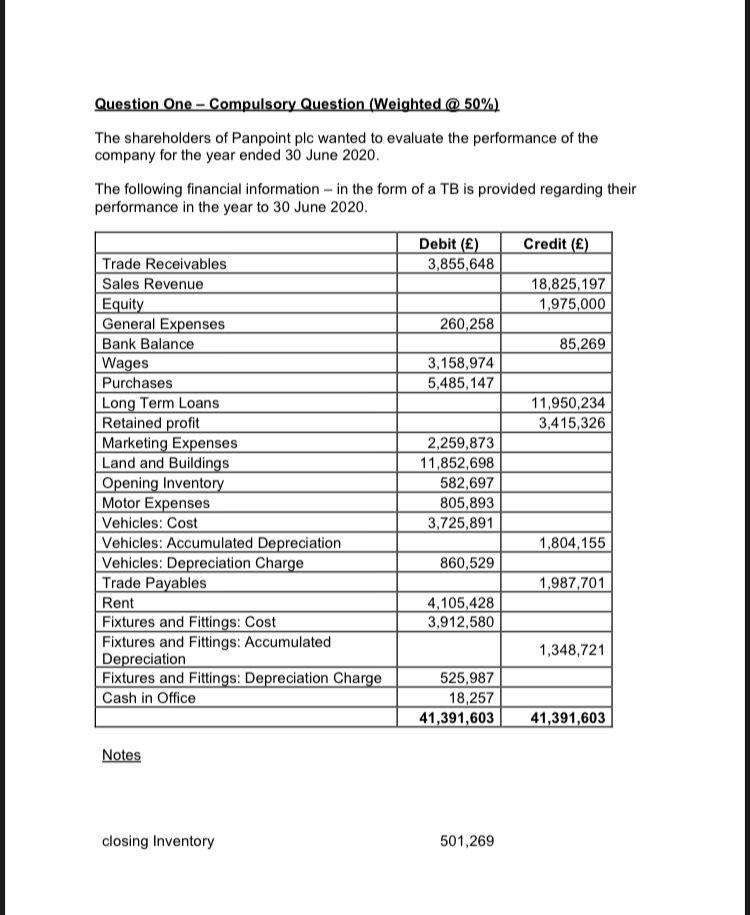

Question: Question One - Compulsory Question (Weighted @ 50%) The shareholders of Panpoint plc wanted to evaluate the performance of the company for the year ended

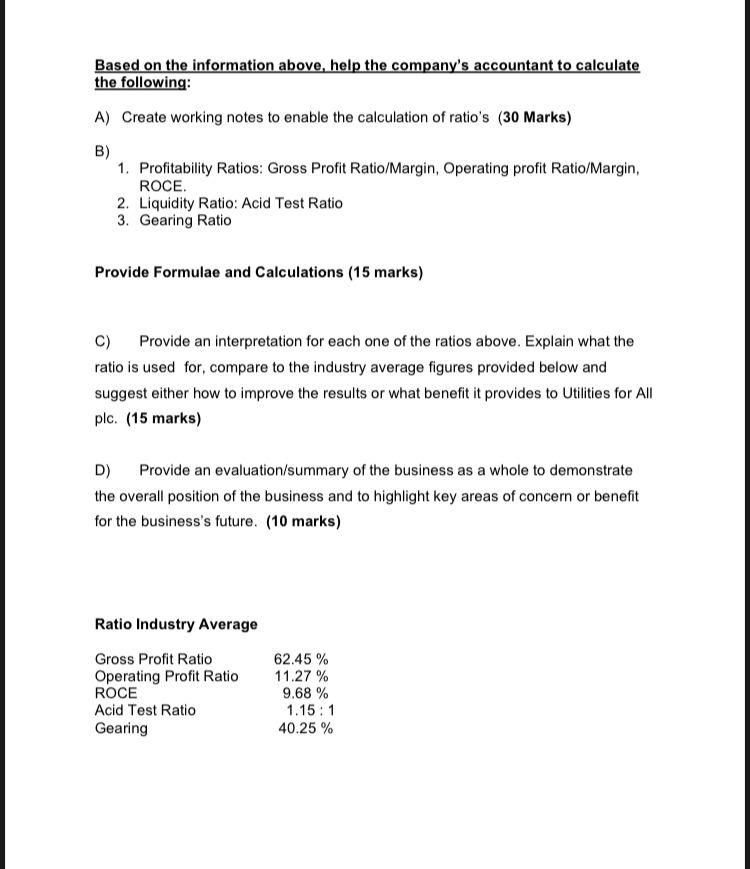

Question One - Compulsory Question (Weighted @ 50%) The shareholders of Panpoint plc wanted to evaluate the performance of the company for the year ended 30 June 2020. The following financial information - in the form of a TB is provided regarding their performance in the year to 30 June 2020. Credit () Debit () 3,855,648 18,825,197 1,975,000 260,258 85,269 3,158,974 5,485,147 11,950,234 3,415,326 Trade Receivables Sales Revenue Equity General Expenses Bank Balance Wages Purchases Long Term Loans Retained profit Marketing Expenses Land and Buildings Opening Inventory Motor Expenses Vehicles: Cost Vehicles: Accumulated Depreciation Vehicles: Depreciation Charge Trade Payables Rent Fixtures and Fittings: Cost Fixtures and Fittings: Accumulated Depreciation Fixtures and Fittings: Depreciation Charge Cash in Office 2,259,873 11,852,698 582,697 805,893 3,725,891 1,804,155 860,529 1,987,701 4,105,428 3,912,580 1,348,721 525,987 18,257 41,391,603 41,391,603 Notes closing Inventory 501,269 Based on the information above, help the company's accountant to calculate the following: A) Create working notes to enable the calculation of ratio's (30 Marks) B) 1. Profitability Ratios: Gross Profit Ratio/Margin, Operating profit Ratio/Margin, ROCE 2. Liquidity Ratio: Acid Test Ratio 3. Gearing Ratio Provide Formulae and Calculations (15 marks) C) Provide an interpretation for each one of the ratios above. Explain what the ratio is used for, compare to the industry average figures provided below and suggest either how to improve the results or what benefit it provides to Utilities for All plc. (15 marks) D) Provide an evaluation/summary of the business as a whole to demonstrate the overall position of the business and to highlight key areas of concern or benefit for the business's future. (10 marks) Ratio Industry Average Gross Profit Ratio Operating Profit Ratio ROCE Acid Test Ratio Gearing 62.45% 11.27 % 9.68 % 1.15: 1 40.25% Question One - Compulsory Question (Weighted @ 50%) The shareholders of Panpoint plc wanted to evaluate the performance of the company for the year ended 30 June 2020. The following financial information - in the form of a TB is provided regarding their performance in the year to 30 June 2020. Credit () Debit () 3,855,648 18,825,197 1,975,000 260,258 85,269 3,158,974 5,485,147 11,950,234 3,415,326 Trade Receivables Sales Revenue Equity General Expenses Bank Balance Wages Purchases Long Term Loans Retained profit Marketing Expenses Land and Buildings Opening Inventory Motor Expenses Vehicles: Cost Vehicles: Accumulated Depreciation Vehicles: Depreciation Charge Trade Payables Rent Fixtures and Fittings: Cost Fixtures and Fittings: Accumulated Depreciation Fixtures and Fittings: Depreciation Charge Cash in Office 2,259,873 11,852,698 582,697 805,893 3,725,891 1,804,155 860,529 1,987,701 4,105,428 3,912,580 1,348,721 525,987 18,257 41,391,603 41,391,603 Notes closing Inventory 501,269 Based on the information above, help the company's accountant to calculate the following: A) Create working notes to enable the calculation of ratio's (30 Marks) B) 1. Profitability Ratios: Gross Profit Ratio/Margin, Operating profit Ratio/Margin, ROCE 2. Liquidity Ratio: Acid Test Ratio 3. Gearing Ratio Provide Formulae and Calculations (15 marks) C) Provide an interpretation for each one of the ratios above. Explain what the ratio is used for, compare to the industry average figures provided below and suggest either how to improve the results or what benefit it provides to Utilities for All plc. (15 marks) D) Provide an evaluation/summary of the business as a whole to demonstrate the overall position of the business and to highlight key areas of concern or benefit for the business's future. (10 marks) Ratio Industry Average Gross Profit Ratio Operating Profit Ratio ROCE Acid Test Ratio Gearing 62.45% 11.27 % 9.68 % 1.15: 1 40.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts