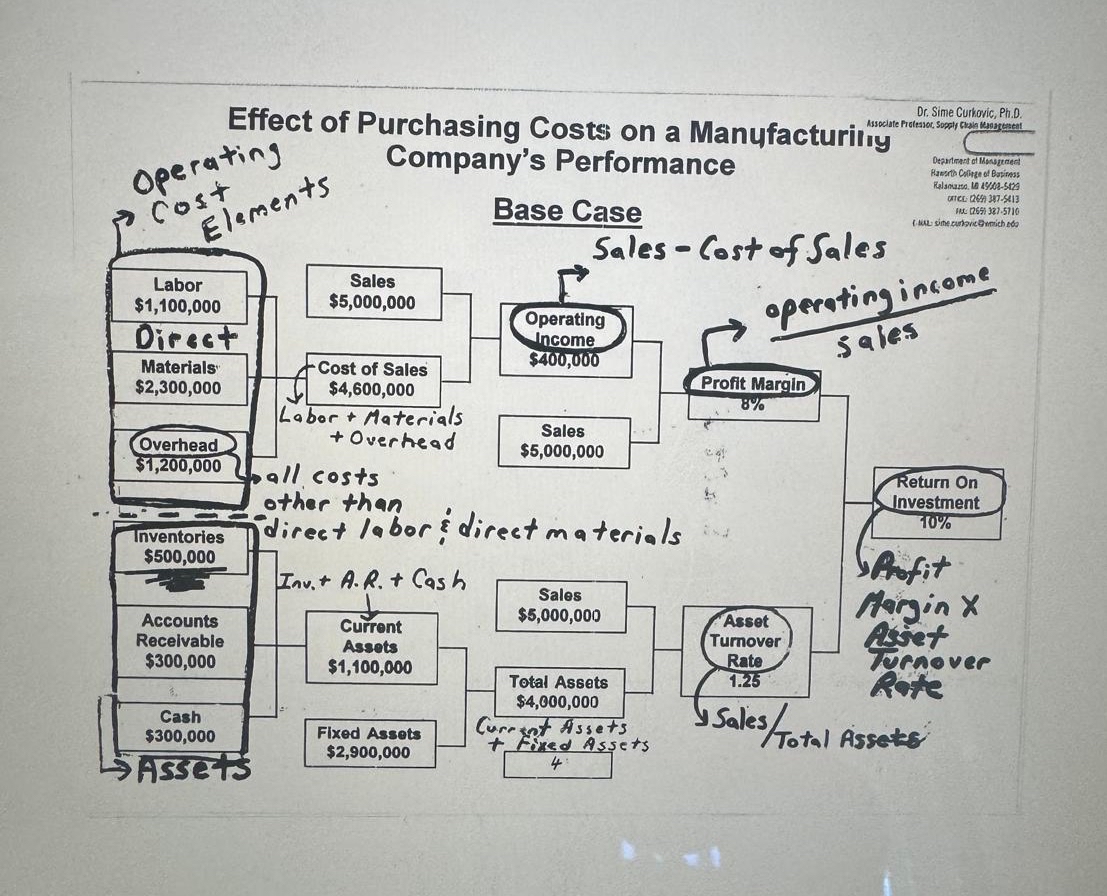

Question: Question / Problem # 1 ( fill in the blanks ) : Here is the question: what impact does reducing your employers direct material (

QuestionProblem #fill in the blanks: Here is the question: what impact does reducing your employers direct material DM costs by have on its ROI use the numbers on the attachment Note, if you reduce your DM costs by it also reduces your inventory value by in other words, it will also increase your asset turnover rate so you have to recalculate profit margin and asset turnover rateFill in the blanks:Such a cost reduction would increase profit margins from to and ROI from to This equals a percentage point increase improvement in return on investment for each percentage reduction in material costsHint for the last blank, new ROI old ROI QuestionProblem #fill in the blanks: Back to the financial statementA reduction in direct material costs produces a profit increase of $ If the same profit increase had to be increased by sales, what sales increase would you need? At the existing profit margin, the following calculation provides the answer: Profit increase plug in the number from the blank above in Question # New sales x New sales $ This represents a needed sales increase of: $$ x So for comparative purposes, in this case study, the same absolute profit improvement can be achieved by reducing material costs by or by increasing sales approximately a ratio of to QuestionProblem #start over with the case study: Go back to the original financial statement on ROI. Lets say you start working for this company and you tell the owner of the company that you need around six months to reduce direct material costs by You tell the owner that it will make the ROI go up by Xyour answer to question # above The owner says that is great but heshe does not have that much time and wants instant cost savings results. This company is privately owned and family run. That means they are not publicly traded you cannot buy stock in the company The hourly workforce in the factory is also not represented by a union. So the owner said heshe is going to cut direct labor costs by How much will doing so improve the owners ROI? How effective do you think that is and what might be the consequences? What would you have done if this was your company and you were dealing with low, thin, and tight margins?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock