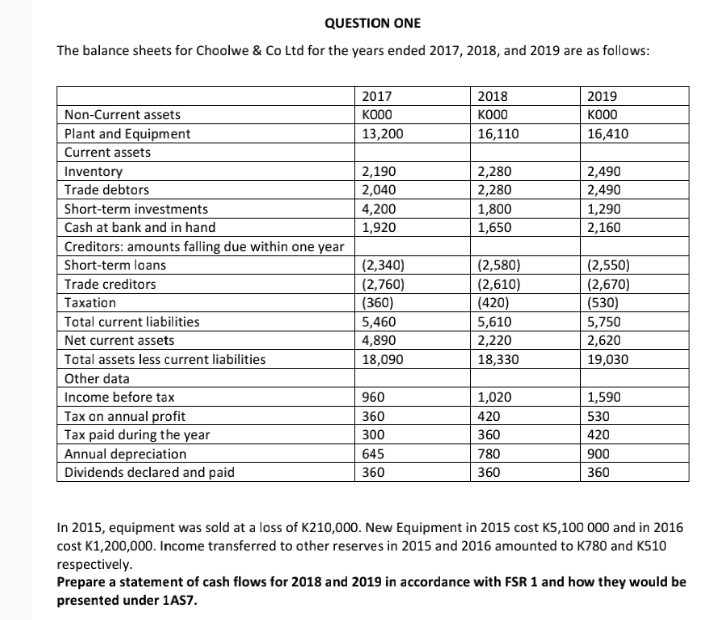

Question: QUESTION ONE The balance sheets for Choolwe & Co Ltd for the years ended 2017, 2018, and 2019 are as follows: 2017 K000 13,200 2018

QUESTION ONE The balance sheets for Choolwe & Co Ltd for the years ended 2017, 2018, and 2019 are as follows: 2017 K000 13,200 2018 K000 16,110 2019 K000 16,410 2,190 2,040 4,200 1,920 2,280 2,280 1,800 1,650 2,490 2,490 1,290 2,160 Non-Current assets Plant and Equipment Current assets Inventory Trade debtors Short-term investments Cash at bank and in hand Creditors: amounts falling due within one year Short-term loans Trade creditors Taxation Total current liabilities Net current assets Total assets less current liabilities Other data Income before tax Tax on annual profit Tax paid during the year Annual depreciation Dividends declared and paid (2,340) (2,760) (360) 5,460 4,890 18,090 (2,580) (2,610) (420) 5,610 2,220 18,330 (2,550) (2,670) (530) 5,750 2,620 19,030 960 360 300 645 360 1,020 420 360 780 360 1,590 530 420 900 360 In 2015, equipment was sold at a loss of K210,000. New Equipment in 2015 cost K5,100 000 and in 2016 cost K1,200,000. Income transferred to other reserves in 2015 and 2016 amounted to K780 and K510 respectively. Prepare a statement of cash flows for 2018 and 2019 in accordance with FSR 1 and how they would be presented under 1AS7. QUESTION ONE The balance sheets for Choolwe & Co Ltd for the years ended 2017, 2018, and 2019 are as follows: 2017 K000 13,200 2018 K000 16,110 2019 K000 16,410 2,190 2,040 4,200 1,920 2,280 2,280 1,800 1,650 2,490 2,490 1,290 2,160 Non-Current assets Plant and Equipment Current assets Inventory Trade debtors Short-term investments Cash at bank and in hand Creditors: amounts falling due within one year Short-term loans Trade creditors Taxation Total current liabilities Net current assets Total assets less current liabilities Other data Income before tax Tax on annual profit Tax paid during the year Annual depreciation Dividends declared and paid (2,340) (2,760) (360) 5,460 4,890 18,090 (2,580) (2,610) (420) 5,610 2,220 18,330 (2,550) (2,670) (530) 5,750 2,620 19,030 960 360 300 645 360 1,020 420 360 780 360 1,590 530 420 900 360 In 2015, equipment was sold at a loss of K210,000. New Equipment in 2015 cost K5,100 000 and in 2016 cost K1,200,000. Income transferred to other reserves in 2015 and 2016 amounted to K780 and K510 respectively. Prepare a statement of cash flows for 2018 and 2019 in accordance with FSR 1 and how they would be presented under 1AS7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts