Question: Question One: Saving for a house deposit (4 marks) As part of your investment plan, you have set the goal of buying a $1,000,000 property

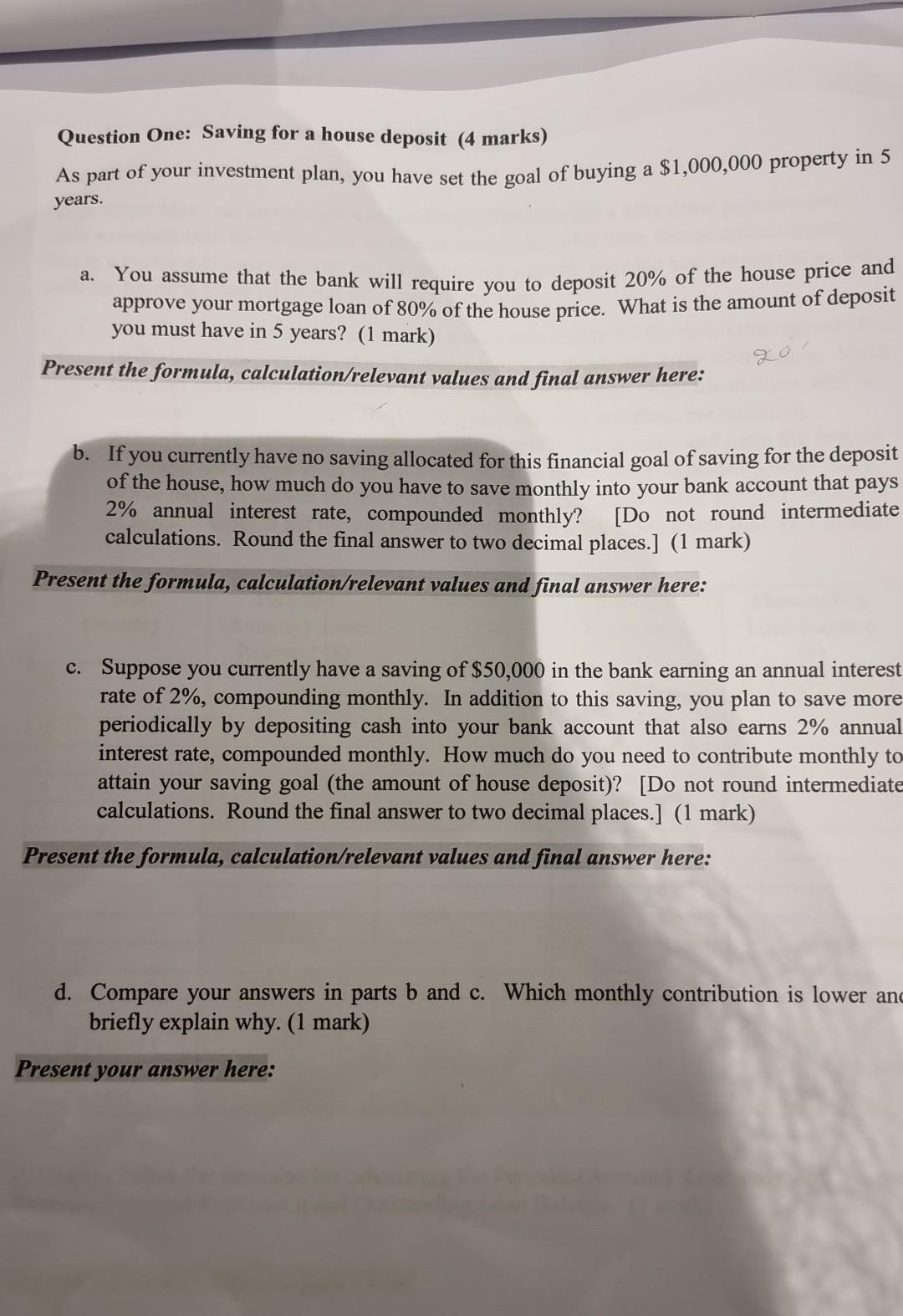

Question One: Saving for a house deposit (4 marks) As part of your investment plan, you have set the goal of buying a $1,000,000 property in 5 years. a. You assume that the bank will require you to deposit 20% of the house price and approve your mortgage loan of 80% of the house price. What is the amount of deposit you must have in 5 years? (1 mark) Present the formula, calculation/relevant values and final answer here: 20 b. If you currently have no saving allocated for this financial goal of saving for the deposit of the house, how much do you have to save monthly into your bank account that pays 2% annual interest rate, compounded monthly? [Do not round intermediate calculations. Round the final answer to two decimal places.] (1 mark) Present the formula, calculation/relevant values and final answer here: c. Suppose you currently have a saving of $50,000 in the bank earning an annual interest rate of 2%, compounding monthly. In addition to this saving, you plan to save more periodically by depositing cash into your bank account that also earns 2% annual interest rate, compounded monthly. How much do you need to contribute monthly to attain your saving goal (the amount of house deposit)? [Do not round intermediate calculations. Round the final answer to two decimal places.] (1 mark) Present the formula, calculation/relevant values and final answer here: d. Compare your answers in parts b and c. Which monthly contribution is lower and briefly explain why. (1 mark) Present your answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts