Question: Question Possible Answer 1 Possible Answer 2 Please answer question C. Please show all work. Consider a 1-year futures contract on an investment asset that

Question

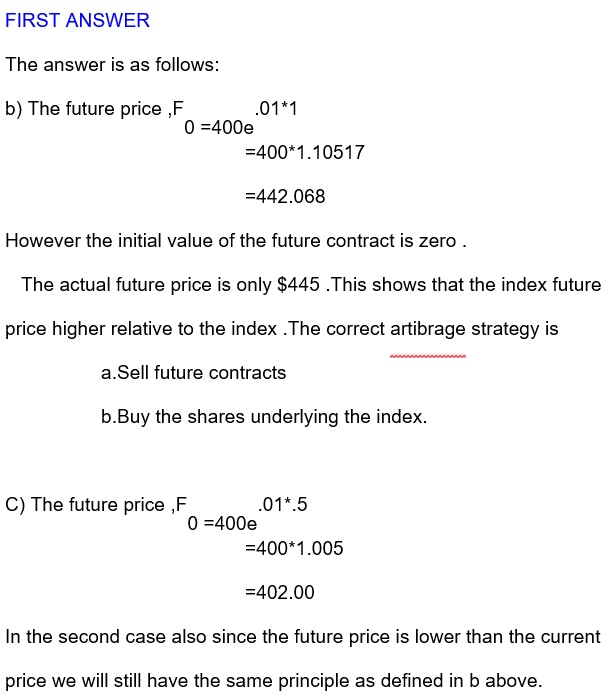

Possible Answer 1

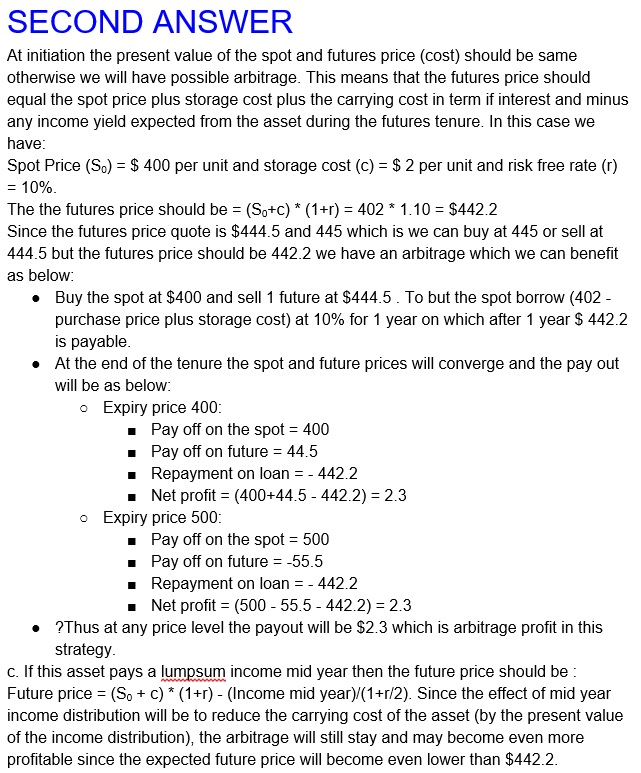

Possible Answer 2

Please answer question C. Please show all work.

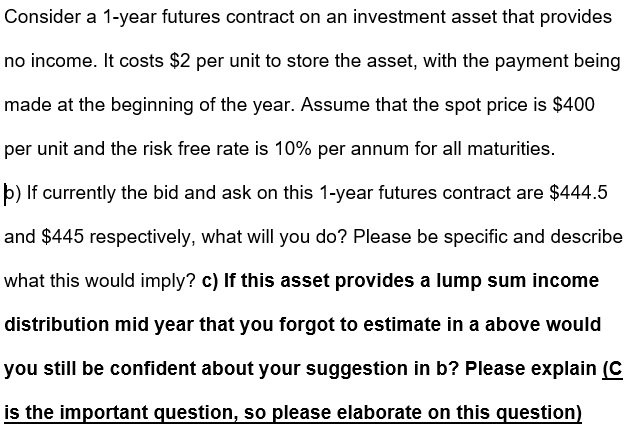

Consider a 1-year futures contract on an investment asset that provides no income. It costs $2 per unit to store the asset, with the payment being made at the beginning of the year. Assume that the spot price is $400 per unit and the risk free rate is 10% per annum for all maturities. b) If currently the bid and ask on this 1-year futures contract are $444.5 and $445 respectively, what will you do? Please be specific and describe what this would mpy jris asset provides a lump sum income distribution mid year that you forgot to estimate in a above would you still be confident about your suggestion in b? Please explain (C is the important question, so please elaborate on this question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts