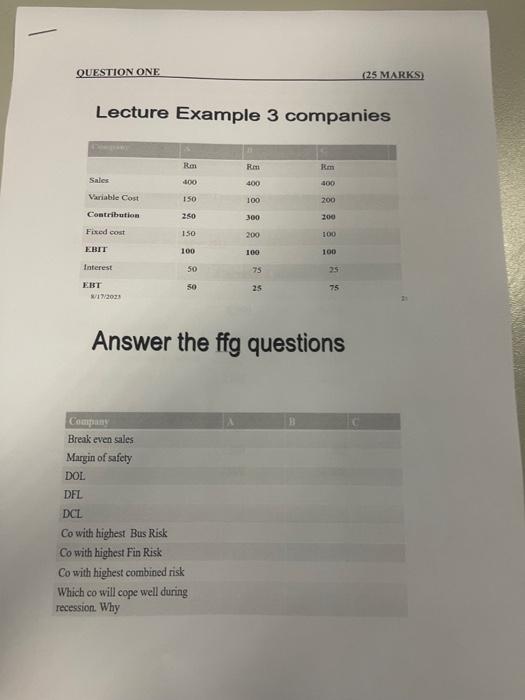

Question: QUESTION ONE Lecture Example 3 companies Sales Variable Cost Contribution Fixed cost EBIT Interest EBT 8/17/2023 Rm 400 150 250 150 100 50 50 B

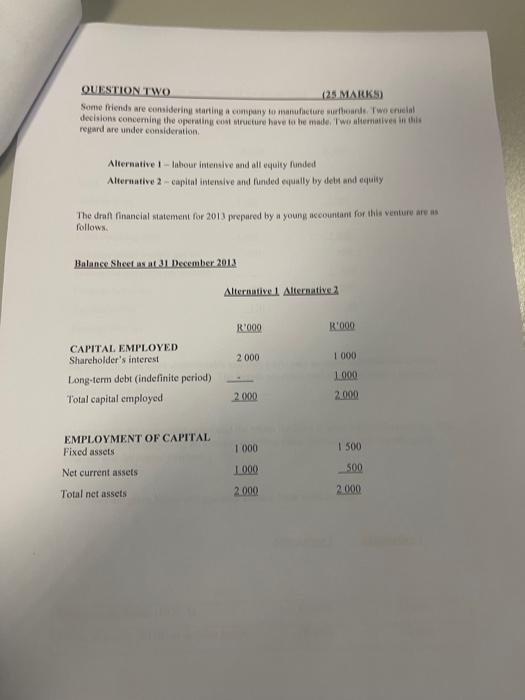

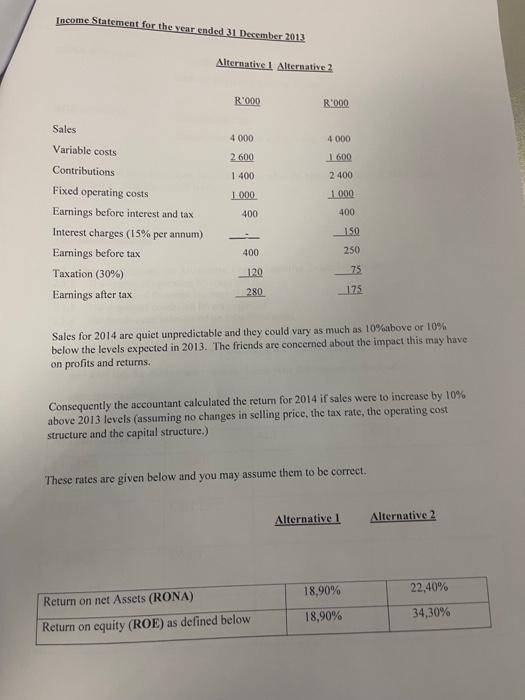

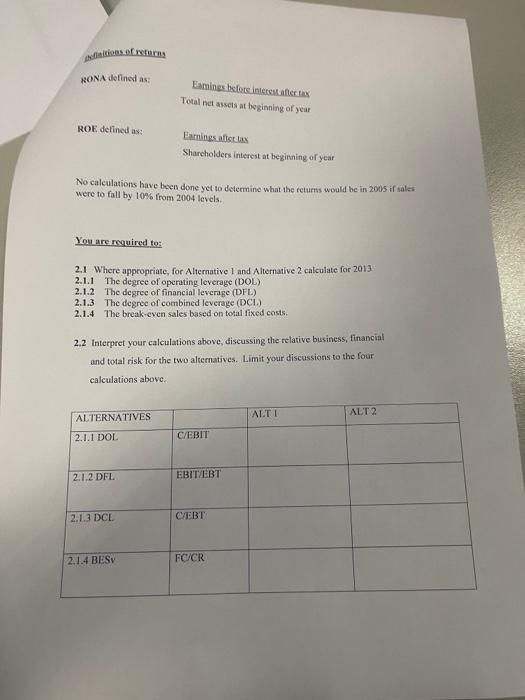

Lecture Example 3 companies Answer the ffg questions regard are under consideration. Alteraative 1-labour intentive and all equity funded Alternative 2 - capital intendive and funded equally by deb and equily The drafl financial statement for 2013 prepared by a young accountant for this venture are as followx. Balance Shect as at 31 December 2013 Sales for 2014 are quiet unpredictable and they could vary as much as \10 above or \10 below the levels expected in 2013 . The friends are concerned about the impact this may have on profits and returns. Consequently the accountant calculated the retum for 2014 if sales were to increase by \10 above 2013 levels (assuming no changes in selling price, the tax rate, the operating cost structure and the capital structure.) These rates are given below and you may assume them to be correct. No calculations have been done yet to defermine what the returms would be in 2005 if sales were to fall by \10 from 2004 levels. You are required to: 2.1 Where appropriate, for Alternative 1 and Alternative 2 calculate for 2013 2.1.1 The degree of operating leverage (DOL) 2.1.2 The degree of financial leverage (DFL) 2.1.3 The degree of combined leverage (DCL) 2.1.4 The break-even sales based on total fixed costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts