Question: Question Release and Answer Submission Time Schedule Question Question Time Allocated Start Time Submission Time Release Time Number 3 40 minutes * Five minutes to

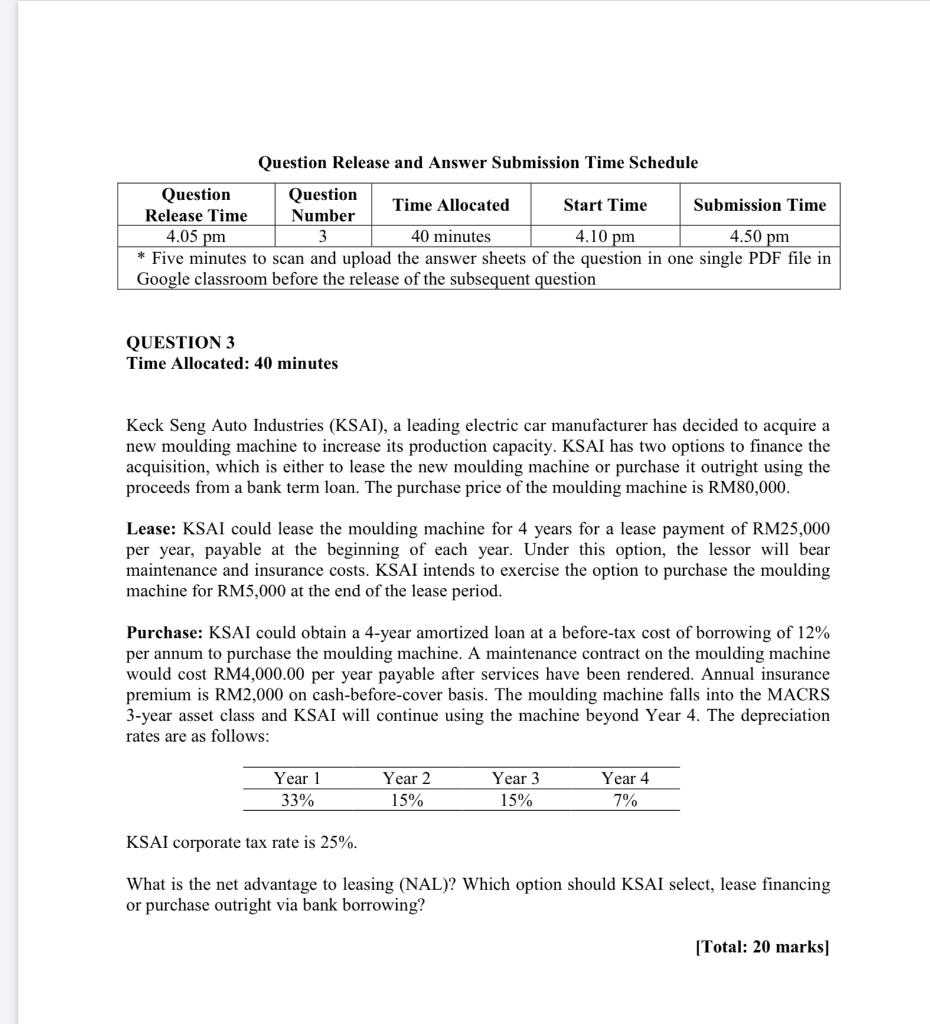

Question Release and Answer Submission Time Schedule Question Question Time Allocated Start Time Submission Time Release Time Number 3 40 minutes * Five minutes to scan and upload the answer sheets of the question in one single PDF file in Google classroom before the release of the subsequent question 4.05 pm 4.10 pm 4.50 pm QUESTION 3 Time Allocated: 40 minutes Keck Seng Auto Industries (KSAI), a leading electric car manufacturer has decided to acquire a new moulding machine to increase its production capacity. KSAI has two options to finance the acquisition, which is either to lease the new moulding machine or purchase it outright using the proceeds from a bank term loan. The purchase price of the moulding machine is RM80,000. Lease: KSAI could lease the moulding machine for 4 years for a lease payment of RM25,000 per year, payable at the beginning of each year. Under this option, the lessor will bear maintenance and insurance costs. KSAI intends to exercise the option to purchase the moulding machine for RM5,000 at the end of the lease period. Purchase: KSAI could obtain a 4-year amortized loan at a before-tax cost of borrowing of 12% per annum to purchase the moulding machine. A maintenance contract on the moulding machine would cost RM4,000.00 per year payable after services have been rendered. Annual insurance premium is RM2,000 on cash-before-cover basis. The moulding machine falls into the MACRS 3-year asset class and KSAI will continue using the machine beyond Year 4. The depreciation rates are as follows: Year 1 33% Year 2 15% Year 3 15% Year 4 7% KSAI corporate tax rate is 25%. What is the net advantage to leasing (NAL)? Which option should KSAI select, lease financing or purchase outright via bank borrowing? [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts