Question: Question: Record the disposal of Machine B & C , and record the depreciation of Machine B During the current year, Merkley Company disposed of

Question: Record the disposal of Machine B & C, and record the depreciation of Machine B

Question: Record the disposal of Machine B & C, and record the depreciation of Machine B

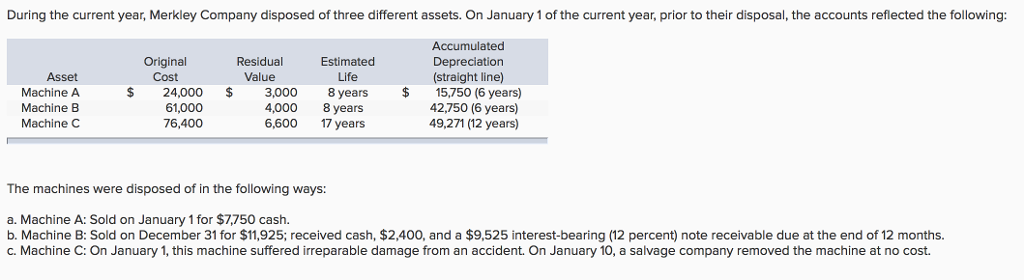

During the current year, Merkley Company disposed of three different assets. On January1of the current year, prior to their disposal, the accounts reflected the following: Accumulated Original Residual Estimated Depreciation Asset Cost Value Life (straight line) 24.000 3,000 8 years 15,750 (6 years) Machine A 61,000 Machine B 4,000 8 years 42,750 (6 years) 49.271 (2 years) Machine C 76,400 6,600 17 years The machines were disposed of in the following ways: a. Machine A: Sold on January 1 for $7,750 cash. b. Machine B: Sold on December 31 for $11,925; received cash, $2,400, and a $9,525 interest-bearing (12 percent note receivable due at the end of 12 months. c. Machine C: On January 1, this machine suffered irreparable damage from an accident. On January 10, a salvage company removed the machine at no cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts