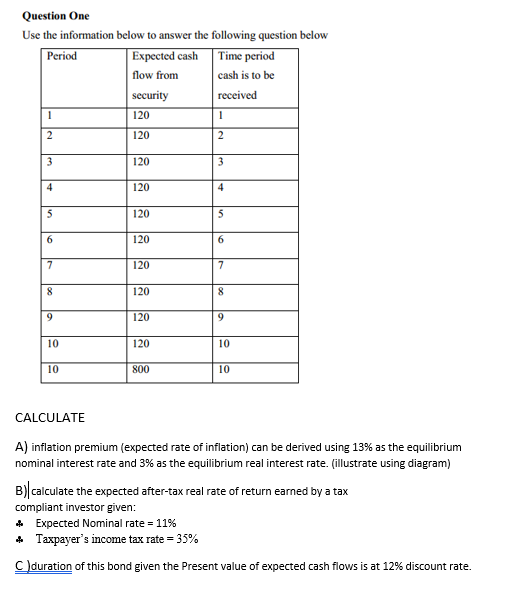

Question: Question One Use the information below to answer the following question below Period Expected cash Time period flow from cash is to be security received

Question One Use the information below to answer the following question below Period Expected cash Time period flow from cash is to be security received 120 1 1 2 120 2 3 120 3 4 120 4 5 120 5 6 120 6 7 120 7 8 120 8 9 120 9 10 120 10 10 800 10 CALCULATE A) inflation premium (expected rate of inflation) can be derived using 13% as the equilibrium nominal interest rate and 3% as the equilibrium real interest rate. (illustrate using diagram) B)| calculate the expected after-tax real rate of return earned by a tax compliant investor given: 4 Expected Nominal rate = 11% 4 Taxpayer's income tax rate= 35% C duration of this bond given the Present value of expected cash flows is at 12% discount rate. Question One Use the information below to answer the following question below Period Expected cash Time period flow from cash is to be security received 120 1 1 2 120 2 3 120 3 4 120 4 5 120 5 6 120 6 7 120 7 8 120 8 9 120 9 10 120 10 10 800 10 CALCULATE A) inflation premium (expected rate of inflation) can be derived using 13% as the equilibrium nominal interest rate and 3% as the equilibrium real interest rate. (illustrate using diagram) B)| calculate the expected after-tax real rate of return earned by a tax compliant investor given: 4 Expected Nominal rate = 11% 4 Taxpayer's income tax rate= 35% C duration of this bond given the Present value of expected cash flows is at 12% discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts