Question: question one ) Marcel Co. is growing quickly. Dividends are expected to grow at a 23 percent rate for the next 3 years, with the

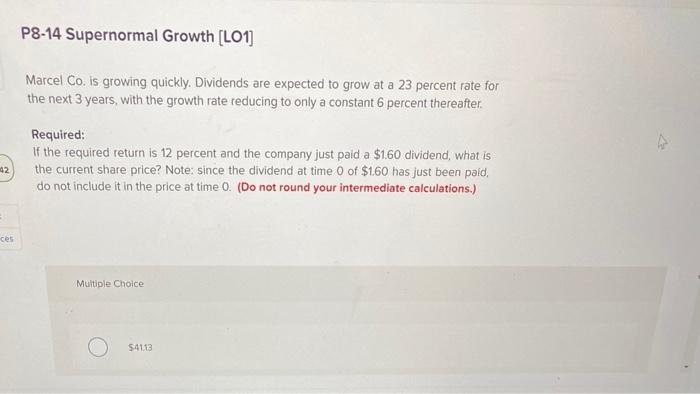

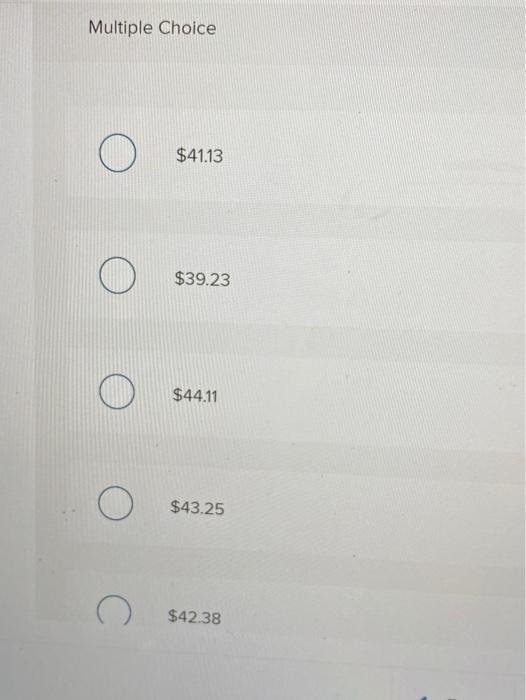

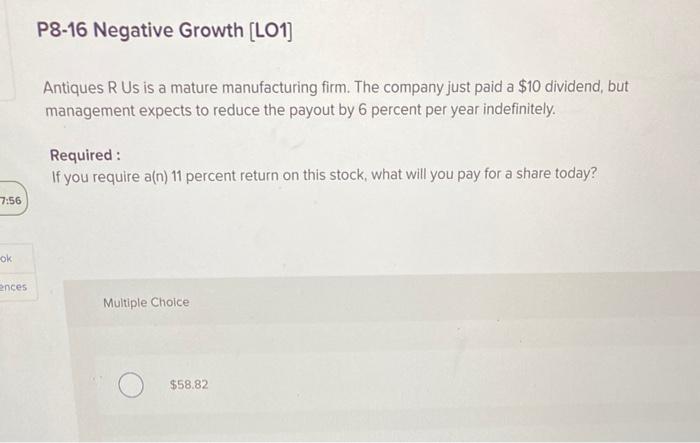

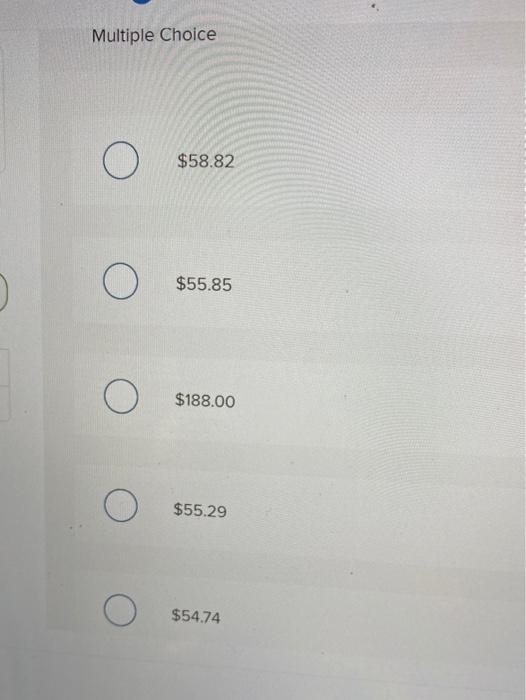

P8-14 Supernormal Growth (LO1] Marcel Co. is growing quickly. Dividends are expected to grow at a 23 percent rate for the next 3 years, with the growth rate reducing to only a constant 6 percent thereafter. 4 Required: If the required return is 12 percent and the company just paid a $1.60 dividend, what is the current share price? Note: since the dividend at time of $1.60 has just been paid, do not include it in the price at time 0. (Do not round your intermediate calculations.) 42 Multiple Choice $41.13 Multiple Choice $41.13 $39.23 $44.11 $43.25 C $42.38 P8-16 Negative Growth (LO1] Antiques R Us is a mature manufacturing firm. The company just paid a $10 dividend, but management expects to reduce the payout by 6 percent per year indefinitely. Required: If you require a(n) 11 percent return on this stock, what will you pay for a share today? 7:56 ok ences Multiple Choice $58.82 Multiple Choice $58.82 O O $55.85 O $188.00 $55.29 O $54.74 Multiple Choice $58.82 O O $55.85 O $188.00 $55.29 O $54.74 Multiple Choice $58.82 O O $55.85 O $188.00 $55.29 O $54.74

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts