Question: Question One Contact Tracing Ltd owns a property which it rents out to some of its employees. The property was purchased for GH90,000 on first

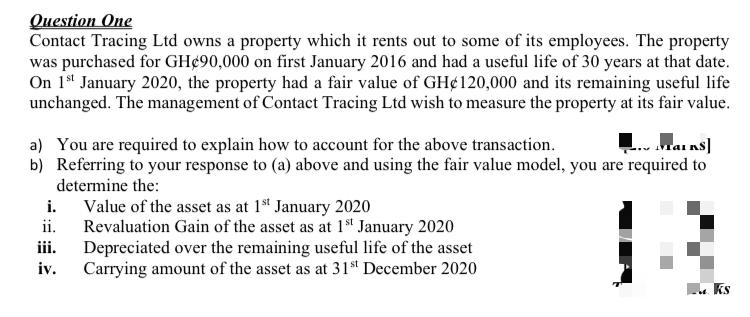

Question One Contact Tracing Ltd owns a property which it rents out to some of its employees. The property was purchased for GH90,000 on first January 2016 and had a useful life of 30 years at that date. On 1st January 2020, the property had a fair value of GH120,000 and its remaining useful life unchanged. The management of Contact Tracing Ltd wish to measure the property at its fair value. a) You are required to explain how to account for the above transaction. b) Referring to your response to (a) above and using the fair value model, you are required to determine the: i. Value of the asset as at 1st January 2020 ii. Revaluation Gain of the asset as at 1st January 2020 Depreciated over the remaining useful life of the asset iv. Carrying amount of the asset as at 31 December 2020 1. Mains]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts