Question: Question One This question must be attempted Immunization is easy, you just put a duration policy in place and then you are protected no matter

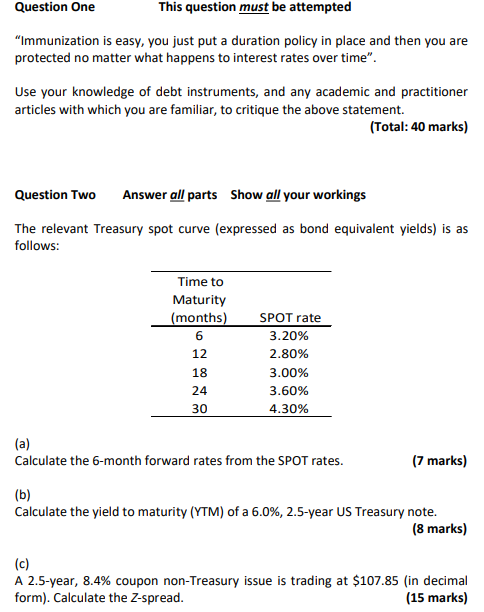

Question One This question must be attempted "Immunization is easy, you just put a duration policy in place and then you are protected no matter what happens to interest rates over time". Use your knowledge of debt instruments, and any academic and practitioner articles with which you are familiar, to critique the above statement. (Total: 40 marks) Question Two Answer all parts Show all your workings The relevant Treasury spot curve (expressed as bond equivalent yields) is as follows: Time to Maturity (months) 6 12 18 24 30 SPOT rate 3.20% 2.80% 3.00% 3.60% 4.30% (a) Calculate the 6-month forward rates from the SPOT rates. (7 marks) (b) Calculate the yield to maturity (YTM) of a 6.0%, 2.5-year US Treasury note. (8 marks) (c) A 2.5-year, 8.4% coupon non-Treasury issue is trading at $107.85 (in decimal form). Calculate the Z-spread. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts