Question: Question: QUESTION 1 For state governments, when budget cuts are necessary, the discretionary portion of state budgets -- that is, the non-entitlement, non-debt repayment portion

Question:

QUESTION 1

For state governments, when budget cuts are necessary, the discretionary portion of state budgets -- that is, the non-entitlement, non-debt repayment portion -- must be disproportionately reduced because many other expenditures are either mandated or out of direct state control.

True

False

0.5 points

QUESTION 2

This budget approach is designed to better highlight the activities and workloads of government

a.object-of-expenditure (or line-item)

b.program

c.performance

d.lump sum

e.None of the above

0.5 points

QUESTION 3

Which of the following would be a method by which a city could reduce its expenses and balance its budget?

a.Transfer operation of its sewer system to a sanitary district.

b.Transfer the city bus system to the local state university.

c.Transfer its dog pound and animal control function to the county.

d.Transfer the airport and economic development office to regional authorities.

e.All of the above would be methods by which a city could reduce its expenses and balance its budget.

0.5 points

QUESTION 4

During the audit and evaluation phase of budgeting managers produce financial reports, auditors produce audit reports, and managers responsible for reviews may produce other reports.

True

False

0.5 points

QUESTION 5

Most commonly, budgeting is considered to be_____________ .

a.rational

b.zero-based

c.incremental

d.all of the above

0.5 points

QUESTION 6

State and local governments depend heavily on grants from the federal government.

True

False

0.5 points

QUESTION 7

Which of the following is a way that local governments can seek to promote economic growth?

a.Lower the proportion of deposits that banks within the city must keep in reserve.

b.Reduce tax rates or exempt from taxation companies agreeing to do business within the city.

c.Physical infrastructure improvements that make the jurisdiction attractive to businesses looking to relocate.

d.All of the above

e.b and c, but not a

0.5 points

QUESTION 8

Public budgets are much more constrained in comparison with private sector budgets because there often are rules about the purposes for which revenue can be spent and the time frame in which it can be spent.

True

False

0.5 points

QUESTION 9

One advantage of incremental budgeting is that it sidesteps problems posed by disagreement on values and objectives so that only adjustments on the margin need to be debated and agreed upon.

True

False

0.5 points

QUESTION 10

In terms of government employment relative to population, local government has the most employees?

True

False

0.5 points

QUESTION 11

Which of the following items would NOT be included in a capital budget?

new building

employee salaries

highway construction project

dam

0.5 points

QUESTION 12

In order to balance their budgets state governments can

a.pass along to local governments expenditures that the state would normally pay for (a form of state unfunded mandates).

b.take over local government tax revenue or require the local governments to remit money to the state.

c.cut state aid to local governments.

d.All of the above

e.b and c, but not a

0.5 points

QUESTION 13

What is not a component of a Capital Improvement Plan?

past actuals

needs assessment

forecasts

current inventory

0.5 points

QUESTION 14

The audit and evaluation budget phase . . .

a.involves various people looking at a budget year to see what can be learned

b.starts when one or more central officials undertake actions to put an approved budget into effect

c.can include external financial audits conducted by accountants

d.All of the above

e.a and c, but not b

0.5 points

QUESTION 15

In comparison to property tax, most local income tax collections are_______.

a.higher

b.lower

c.a more reliable source of revenue

d.All of the above

e.None of the above

0.5 points

QUESTION 16

The federal budget can affect the taxing and spending decisions of state and local governments.

True

False

0.5 points

QUESTION 17

According to Fisher, what is the primary factor driving the increase in 'welfare' spending at the state and local level?

a.Medicaid

b.cash assistance

c.unemployment benefits

d.b and c, but not a

e.none of the above

0.5 points

QUESTION 18

When the Federal Reserve seeks to slow inflation by changing interest rates and/or changing the proportion of deposits that banks must keep in reserve, the government is practicing

a.Fiscal policy

b.Monetary policy

c.Inflationary budget making

d.Political maneuvering

e.None of the above

0.5 points

QUESTION 19

What is NOT a way that a federal system of government (i.e. different levels of government) affects public budgeting?

grants

mandates

bond ratings

tax credits, exemptions, and deductions

0.5 points

QUESTION 20

States limit their budgets in constitutions and laws by which of the following

a.Statutory balanced budget requirments

b.Statutory debt limits

c.Statutory tax and expenditure limitations

d.a and b, but not c

e.All of the above

0.5 points

QUESTION 21

When cuts are necessary in order to balance a budget, which of the following is a strategy that can be employed to make those cuts more politically acceptable?

a.Make cuts where they are least noticeable to prevent citizen complaints, for example a city reducing its vehicle renewal fund.

b.Make cuts across the board so that the cuts appear to be fair for everyone.

c.Make cuts in the programs that have the weakest interest group support.

d.All of the above

e.None of the above

0.5 points

QUESTION 22

In formulating choices for budgetary decreases or increases, the starting point is generating possible changes and choosing recommendations.

True

False

0.5 points

QUESTION 23

Which is not one of the primary roles of government in shaping the economy and society in general?

allocation

equalization

stabilization

distribution

none of the above; all are roles of government in shaping the economy

0.5 points

QUESTION 24

This relatively simple budget approach with a few broad expenditure categories is:

a.object-of-expenditure (or line-item)

b.program

c.performance

d.lump sum

e.None of the above

0.5 points

QUESTION 25

School districts receive the majority of their funding from

a.property taxes

b.sales taxes

c.state aid

d.a and c, but not b

e.None of the above

0.5 points

QUESTION 26

A reason why local policy makers build a politically acceptable surplus into the budget is

a.to provide a cushion to protect against inflation when it turns out to be higher than expected.

b.to provide a contingency against revenues falling short of estimates.

c.to provide a cushion against unanticipated arbitration judgments or court awards.

d.All of the above

e.b and c, but not a

0.5 points

QUESTION 27

Which of the following is a way in which gubernatorial powers differ between the states?

a.Governors have different powers in terms of organizing the executive branch.

b.Governors have different powers in terms of appointing agency officials.

c.Governors have different powers in terms of vetoing legislative acts.

d.Governors have different powers in terms of releasing and transferring appropriated funds.

e.All of the above

0.5 points

QUESTION 28

The budget that has been executed at the end of the fiscal year is almost never identical to the plan enacted at the outset.

True

False

0.5 points

QUESTION 29

Outsider or stakeholder involvement occurs predominantly during the ______________part of the budget cycle.

a.preparation

b.submission/approval

c.implementation

d.audit and evaluation

e.b and d

0.5 points

QUESTION 30

When the federal government seeks to stimulate economic growth by increasing government spending and/or cutting taxes, the government is practicing

a.Fiscal policy

b.Monetary policy

c.Recessionary budget making

d.Political grandstanding

e.None of the above

0.5 points

QUESTION 31

A financial audit is completed during the implementation stage of the budget cycle.

True

False

0.5 points

QUESTION 32

Most revenue collected by governments comes from taxes.

True

False

0.5 points

QUESTION 33

Which of the following budget formats is largely a detailed accounting activity that breaks down agency/department funding into discrete categories of expenditures?

a.object-of-expenditure (or line-item)

b.program

c.performance

d.zero-based or what-if

e.None of the above

0.5 points

QUESTION 34

A city government cannot always counts on intergovernment transfers as a reliable source of revenue because it is possible that the if the donor government (e.g. the state government) is in financial difficulties they may delay transfer of funds, or even reduce or cancel shared revenue programs.

True

False

0.5 points

QUESTION 35

Governors in a majority of states have line-item veto authority.

True

False

0.5 points

QUESTION 36

In the state budgeting process, "local assistance" refers to

a.the technical assistance that states lend to local units of government (e.g. counties and cities) in helping them prepare their budgets.

b.money provided by local units of government to the state.

c.state payments to local units of government to meet costs that otherwise would have to be borne by the local jurisdictions.

d.the fact that local units of government were created by the states and therefore need to assist the state in achieving its policy goals.

e.None of the above

0.5 points

QUESTION 37

In most states roughly 10% or less of their general expenditures is provided to local units of government (counties and cities) in the form of state aid.

True

False

0.5 points

QUESTION 38

According to Ronald Fisher, in 1998-1999 state - local governments got the largest percentage of their revenue from

a.the federal government

b.income taxes

c.property taxes

d.sales taxes

0.5 points

QUESTION 39

Like the federal government, state governments (with the exception of Vermont) do not use capital budgets.

True

False

0.5 points

QUESTION 40

Budgetary decision making is a linear process and sequential, moving seamlessly through various stages of the budget process.

True

False

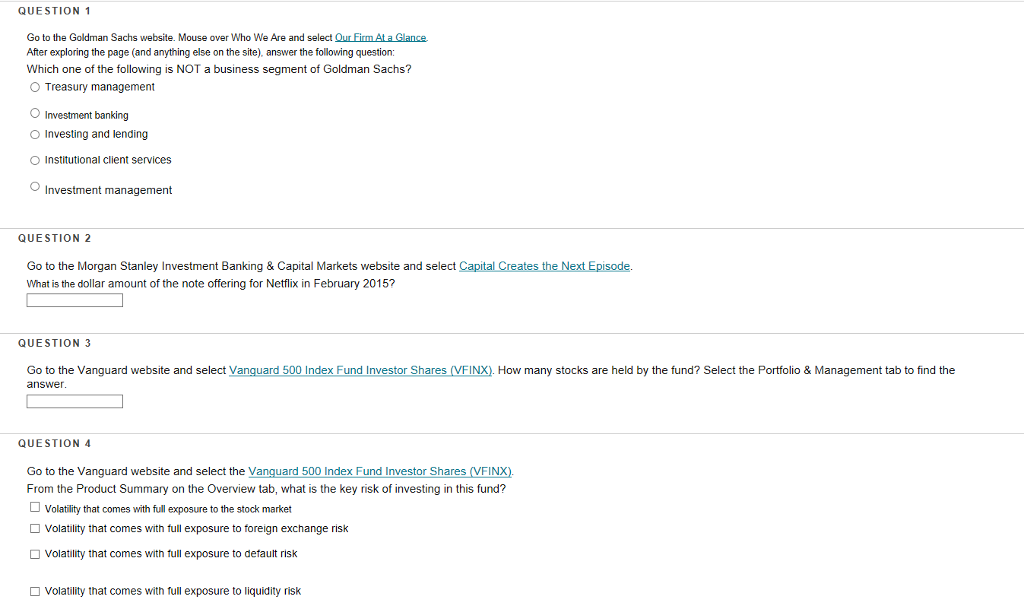

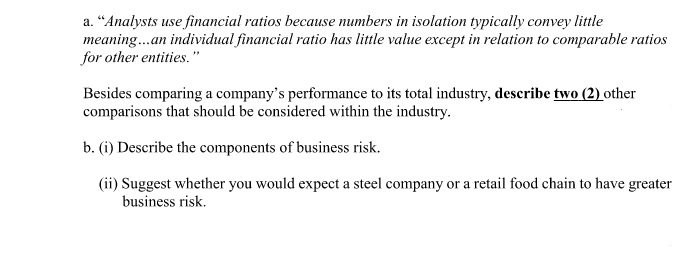

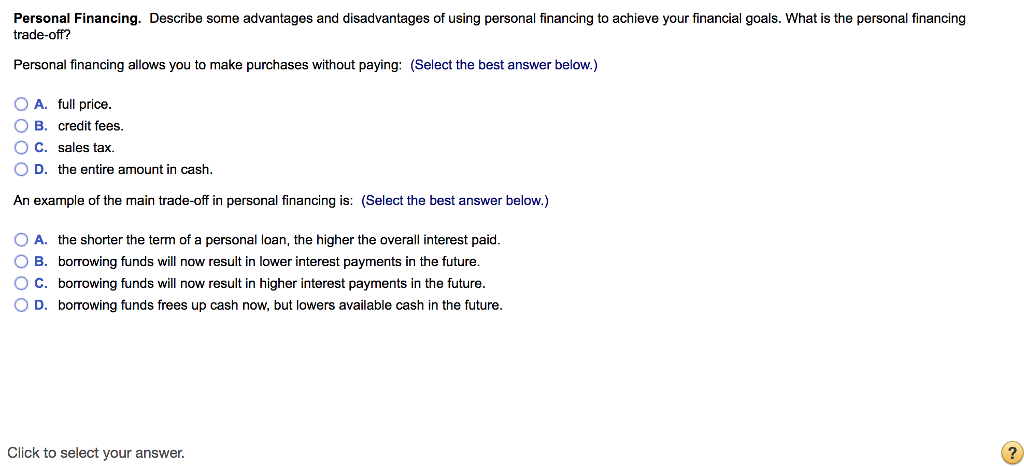

QUESTION 1 Go to the Goldman Sachs website. Mouse over Who We Are and select Our Firm At a Glance After exploring the page (and anything else on the site). answer the following question: Which one of the following is NOT a business segment of Goldman Sachs? O Treasury management Investment banking O Investing and lending O Institutional client services Investment management QUESTION 2 Go to the Morgan Stanley Investment Banking & Capital Markets website and select Capital Creates the Next Episode. What is the dollar amount of the note offering for Netflix in February 2015? QUESTION 3 Go to the Vanguard website and select Vanguard 500 Index Fund Investor Shares (VFINX). How many stocks are held by the fund? Select the Portfolio & Management tab to find the answer. QUESTION 4 Go to the Vanguard website and select the Vanguard 500 Index Fund Investor Shares (VFINX). From the Product Summary on the Overview tab, what is the key risk of investing in this fund? Volatility that comes with full exposure to the stock market O Volatility that comes with full exposure to foreign exchange risk Volatility that comes with full exposure to default risk [ Volatility that comes with full exposure to liquidity riska. "Analysts use financial ratios because numbers in isolation typically convey little meaning...an individual financial ratio has little value except in relation to comparable ratios for other entities." Besides comparing a company's performance to its total industry, describe two (2) other comparisons that should be considered within the industry. b. (i) Describe the components of business risk. (ii) Suggest whether you would expect a steel company or a retail food chain to have greater business risk.Personal Financing. Describe some advantages and disadvantages of using personal financing to achieve your financial goals. What is the personal financing trade-off? Personal financing allows you to make purchases without paying: (Select the best answer below.) O A. full price. O B. credit fees. O C. sales tax. O D. the entire amount in cash. An example of the main trade-off in personal financing is: (Select the best answer below.) O A. the shorter the term of a personal loan, the higher the overall interest paid. O B. borrowing funds will now result in lower interest payments in the future. O C. borrowing funds will now result in higher interest payments in the future. O D. borrowing funds frees up cash now, but lowers available cash in the future. Click to select your answer.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts