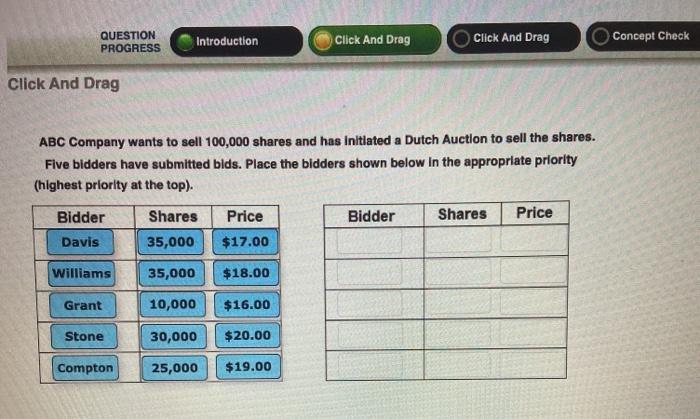

Question: QUESTION PROGRESS Introduction Click And Drag Click And Drag Concept Check Click And Drag ABC Company wants to sell 100,000 shares and has initiated a

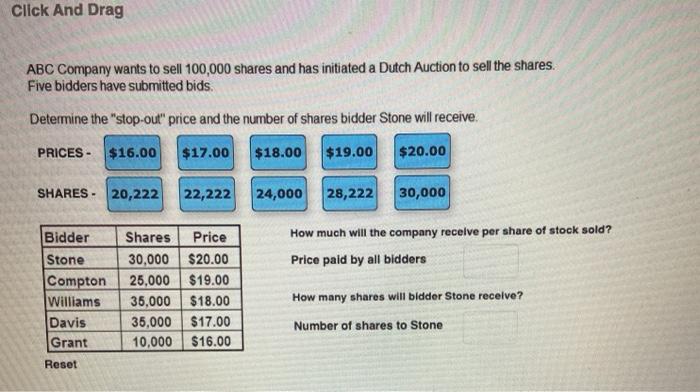

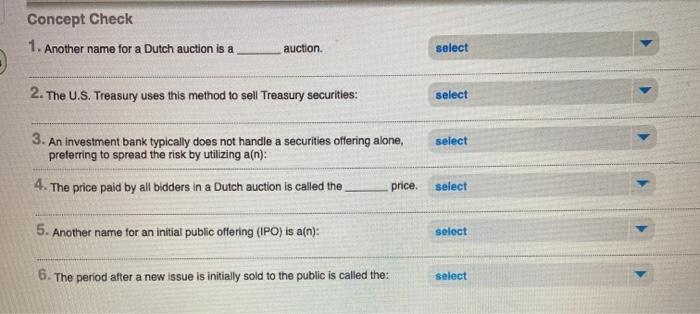

QUESTION PROGRESS Introduction Click And Drag Click And Drag Concept Check Click And Drag ABC Company wants to sell 100,000 shares and has initiated a Dutch Auction to sell the shares. Five bidders have submitted blds. Place the bidders shown below in the appropriate priority (highest priority at the top). Bidder Bidder Shares Price Shares 35,000 Price $17.00 Davis Williams 35,000 $18.00 Grant 10,000 $16.00 Stone 30,000 $20.00 Compton 25,000 $19.00 Click And Drag ABC Company wants to sell 100,000 shares and has initiated a Dutch Auction to sell the shares. Five bidders have submitted bids. Determine the "stop-out" price and the number of shares bidder Stone will receive PRICES - $16.00 $17.00 $18.00 $19.00 $20.00 SHARES - 20,222 22,222 24,000 28,222 30,000 How much will the company receive per share of stock sold? Price paid by all bidders Bidder Stone Compton Williams Davis Grant Shares Price 30,000 $20.00 25,000 $19.00 35,000 $18.00 35,000 $17.00 10,000 $16.00 How many shares will bidder Stone receive? Number of shares to Stone Reset Concept Check 1. Another name for a Dutch auction is a auction select 2. The U.S. Treasury uses this method to sell Treasury securities: select select 3. An investment bank typically does not handle a securities offering alone, preferring to spread the risk by utilizing a(n): 4. The price paid by all bidders in a Dutch auction is called the price select 5. Another name for an initial public offering (IPO) is a(n): select 6. The period after a new issue is initially sold to the public is called the: select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts