Question: QUESTION p2s Mark The term njerner refers to the absorption of two companies where one now company will continue to exist. The term acquisition refers

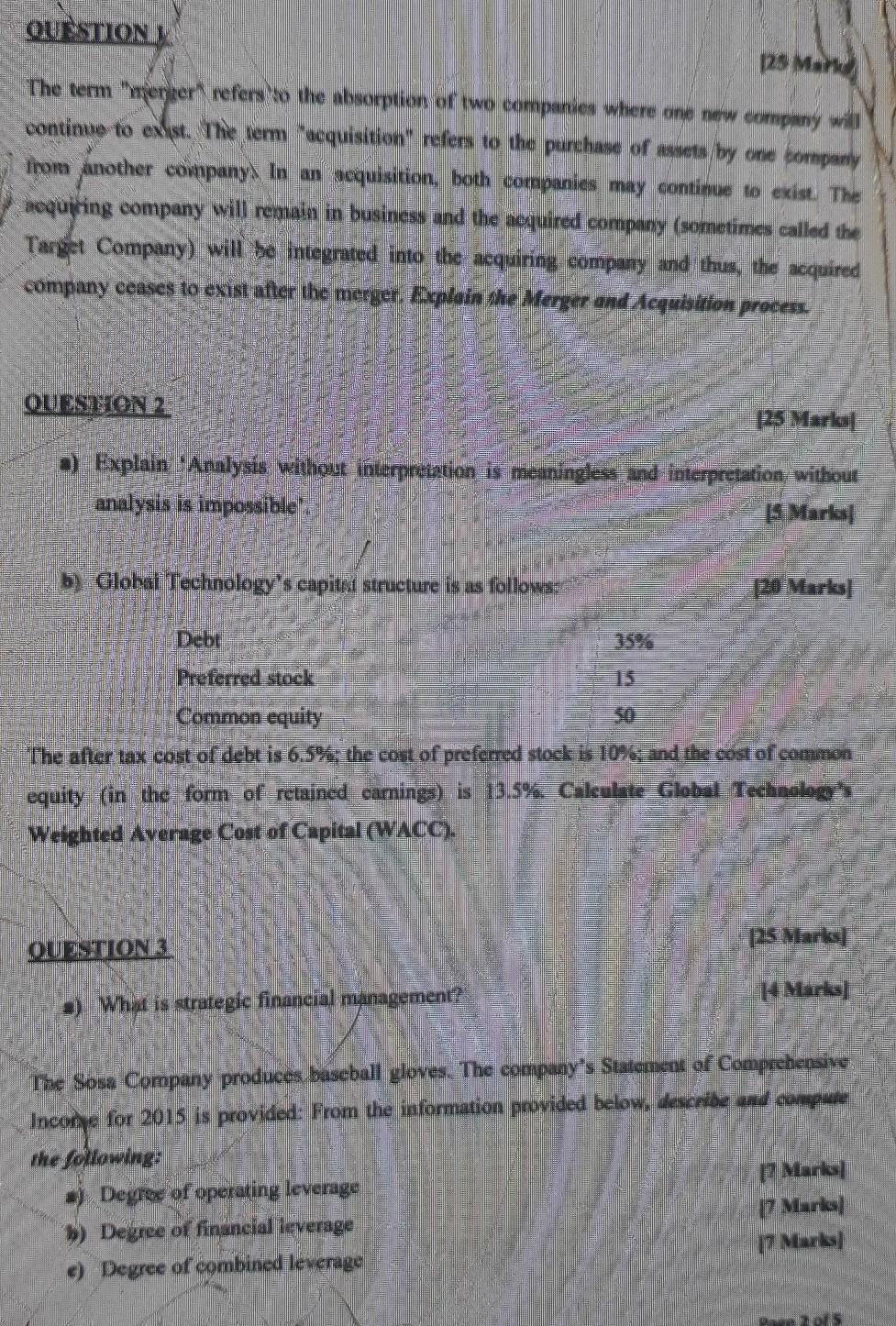

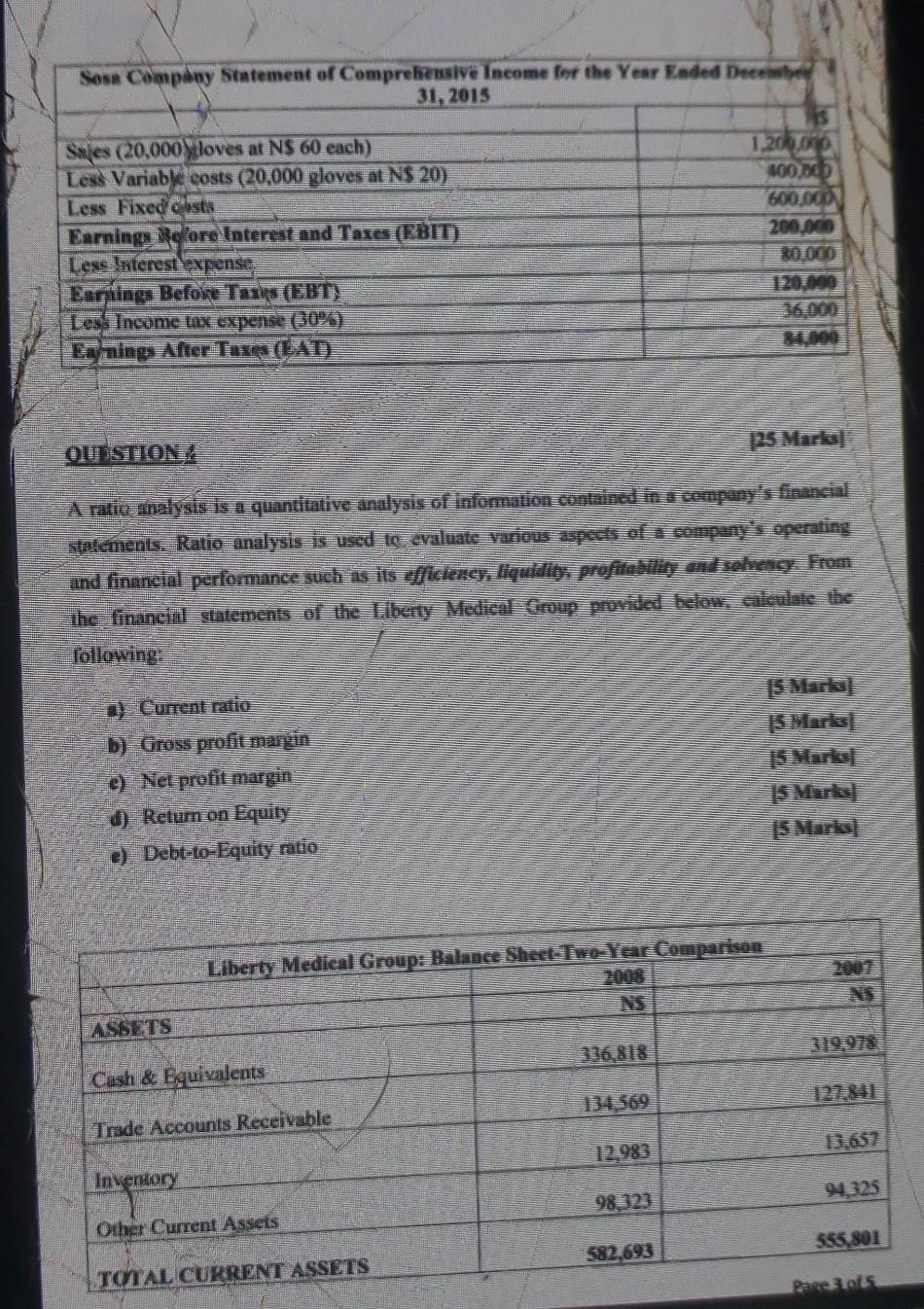

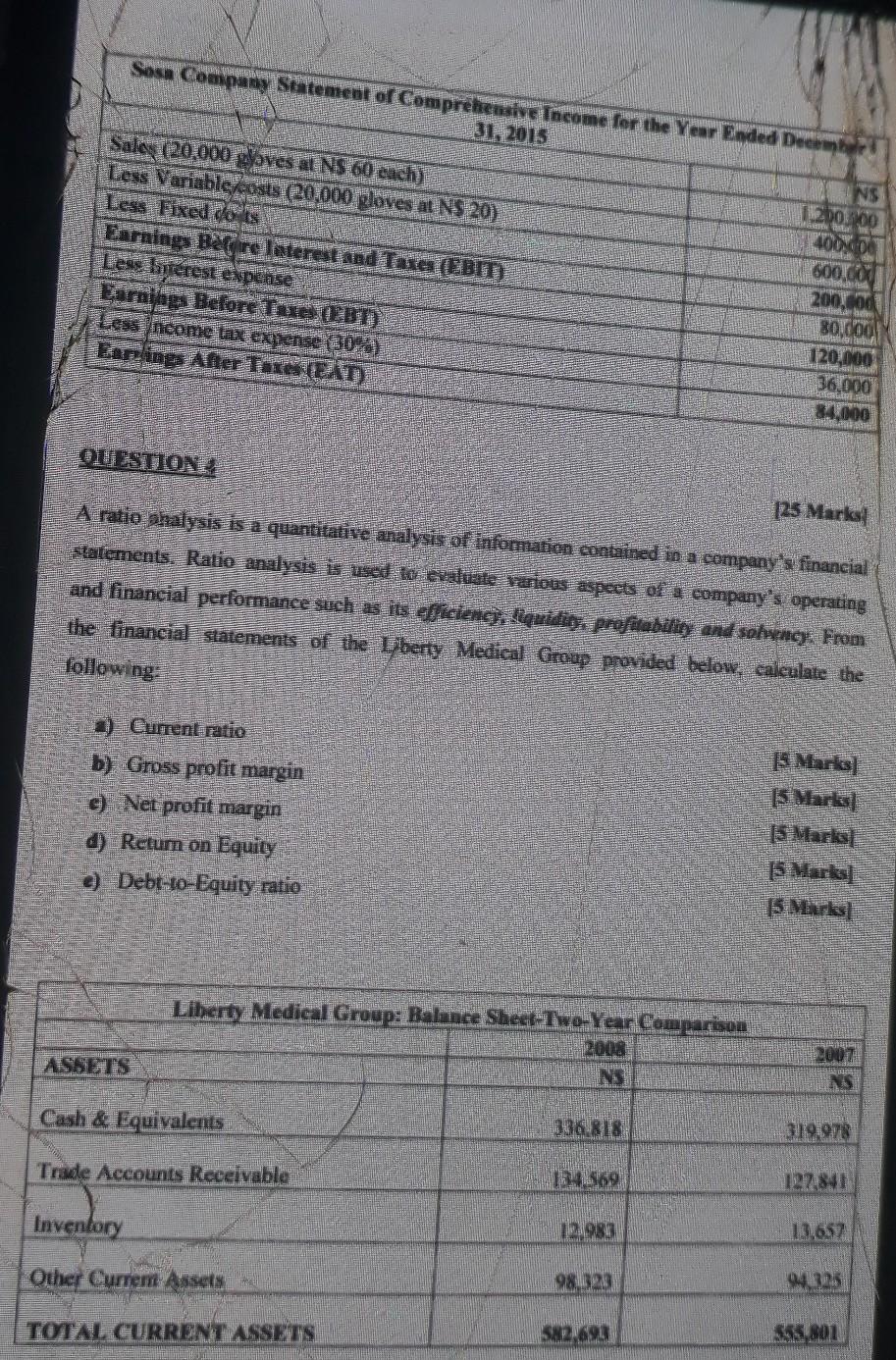

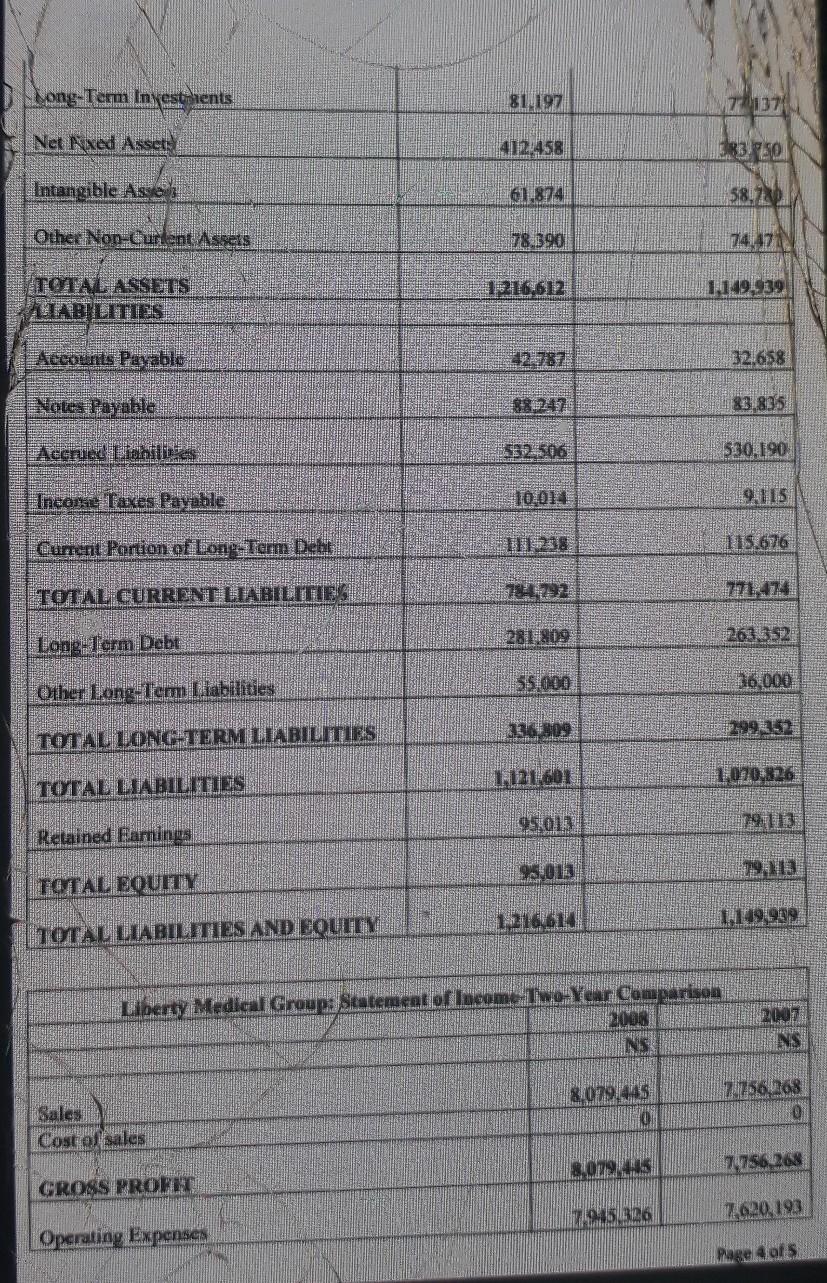

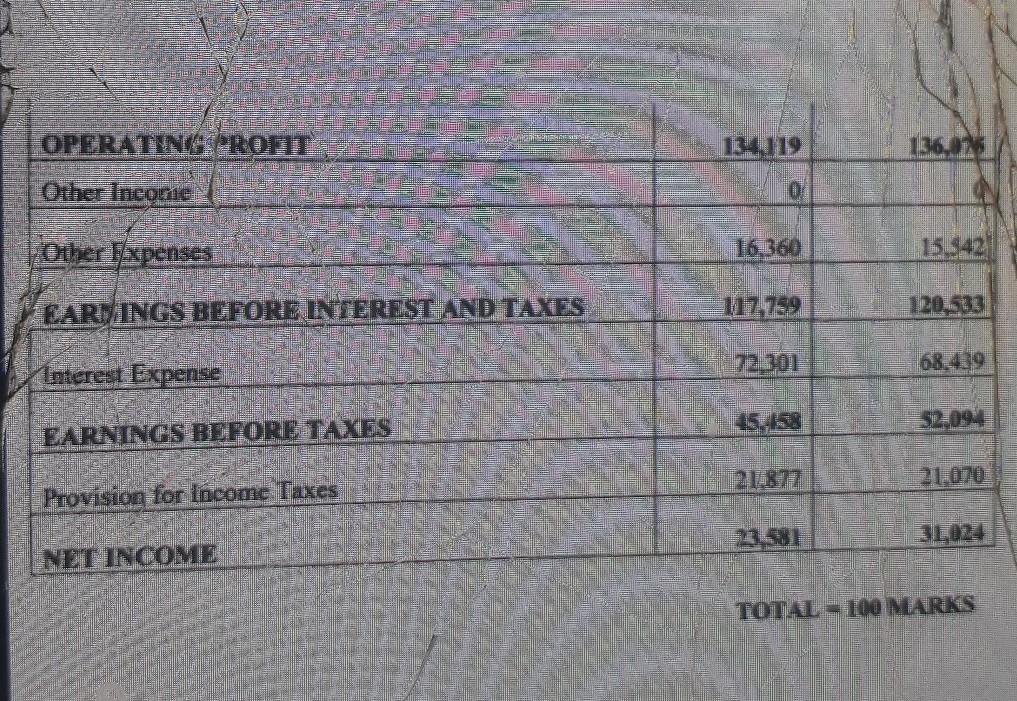

QUESTION p2s Mark The term "njerner" refers to the absorption of two companies where one now company will continue to exist. The term "acquisition" refers to the purchase of us by one company from another coinpanya In an soquisition, both companies may continue to exist . This roquiding company will remain in business and the acquired company (sometimes called the Target Company) will be integrated into the acquiring company and thus, the acquired company ceases to exist after the merger. Explain the Merger and Acquisition process QUESTION 2 125 Maria! a) Explain SAnalysis without interpretation is meaningless and interpretation without analysis is impossible, 13 Marles b) Global Technology's capitrit structure is as follows: Debt Preferred stock Common equity The after lax cost of debt is 6.5%; the cost of preferred stock is 10%; and the cost of common equity (in the form of retained cuminga) is 13.5% Calculate Global Technology Weighted Average Cost of Capital (WACC). QUESTION 3 125 Marko H Marlo) 3) What is strategie financial management? The Sosa Company produces baseball gloves. The compaay's Statement of Comprehensive Incone for 2015 is providedFrom the information provided below, describe and computer the following: Degree of operating leverage 12 Marhol Degree of financial leverage 17 Marial 4) Degree of combined leverage 17 Mars] Sess Company Statement of Comprehensive Income for the Year Ended December 31, 2015 1.200 400 DD 600.000 200.000 Sajes (20.000 yloves at N$ 60 each) Less Variable costs (20.000 gloves at N$ 20) Less Fixed costs Earning Refore Interest and Taxes (EBIT) Less terest axpense Earnings Before Tans (EBT) Les Income tax expense (30%) Exyning After Taxe (LAT) 14,000 PS Marks OU STIONEA A ratio analysis is a quantitative analysis of information containd in 5 company's financial statements. Ratio analysis is used to evaluate various aspects of a company's operating and financial performance such is its eficiency, liquidit, profitabilig end seheng. From the financial statements of the Liberty Medical Group provided below, aleulate the Tollowing Current ratio 5 Marlies b) Gross profit margin e) Net profit margin d) Retum on Equity e) Debt-to-Equity ratio S Marka 15 Marks Liberty Medical Group: Balance Sheet-Two-Year Comparison NS ASSETS 336,818 Cash & Equivalents 12.30 Trade Accounts Receivable 13.657 12.983 Inventory 98,123 Other Current Assets 355,801 582.693 TONAL CURRENT ASSETS Sasa Company Statement of Comprehensive Income for the Year Ended Dee 31. 2015 NS Sales (20.000 gloves al NS 60 euch) 1120000 Less Variable costs (20.000 gloves at NS 20) 400D Less Fixed Lots 600.000 Earning Barere Interest and Tases (EBIT 200.00 Lese nerest expense 80,000 Earnings Before Taxe EDT) 120,000 Less ncome tax cense (30) 36,000 84.000 QUESTION 125 Marka A ratio Shalysis is a quantitative analysis of infomation contained in a company's financial statements. Ratio analysis is used to reluate various aspects of a company's operating and financial performance such as its efficiency, liquidity, profitability and solvency. From the financial statements of the Iben Medical Group provided below. caleulate the following: Is Marks) Current ratio b) Gross profit margin e) Net profit margin d) Retum on Equity e) Debt-to-Equity ratio 15 Marks) 5 Mark] 15 Marks Liberty Medical Group: Balance Sheet-Two-Year Comparbon 2008 ASSETS 2007 NS INS Cash & Equivalents 336.818 319,978 Trade Accounts Receivable 14569 12781 Inventory 122.983 13.657 Other Currem Assets 28 329 94325 TOTAL CURRENT ASSETS 582,693 Long-Term Investnients 81.197 71374 Net Nxed Asset: 1412:458 ER250 Intangible Asses 61.874 58.70 Other Non-Curent Assers 78.390 TOTALASSOTS AIABILITIES 1216,612 1.149.939 Accounts Payable 22 787 32.658 Notes Payable 88.247 83.835 Accrued as 1982.506 530.190 Theome Taxes Pavahle 10.014 9115 Cument Portion of Lone Term Debt 115.676 TOTAL CURRENT LIABILITIEG 784292 2811809 2632332 Long Term Debt 55.000 16.000 Other Long Tem Liabilities 336 309 TOTAL LONG-TERM LIABILITIES 21601 1,070,826 TOTAL LIABILITIES 95013 Retained Earnings 982013 1913 TOTAL EQUITY 121661 1.109.999 TOTAL LIABILITIES AND EQUITY Liberty Medical Group: Statement of Income Two-Year Comparison 2008 INS 2007 NS 8,079,445 2.756.268 ON Sales Cost of sales 7.756.268 CROSS PROFIT 326 7920, 193 Operating Expenses Page 4 of 5 OPERATINGSPROFIT 136,7 Other Income 16.360 Other Fxpenses EARINGS BEFORE INTEREST AND TAXES 117.759 68,439 72-301 Interest Expense 52.094 EARNINGS BEFORE TAXES 21,877 21.070 Provision for Income Taxes NET INCOME TOTAL 100 MARKS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts