Question: question: prepare a cash flow statement using indirect method for creative company ? Solution for question 1 (Creative company income statement): December 31, 2019 and

question: prepare a cash flow statement using indirect method for creative company ?

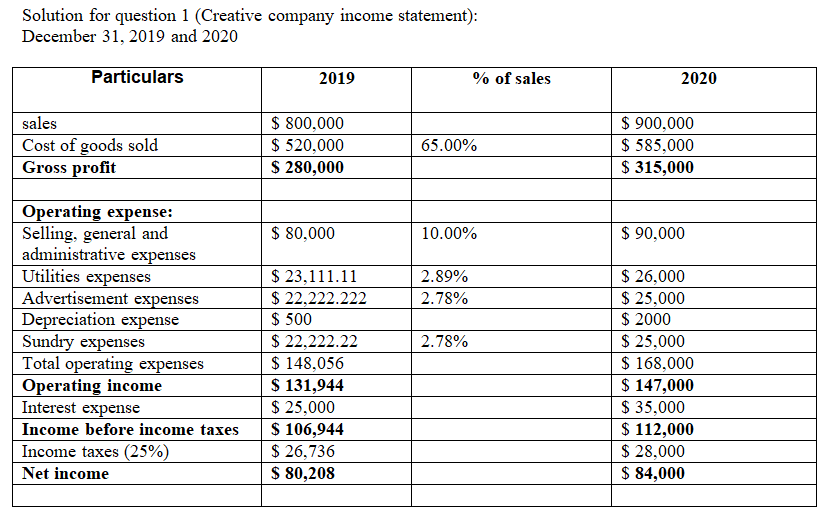

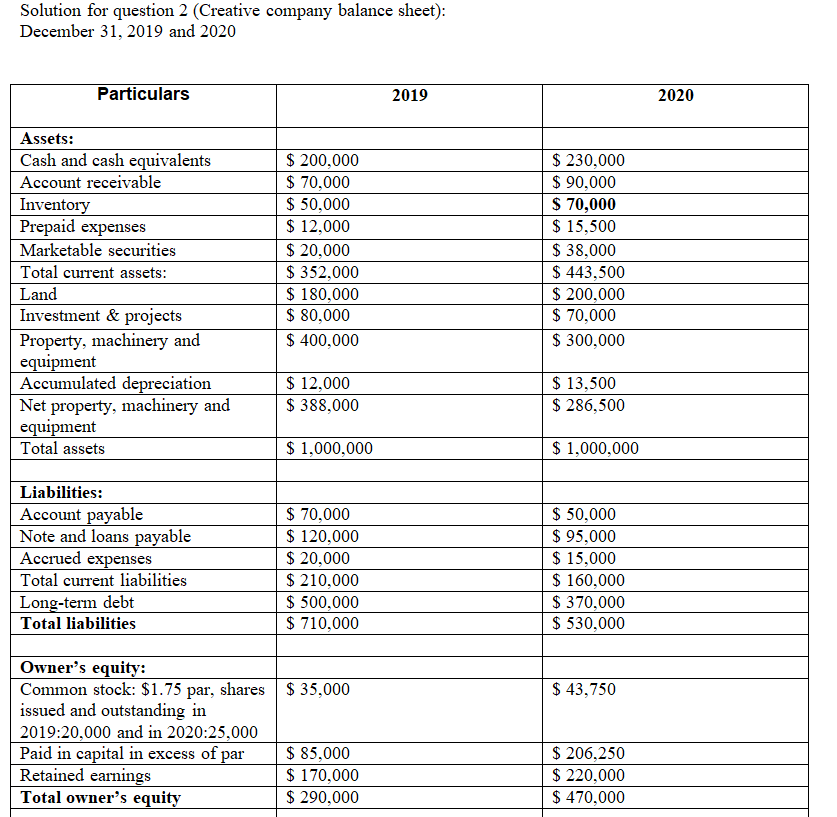

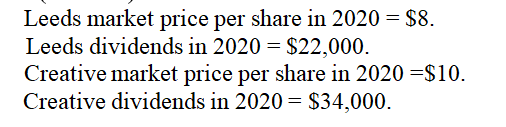

Solution for question 1 (Creative company income statement): December 31, 2019 and 2020 Particulars 2019 % of sales 2020 sales Cost of goods sold Gross profit $ 800,000 $ 520,000 $ 280,000 65.00% $ 900,000 $ 585,000 $ 315,000 $ 80,000 10.00% $ 90,000 2.89% 2.78% Operating expense: Selling, general and administrative expenses Utilities expenses Advertisement expenses Depreciation expense Sundry expenses Total operating expenses Operating income Interest expense Income before income taxes Income taxes (25%) Net income 2.78% $ 23,111.11 $ 22,222.222 $ 500 $ 22,222.22 $ 148,056 $ 131,944 $ 25,000 $ 106,944 $ 26,736 $ 80,208 $ 26,000 $ 25,000 $ 2000 $ 25,000 $ 168,000 $ 147,000 $ 35,000 $ 112,000 $ 28,000 $ 84,000 Solution for question 2 (Creative company balance sheet): December 31, 2019 and 2020 Particulars 2019 2020 Assets: Cash and cash equivalents Account receivable Inventory Prepaid expenses Marketable securities Total current assets: Land Investment & projects Property, machinery and equipment Accumulated depreciation Net property, machinery and equipment Total assets $ 200,000 $ 70,000 $ 50,000 $ 12,000 $ 20,000 $ 352,000 $ 180,000 $ 80,000 $ 400,000 $ 230,000 $ 90,000 $ 70,000 $ 15,500 $ 38,000 $ 443,500 $ 200,000 $ 70,000 $ 300,000 $ 12,000 $ 388,000 $ 13,500 $ 286,500 $ 1,000,000 $ 1,000,000 Liabilities: Account payable Note and loans payable Accrued expenses Total current liabilities Long-term debt Total liabilities $ 70,000 $ 120,000 $ 20,000 $ 210,000 $ 500,000 $ 710,000 $ 50,000 $ 95,000 $ 15,000 $ 160,000 $ 370,000 $ 530,000 $ 43,750 Owner's equity: Common stock: $1.75 par, shares $ 35,000 issued and outstanding in 2019:20,000 and in 2020:25,000 Paid in capital in excess of par $ 85,000 Retained earnings $ 170,000 Total owner's equity $ 290,000 $ 206,250 $ 220,000 $ 470,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts