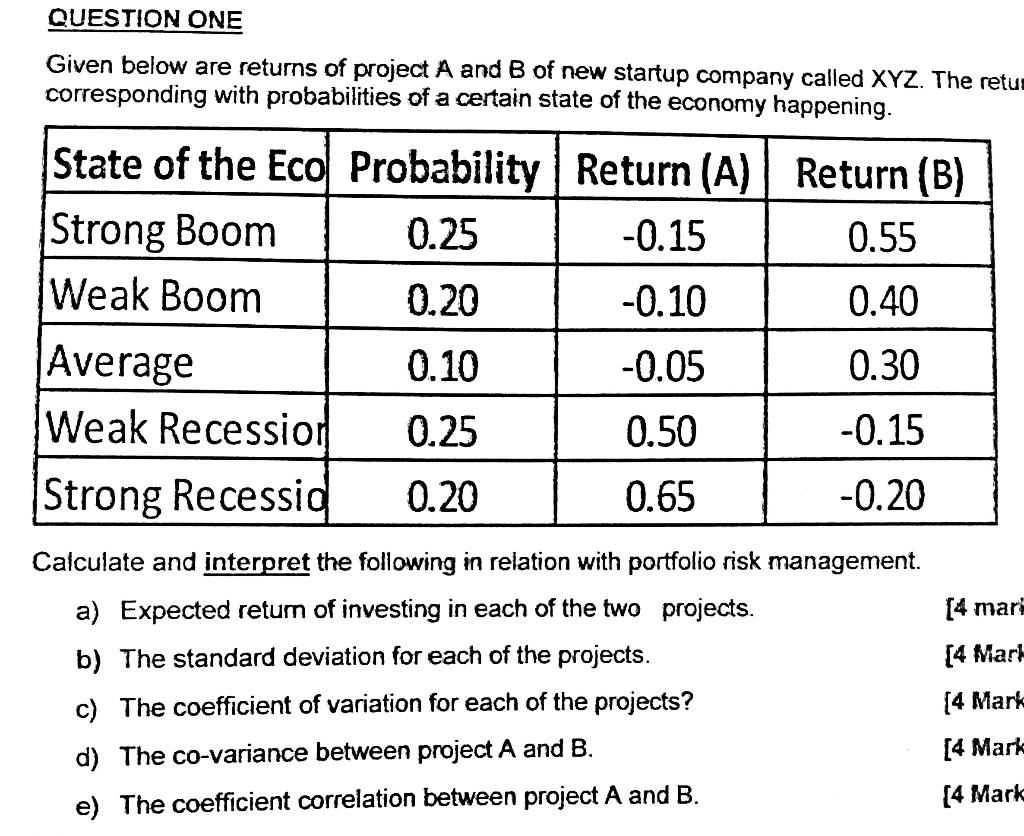

Question: QUESTION ONE Given below are returns of project A and B of new startup company called XYZ. The retu corresponding with probabilities of a certain

QUESTION ONE Given below are returns of project A and B of new startup company called XYZ. The retu corresponding with probabilities of a certain state of the economy happening. State of the Eco Probability Return (A) Return (B) Strong Boom 0.25 -0.15 0.55 Weak Boom 0.20 -0.10 0.40 Average 0.10 -0.05 0.30 Weak Recession 0.25 0.50 -0.15 Strong Recessid 0.20 0.65 -0.20 Calculate and interpret the following in relation with portfolio risk management. a) Expected return of investing in each of the two projects. b) The standard deviation for each of the projects. c) The coefficient of variation for each of the projects? d) The co-variance between project A and B. e) The coefficient correlation between project A and B. [4 mar [4 Mark [4 Mark [4 Mark [4 Mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts