Question: Question: Please fast answer. Please proper explain and do not copy from Chegg. Otherwise i have to report the answer. Suppose the term structure of

Question:

Please fast answer.

Please proper explain and do not copy from Chegg. Otherwise i have to report the answer.

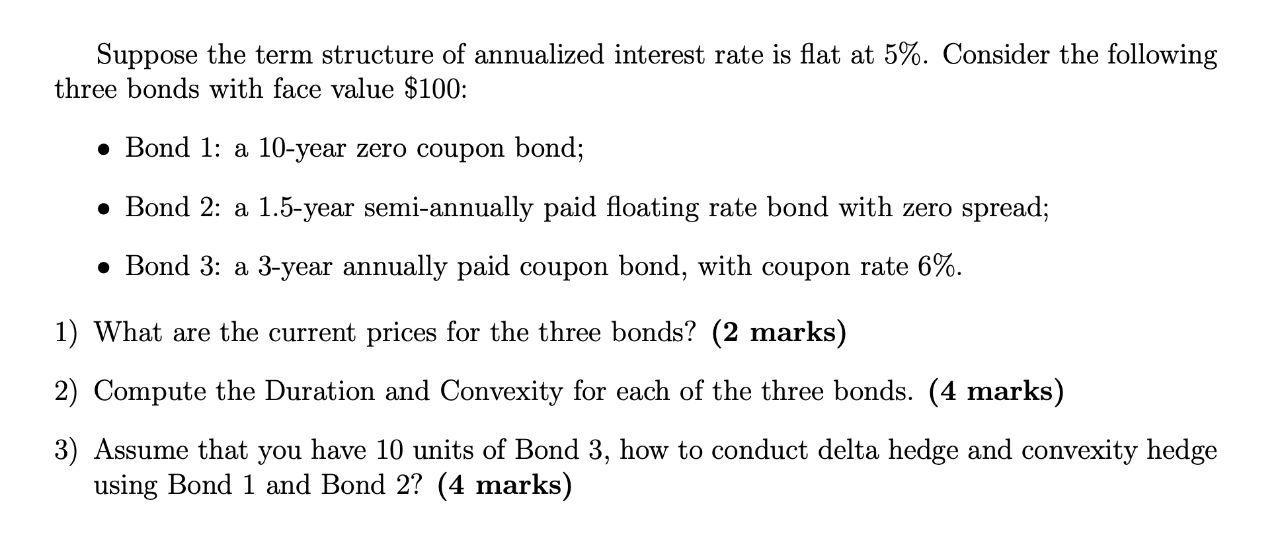

Suppose the term structure of annualized interest rate is flat at 5%. Consider the following three bonds with face value $100: Bond 1: a 10-year zero coupon bond; Bond 2: a 1.5-year semi-annually paid floating rate bond with zero spread; Bond 3: a 3-year annually paid coupon bond, with coupon rate 6%. 1) What are the current prices for the three bonds? (2 marks) 2) Compute the Duration and Convexity for each of the three bonds. (4 marks) 3) Assume that you have 10 units of Bond 3, how to conduct delta hedge and convexity hedge using Bond 1 and Bond 2? (4 marks) Suppose the term structure of annualized interest rate is flat at 5%. Consider the following three bonds with face value $100: Bond 1: a 10-year zero coupon bond; Bond 2: a 1.5-year semi-annually paid floating rate bond with zero spread; Bond 3: a 3-year annually paid coupon bond, with coupon rate 6%. 1) What are the current prices for the three bonds? (2 marks) 2) Compute the Duration and Convexity for each of the three bonds. (4 marks) 3) Assume that you have 10 units of Bond 3, how to conduct delta hedge and convexity hedge using Bond 1 and Bond 2? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts