANSWER THE QUESTIONS THAT FOLLOW: Spirit Limited is a manufacturer of electrical appliances.

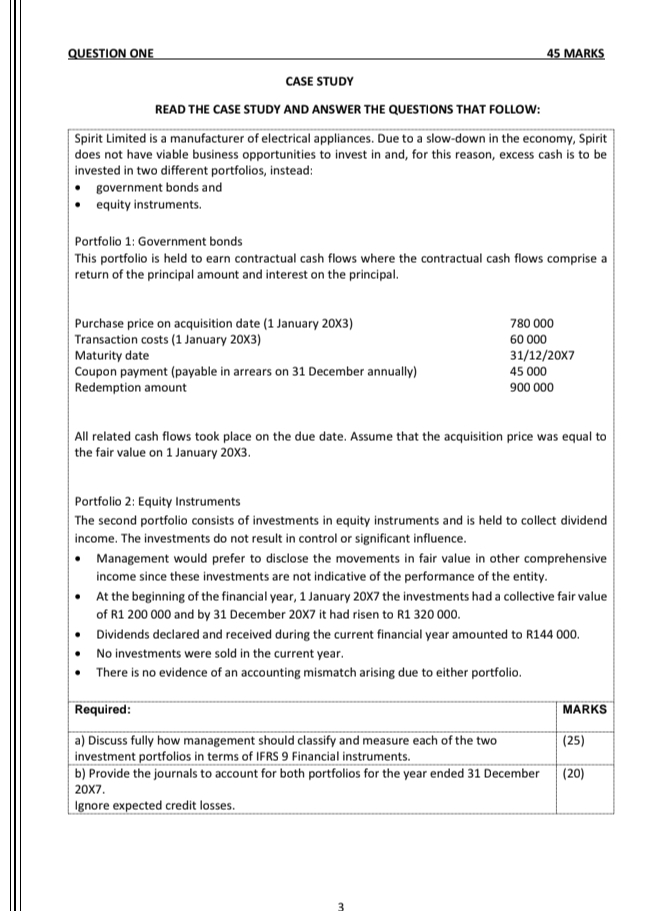

QUESTION ONE CASE STUDY 45 MARKS READ THE CASE STUDY AND ANSWER THE QUESTIONS THAT FOLLOW: Spirit Limited is a manufacturer of electrical appliances. Due to a slow-down in the economy, Spirit does not have viable business opportunities to invest in and, for this reason, excess cash is to be invested in two different portfolios, instead: government bonds and equity instruments. Portfolio 1: Government bonds This portfolio is held to earn contractual cash flows where the contractual cash flows comprise a return of the principal amount and interest on the principal. Purchase price on acquisition date (1 January 20X3) Transaction costs (1 January 20X3) Maturity date Coupon payment (payable in arrears on 31 December annually) Redemption amount 780 000 60 000 31/12/20X7 45 000 900 000 All related cash flows took place on the due date. Assume that the acquisition price was equal to the fair value on 1 January 20X3. Portfolio 2: Equity Instruments The second portfolio consists of investments in equity instruments and is held to collect dividend income. The investments do not result in control or significant influence. Management would prefer to disclose the movements in fair value in other comprehensive income since these investments are not indicative of the performance of the entity. At the beginning of the financial year, 1 January 20X7 the investments had a collective fair value of R1 200 000 and by 31 December 20X7 it had risen to R1 320 000. Dividends declared and received during the current financial year amounted to R144 000. No investments were sold in the current year. There is no evidence of an accounting mismatch arising due to either portfolio. Required: a) Discuss fully how management should classify and measure each of the two investment portfolios in terms of IFRS 9 Financial instruments. MARKS (25) b) Provide the journals to account for both portfolios for the year ended 31 December 20X7. (20) Ignore expected credit losses.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts