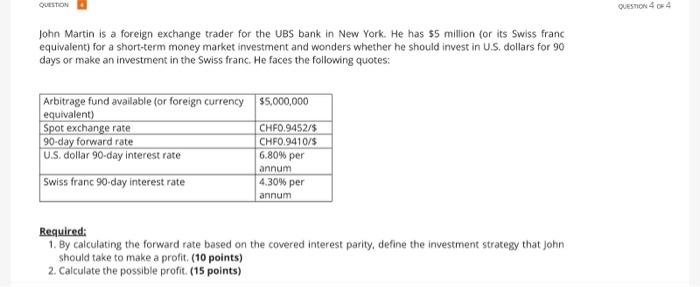

Question: QUESTION QUESTION 404 John Martin is a foreign exchange trader for the UBS bank in New York. He has $5 million for its Swiss franc

QUESTION QUESTION 404 John Martin is a foreign exchange trader for the UBS bank in New York. He has $5 million for its Swiss franc equivalent) for a short-term money market investment and wonders whether he should invest in U.S. dollars for 90 days or make an investment in the Swiss franc. He faces the following quotes: Arbitrage fund available for foreign currency 55,000,000 equivalent) Spot exchange rate CHF0.9452/5 90-day forward rate CHF0.9410/$ U.S. dollar 90-day interest rate 6.80% per annum Swiss franc 90 day interest rate 4.30% per annum Required: 1. By calculating the forward rate based on the covered interest parity, define the investment strategy that John should take to make a profit . (10 points) 2. Calculate the possible profit. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts