Question: Question: Really need help in this Questions 1. First build main-race.c. Examine the code so you can see the (hopefully obvious) data race in the

Question:

Really need help in this

Questions

1. First build main-race.c. Examine the code so you can see the (hopefully obvious) data race in the code. Now run helgrind (by typing valgrind --tool=helgrind main-race) to see how it reports the race. Does it point to the right lines of code? What other information does it give to you?

2. What happens when you remove one of the offending lines of code? Now add a lock around one of the updates to the shared variable, and then around both. What does helgrind report in each of these cases?

3. Now let's look at main-deadlock.c. Examine the code. This code has a problem known as deadlock (which we discuss in much more d

4. Now run helgrind on this code. What does helgrind report?

5. Now run helgrind on main-deadlock-global.c. Examine the code; does it have the same problem that main-deadlock.c has? Should helgrind be reporting the same error? What does this tell you about tools like helgrind?

6. Let's next look at main-signal.c. This code uses a variable (done) to signal that the child is done and that the parent can now continue. Why is this code inefficient? (what does the parent end up spending its time doing, particularly if the child thread takes a long time to complete?)

7. Now run helgrind on this program. What does it report? Is the code correct?

8. Now look at a slightly modified version of the code, which is found in main-signal-cv.c. This version uses a condition variable to do the signaling (and associated lock). Why is this code preferred to the previous version? Is it correctness, or performance, or both?

9. Once again run helgrind on main-signal-cv. Does it report any errors?

How would sale of $400 of inventory on credit affect the financial statement if the cost of the inventory sold was of $160.

It would increase cash by $400 on the income statement and increase revenue by $400 on the balance sheet.

It would decrease non-cash assets by $400 on the balance sheet and decrease retained earnings by $400 on the income statement.

It would increase non-cash assets by $240 on the balance sheet and increase retained earnings by $240 on the balance sheet.

It would increase decrease inventory by $400 on the balance sheet and increase revenue by $400 on the income statement.

During fiscal 2016, Shoe Productions recorded inventory purchases on credit of $337.8 million. The financial statement effect of these purchase transactions would be to:

Increase expenses (Cost of goods sold) on the balance sheet and increases liability (accounts payable) on the income statement.

Increase liabilities (Accounts payable) on the balance sheet and increase assets on the balance sheet.

Increase expenses (Cost of goods sold) on the income statement and increase liabilities (Accounts payable) on the balance sheet.

Decrease cash on the income statement and increase liability (account payable) on the balance sheet.

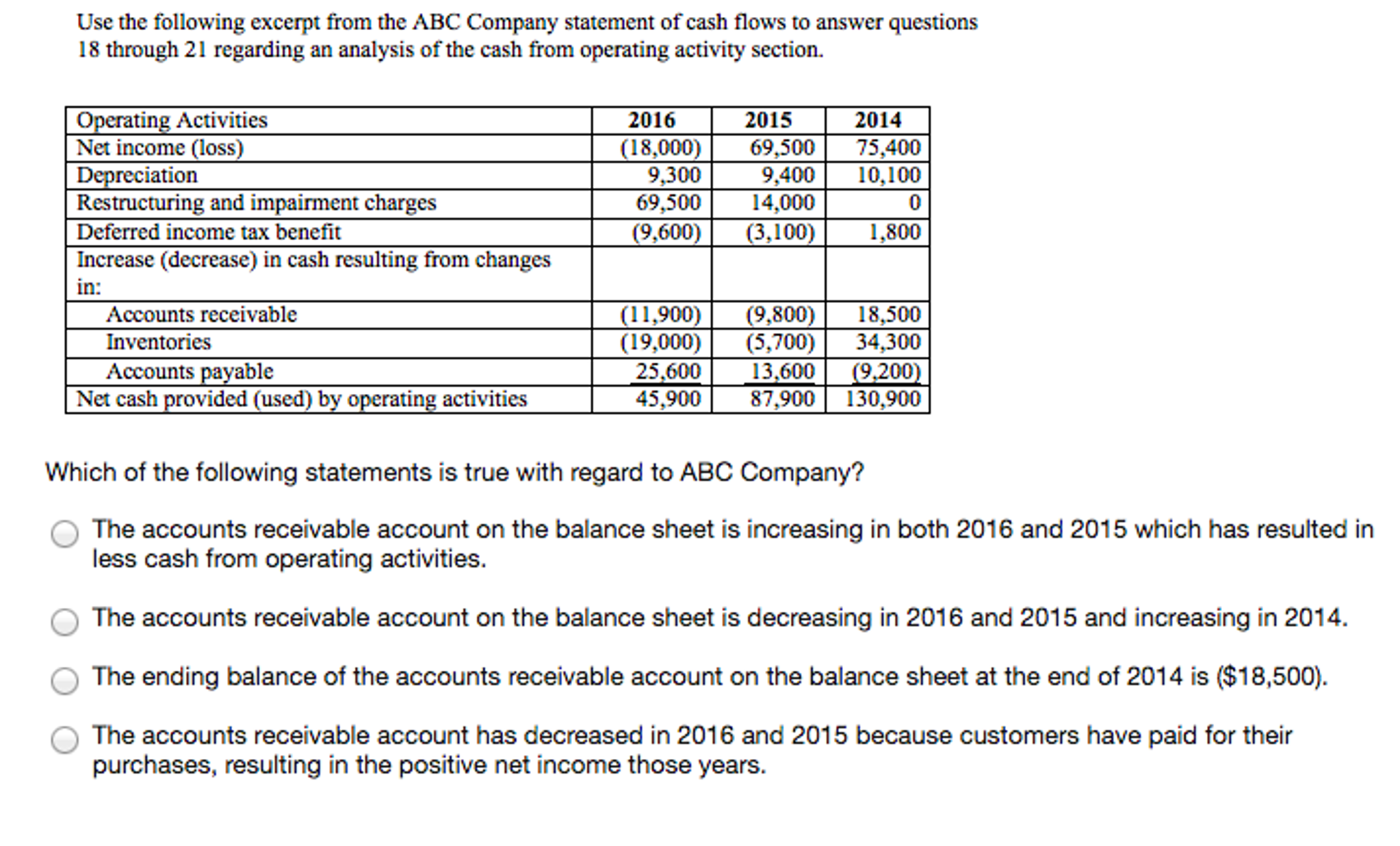

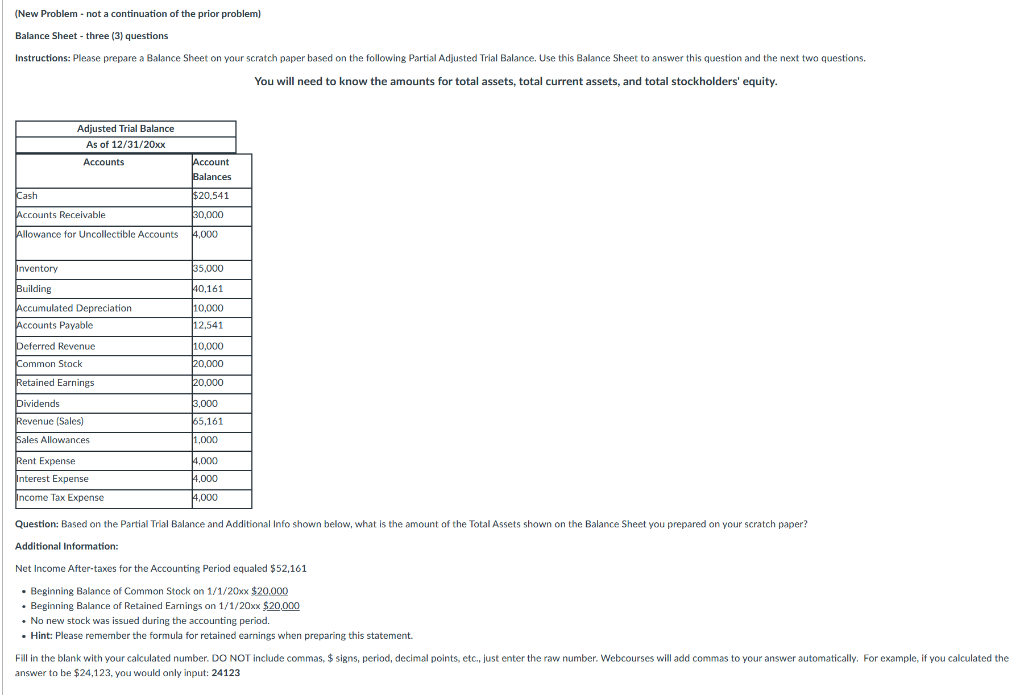

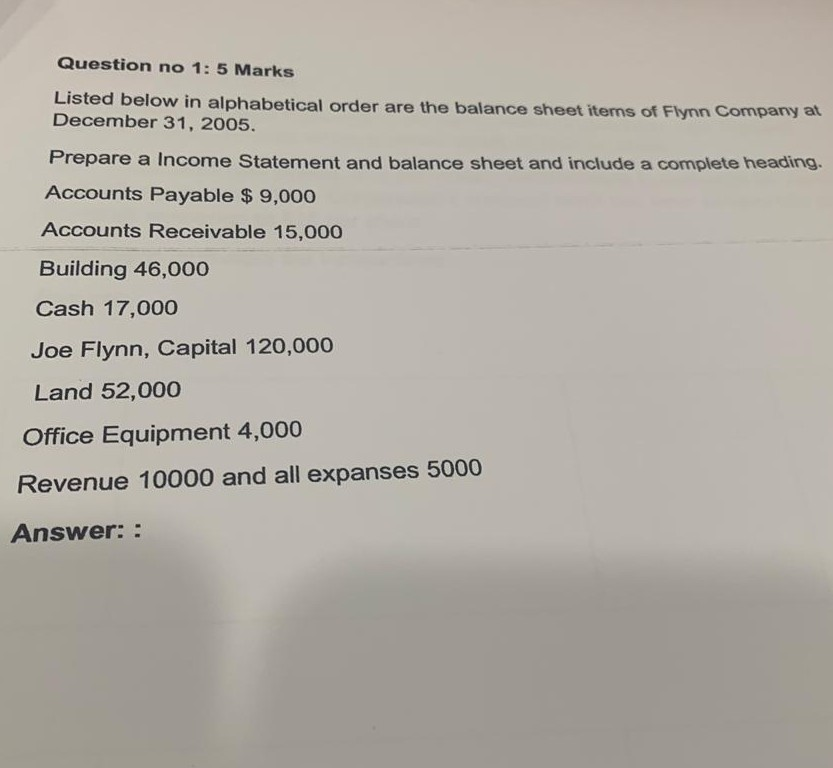

Use the following excerpt from the ABC Company statement of cash flows to answer questions 18 through 21 regarding an analysis of the cash from operating activity section. Operating Activities 2016 2015 2014 Net income (loss) (18,000) 69,500 75,400 Depreciation 9,300 9.400 10,100 Restructuring and impairment charges 69,500 14,000 0 Deferred income tax benefit (9,600) (3,100) 1,800 Increase (decrease) in cash resulting from changes in: Accounts receivable (11,900) (9,800) 18,500 Inventories (19,000) (5,700) 34,300 Accounts payable 25,600 13,600 (9,200) Net cash provided (used) by operating activities 45,900 87,900 130,900 Which of the following statements is true with regard to ABC Company? The accounts receivable account on the balance sheet is increasing in both 2016 and 2015 which has resulted in less cash from operating activities. The accounts receivable account on the balance sheet is decreasing in 2016 and 2015 and increasing in 2014. The ending balance of the accounts receivable account on the balance sheet at the end of 2014 is ($18,500). The accounts receivable account has decreased in 2016 and 2015 because customers have paid for their purchases, resulting in the positive net income those years.(New Problem - not a continuation of the prior problem] Balance Sheet - three (3) questions Instructions: Please prepare a Balance Sheet on your scratch paper based on the following Partial Adjusted Trial Balance. Use this Balance Sheet to answer this question and the next two questions. You will need to know the amounts for total assets, total current assets, and total stockholders equity. Adjusted Trial Balance As of 12/31/20xx Accounts Account Balances Cash $20.541 Accounts Receivable 30,000 Allowance for Uncollectible Accounts 4,000 Inventory 35,000 Building 10,161 Accumulated Depreciation 0,000 Accounts Payable 12.541 Deferred Revenue 10,000 Common Stock 20,000 Retained Earnings 20,000 Dividends 3,000 Revenue [Sales) 65,161 Sales Allowances 1,00 Rent Expense 4,000 Interest Expense 4,000 ncome Tax Expense 4,00 Question: Based on the Partial Trial Balance and Additional Info shown below, what is the amount of the Total Assets shown on the Balance Sheet you prepared on your scratch paper? Additional Information: Net Income After-taxes for the Accounting Period equaled $52,161 . Beginning Balance of Common Stock on 1/1/20xx $20.000 . Beginning Balance of Retained Earnings on 1/1/20xx $20,000 . No new stock was issued during the accounting period. . Hint: Please remember the formula for retained earnings when preparing this statement. Fill in the blank with your calculated number. DO NOT include commas, $ signs, period, decimal points, etc., just enter the raw number. Webcourses will add commas to your answer automatically. For example, if you calculated the answer to be $24,123, you would only input: 24123Question no 1: 5 Marks Listed below in alphabetical order are the balance sheet items of Flynn Company at December 31, 2005. Prepare a Income Statement and balance sheet and include a complete heading. Accounts Payable $ 9,000 Accounts Receivable 15,000 Building 46,000 Cash 17,000 Joe Flynn, Capital 120,000 Land 52,000 Office Equipment 4,000 Revenue 10000 and all expanses 5000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts