Question: Question Question 1 (a) Theo needs RM40,000 as a down payment for a house 6 years from now. He earns 3.5 percent on his savings.

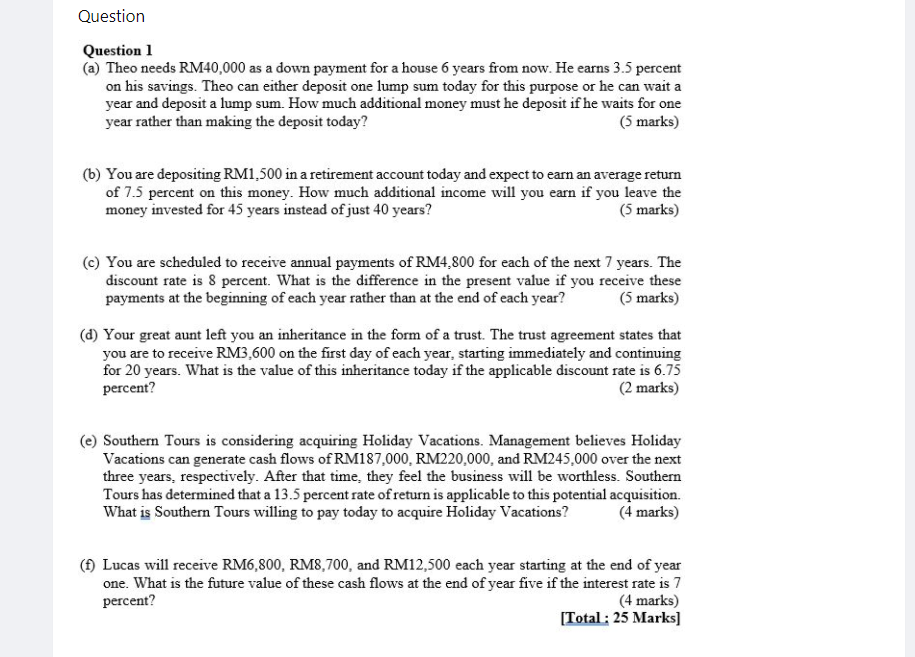

Question Question 1 (a) Theo needs RM40,000 as a down payment for a house 6 years from now. He earns 3.5 percent on his savings. Theo can either deposit one lump sum today for this purpose or he can wait a year and deposit a lump sum. How much additional money must he deposit if he waits for one year rather than making the deposit today? (5 marks) (b) You are depositing RM1,500 in a retirement account today and expect to earn an average return of 7.5 percent on this money. How much additional income will you earn if you leave the money invested for 45 years instead of just 40 years? (5 marks) (C) You are scheduled to receive annual payments of RM4,800 for each of the next 7 years. The discount rate is 8 percent. What is the difference in the present value if you receive these payments at the beginning of each year rather than at the end of each year? (5 marks) (d) Your great aunt left you an inheritance in the form of a trust. The trust agreement states that you are to receive RM3,600 on the first day of each year, starting immediately and continuing for 20 years. What is the value of this inheritance today if the applicable discount rate is 6.75 percent? (2 marks) (e) Southern Tours is considering acquiring Holiday Vacations Management believes Holiday Vacations can generate cash flows of RM187,000, RM220,000, and RM245,000 over the next three years, respectively. After that time, they feel the business will be worthless. Southern Tours has determined that a 13.5 percent rate of return is applicable to this potential acquisition. What is Southern Tours willing to pay today to acquire Holiday Vacations? (4 marks) (1) Lucas will receive RM6,800, RM8,700, and RM12,500 each year starting at the end of year one. What is the future value of these cash flows at the end of year five if the interest rate is 7 percent? (4 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts