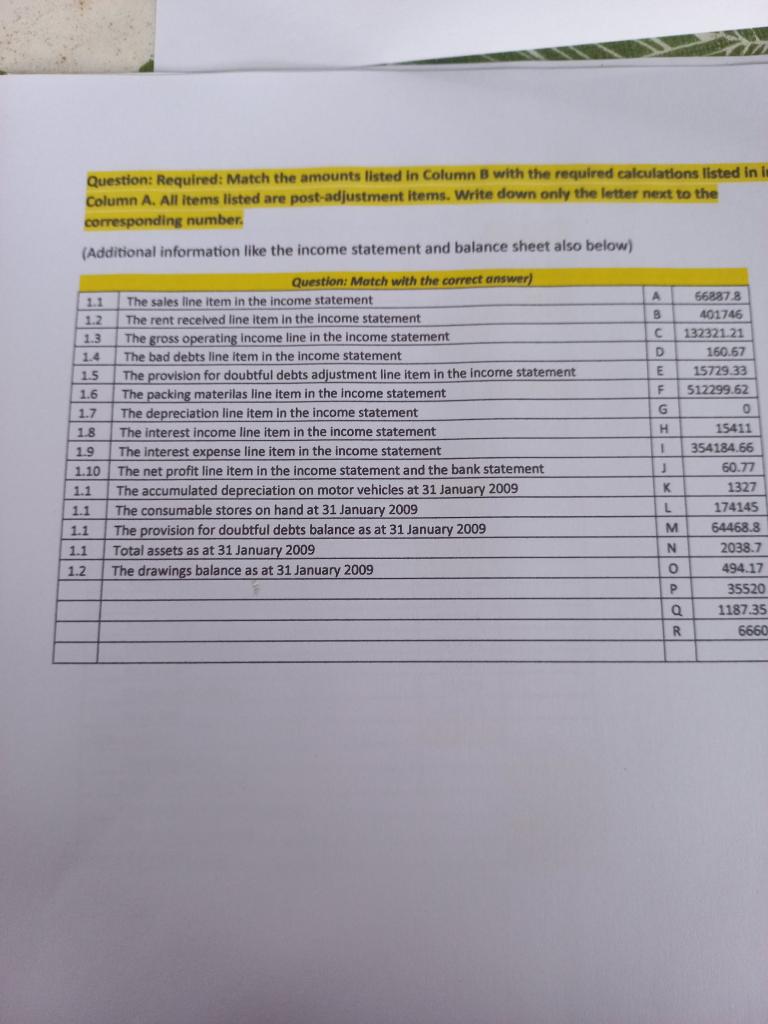

Question: Question: Required: Match the amounts listed in Column B with the required calculations listed in Column A. All items listed are post-adjustment items. Write down

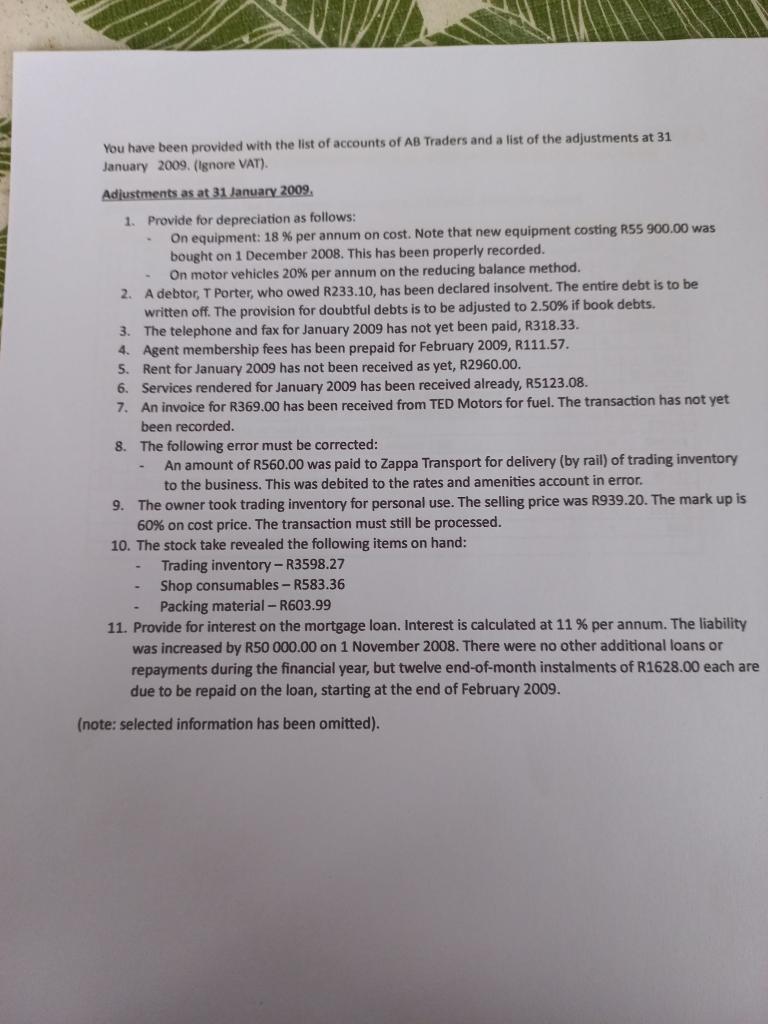

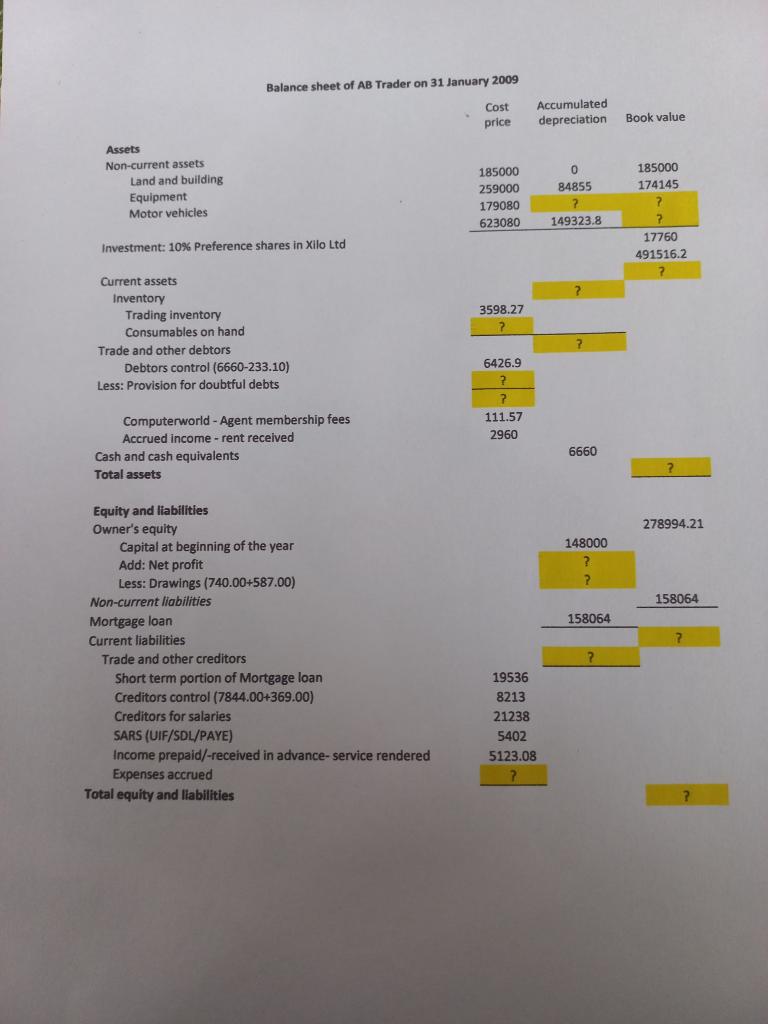

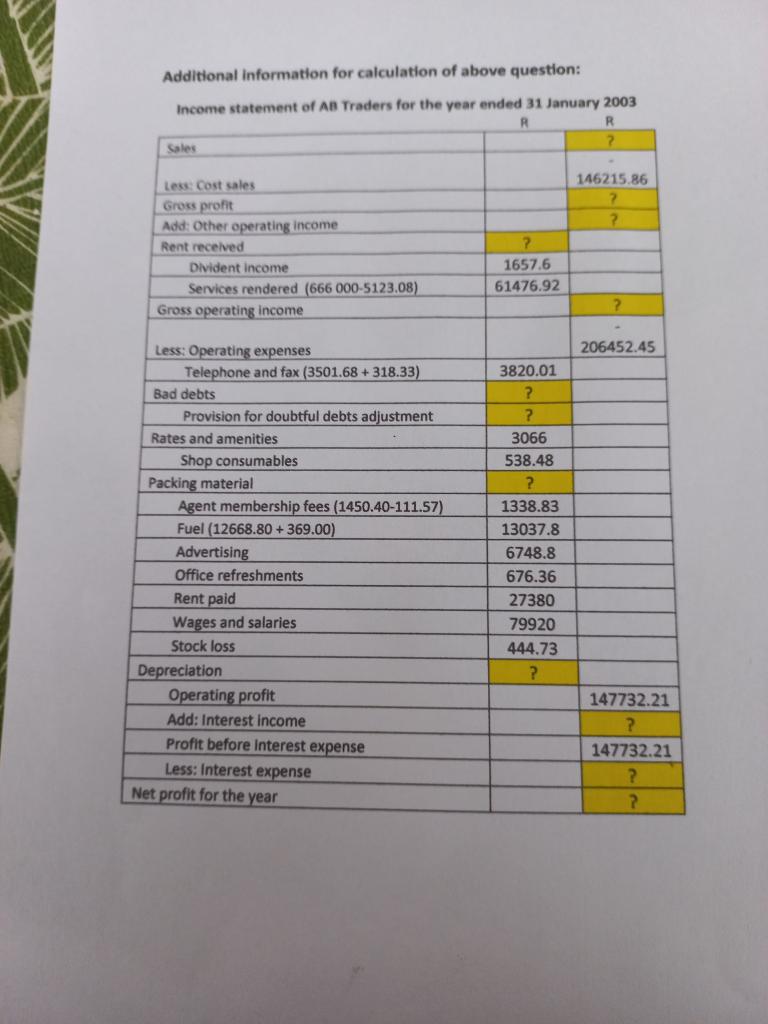

Question: Required: Match the amounts listed in Column B with the required calculations listed in Column A. All items listed are post-adjustment items. Write down only the letter next to the corresponding number. (Additional information like the income statement and balance sheet also below) You have been provided with the list of accounts of AB Traders and a list of the adjustments at 31 January 2009. (Ignore VAT). Adiustments as at 31 lanuary 2009. 1. Provide for depreciation as follows: On equipment: 18% per annum on cost. Note that new equipment costing R55 900.00 was bought on 1 December 2008 . This has been properly recorded. - On motor vehicles 20% per annum on the reducing balance method. 2. A debtor, T Porter, who owed R233.10, has been declared insolvent. The entire debt is to be written off. The provision for doubtful debts is to be adjusted to 2.50% if book debts. 3. The telephone and fax for January 2009 has not yet been paid, R318.33. 4. Agent membership fees has been prepaid for February 2009, R111.57. 5. Rent for January 2009 has not been received as yet, R2960.00. 6. Services rendered for January 2009 has been received already, R5123.08. 7. An invoice for R369.00 has been received from TED Motors for fuel. The transaction has not yet been recorded. 8. The following error must be corrected: - An amount of R560.00 was paid to Zappa Transport for delivery (by rail) of trading inventory to the business. This was debited to the rates and amenities account in error. 9. The owner took trading inventory for personal use. The selling price was R939.20. The mark up is 60% on cost price. The transaction must still be processed. 10. The stock take revealed the following items on hand: - Trading inventory - R3598.27 - Shop consumables - R583.36 - Packing material - R603.99 11. Provide for interest on the mortgage loan. Interest is calculated at 11% per annum. The liability was increased by R50 000.00 on 1 November 2008 . There were no other additional loans or repayments during the financial year, but twelve end-of-month instalments of R1628.00 each are due to be repaid on the loan, starting at the end of February 2009. (note: selected information has been omitted). Balance sheet of AB Trader on 31 January 2009 Cost Accumulated price depreciation Bookvalue Assets Non-current assets Land and building Equipment Motor vehicles Investment: 10% Preference shares in Xilo Ltd Current assets Inventory Trading inventory Consumables on hand Trade and other debtors Equity and liabilities Owner's equity Capital at beginning of the year Add: Net profit Less: Drawings (740.00+587.00) Non-current liabilities Mortgage loan Current liabilities Trade and other creditors Short term portion of Mortgage loan Creditors control (7844.00+369.00) Creditors for salaries SARS (UIF/SDL/PAYE) Income prepaid/-received in advance- service rendered Expenses accrued Total equity and liabilities ? Additional information for calculation of above question: Income statement of AB Traders for the year ended 31 January 2003 Question: Required: Match the amounts listed in Column B with the required calculations listed in Column A. All items listed are post-adjustment items. Write down only the letter next to the corresponding number. (Additional information like the income statement and balance sheet also below) You have been provided with the list of accounts of AB Traders and a list of the adjustments at 31 January 2009. (Ignore VAT). Adiustments as at 31 lanuary 2009. 1. Provide for depreciation as follows: On equipment: 18% per annum on cost. Note that new equipment costing R55 900.00 was bought on 1 December 2008 . This has been properly recorded. - On motor vehicles 20% per annum on the reducing balance method. 2. A debtor, T Porter, who owed R233.10, has been declared insolvent. The entire debt is to be written off. The provision for doubtful debts is to be adjusted to 2.50% if book debts. 3. The telephone and fax for January 2009 has not yet been paid, R318.33. 4. Agent membership fees has been prepaid for February 2009, R111.57. 5. Rent for January 2009 has not been received as yet, R2960.00. 6. Services rendered for January 2009 has been received already, R5123.08. 7. An invoice for R369.00 has been received from TED Motors for fuel. The transaction has not yet been recorded. 8. The following error must be corrected: - An amount of R560.00 was paid to Zappa Transport for delivery (by rail) of trading inventory to the business. This was debited to the rates and amenities account in error. 9. The owner took trading inventory for personal use. The selling price was R939.20. The mark up is 60% on cost price. The transaction must still be processed. 10. The stock take revealed the following items on hand: - Trading inventory - R3598.27 - Shop consumables - R583.36 - Packing material - R603.99 11. Provide for interest on the mortgage loan. Interest is calculated at 11% per annum. The liability was increased by R50 000.00 on 1 November 2008 . There were no other additional loans or repayments during the financial year, but twelve end-of-month instalments of R1628.00 each are due to be repaid on the loan, starting at the end of February 2009. (note: selected information has been omitted). Balance sheet of AB Trader on 31 January 2009 Cost Accumulated price depreciation Bookvalue Assets Non-current assets Land and building Equipment Motor vehicles Investment: 10% Preference shares in Xilo Ltd Current assets Inventory Trading inventory Consumables on hand Trade and other debtors Equity and liabilities Owner's equity Capital at beginning of the year Add: Net profit Less: Drawings (740.00+587.00) Non-current liabilities Mortgage loan Current liabilities Trade and other creditors Short term portion of Mortgage loan Creditors control (7844.00+369.00) Creditors for salaries SARS (UIF/SDL/PAYE) Income prepaid/-received in advance- service rendered Expenses accrued Total equity and liabilities ? Additional information for calculation of above question: Income statement of AB Traders for the year ended 31 January 2003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts