Question: Question: Please see the yellow star on the first page. I don't understand Question 5B. This is my second attempt of asking this question. I

Question: Please see the yellow star on the first page. I don't understand Question 5B. This is my second attempt of asking this question. I would like to know the following and would appreciate if explained in greater detail thanks a lot. (a) The question states that the rental income of 8000 is for the rent of the following year - I don't understand which period of the following year? Is this 8000 also included in the 44,000?

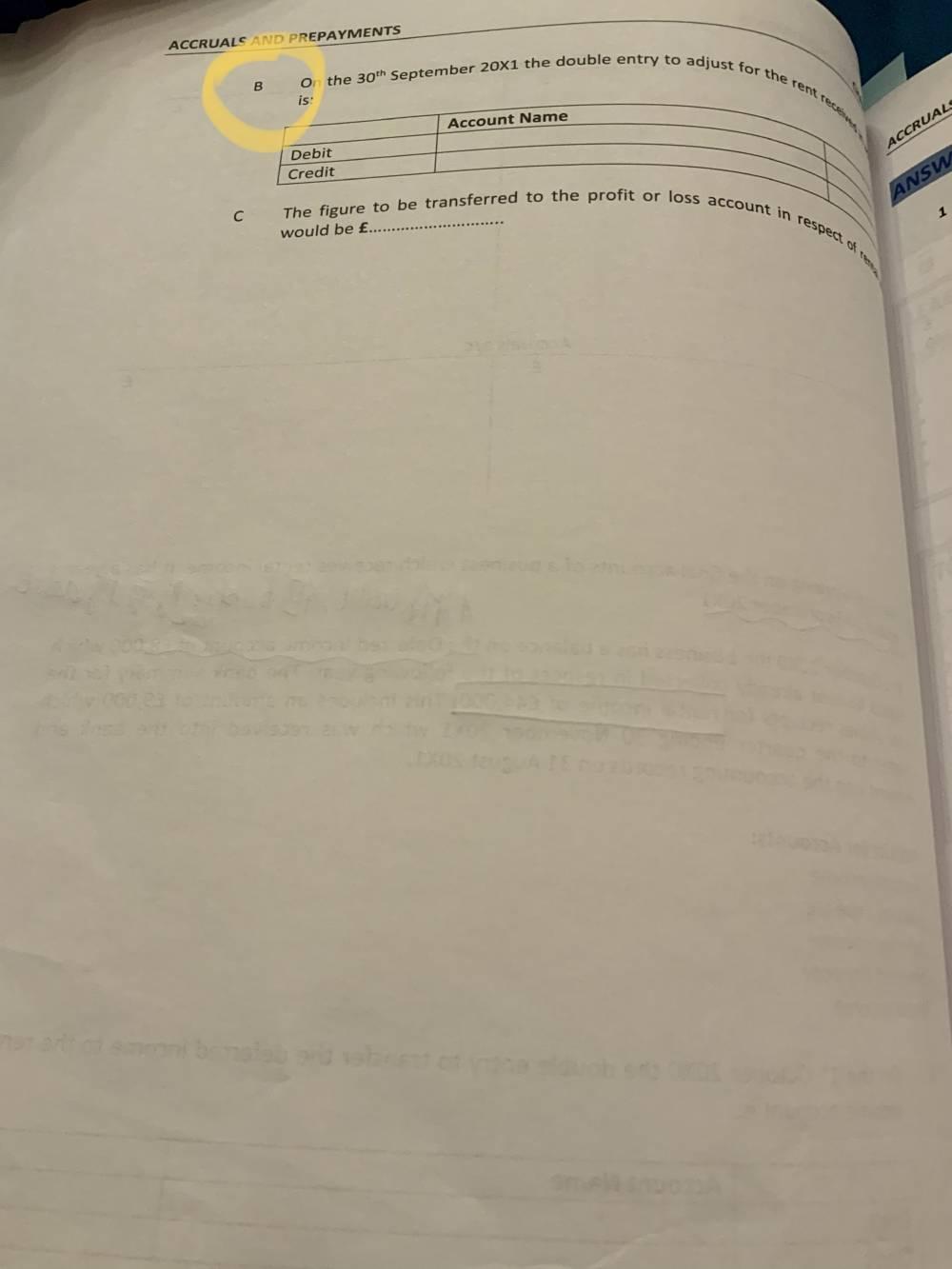

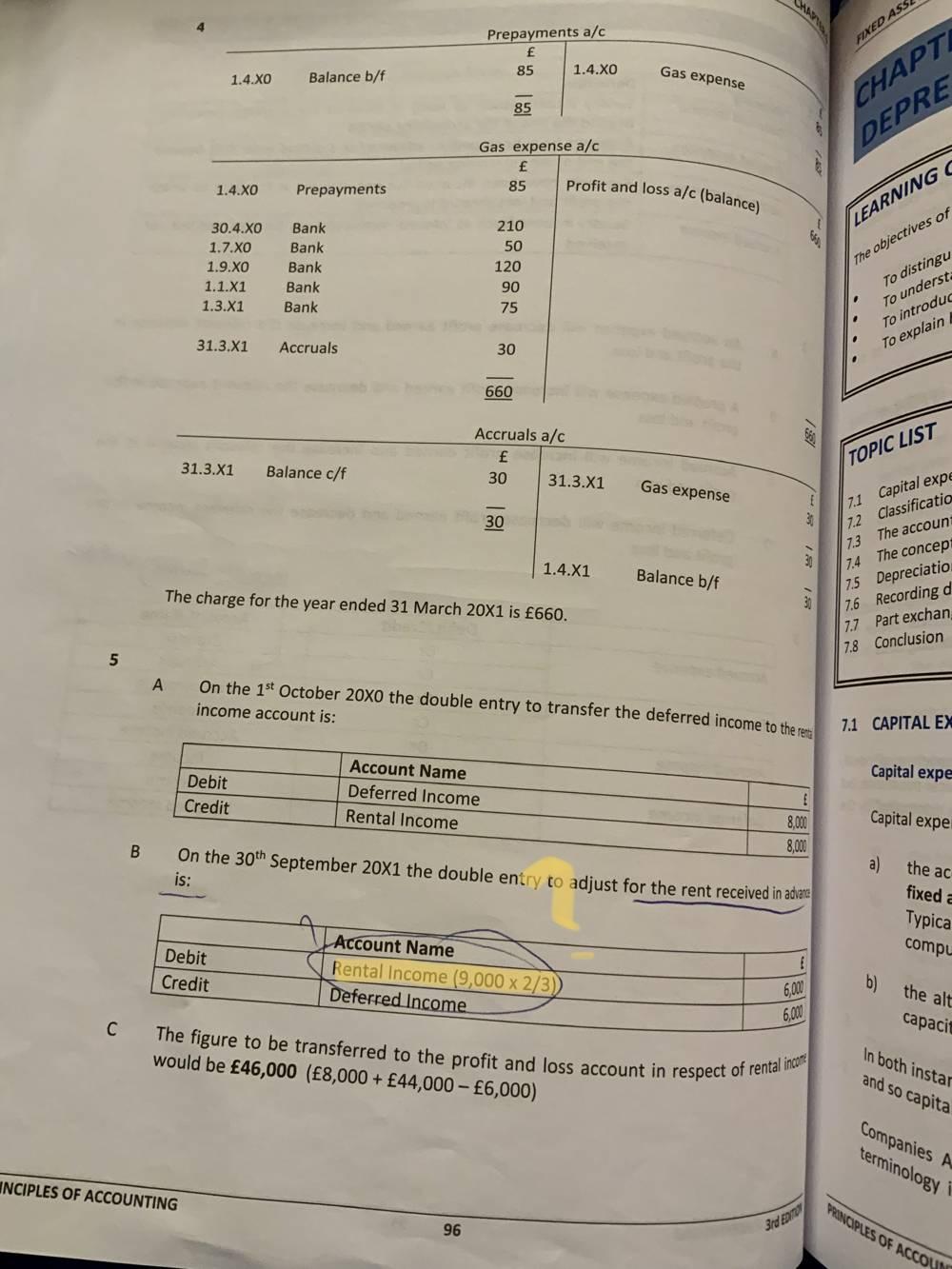

(b) The question states that the rental income of 9000 relates to the quarter ending on 30 November 2021. I don't understand what that quarter is - I mean from what date to what date? (c) How the rental income of 6000 is calculated. I don't understand why 9000 x 2/3. I would appreciate more detailed response. Thank you.

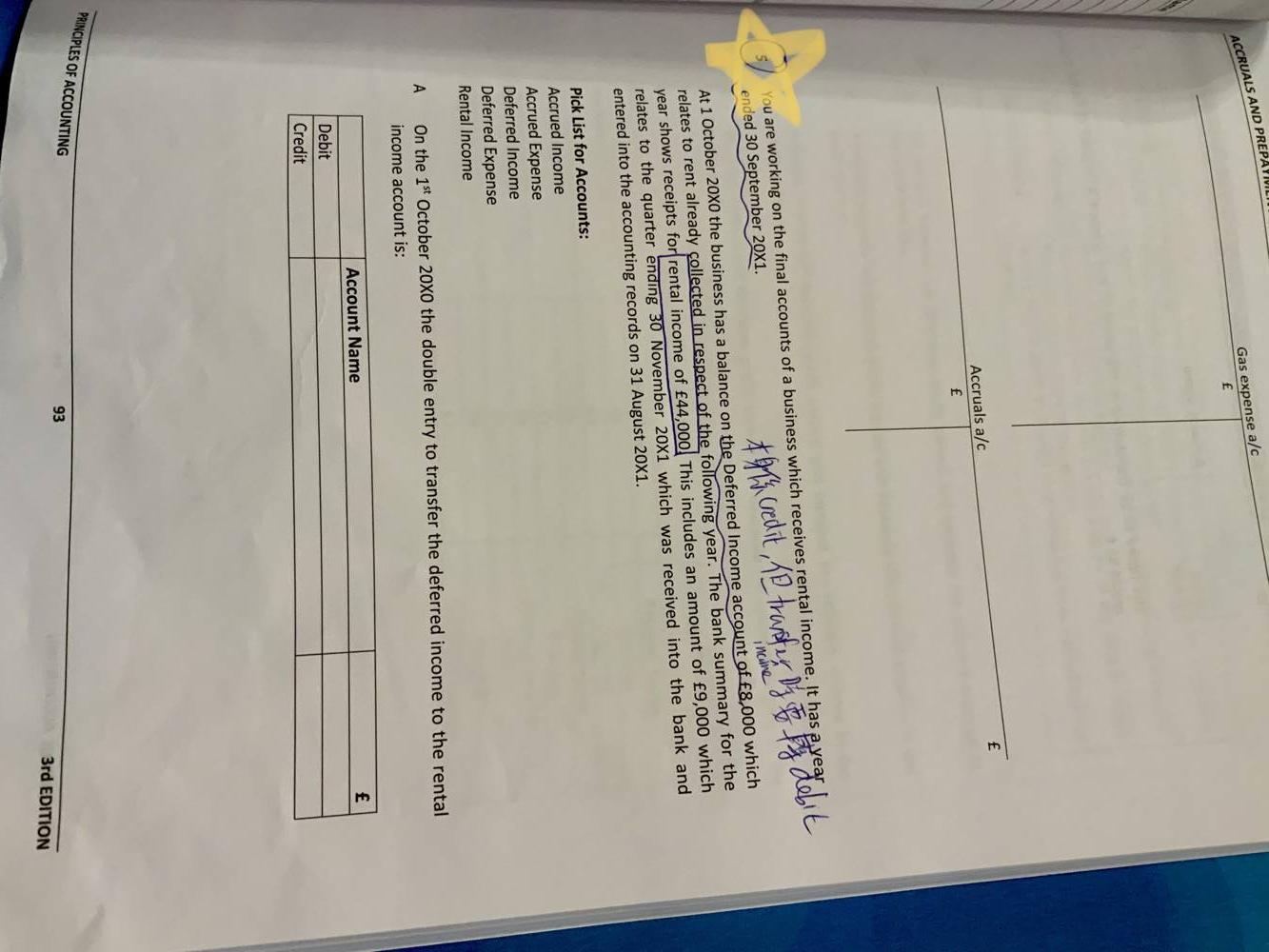

ended 30 September 201. At 1 October 20XO the business has a balance on the Deferred Income account of f8,000 which relates to rent already collected in respect of the following year. The bank summary for the year shows receipts for rental income of 44,000. This includes an amount of 9,000 which relates to the quarter ending 30 November 201 which was received into the bank and entered into the accounting records on 31 August 201. Pick List for Accounts: Accrued Income Accrued Expense Deferred Income Deferred Expense Rental Income A On the 1st October 200 the double entry to transfer the deferred income to the rental income account is: B O the 30th September 201 the double entry to adjust for the rnt. C The figure to be transferred to the profit or loss account in would be E. 5 A On the 1st October 200 the double entry to transfer the deferred income to the reth income account is: B is: C = igure to be transferred to the profit and loss account in respect of rental incor would be 46,000(8,000+44,0006,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts