Question: Question: REVIEW THE CASE POSTED ANSWER THE QUESTION - BE AS COMPREHENSIVE AS POSSIBLE. CASE ANALYSIS You are employed as the Marketing Manager for a

Question: REVIEW THE CASE POSTED ANSWER THE QUESTION - BE AS COMPREHENSIVE AS POSSIBLE.

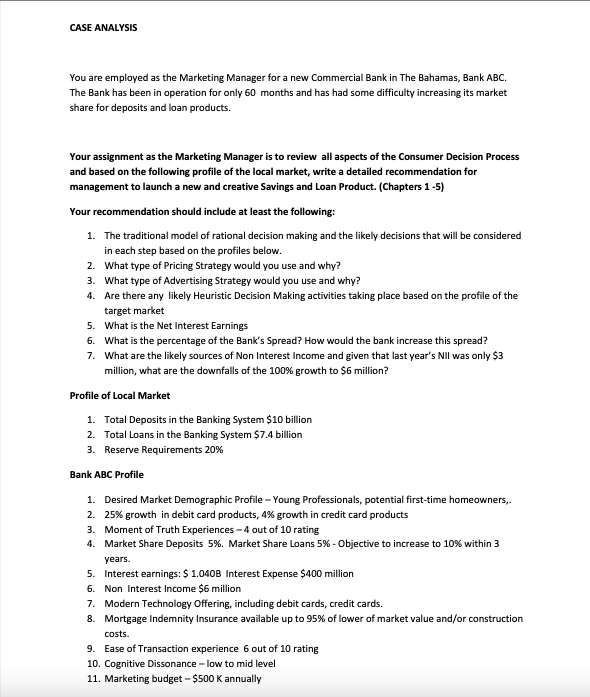

CASE ANALYSIS You are employed as the Marketing Manager for a new Commercial Bank in The Bahamas, Bank ABC. The Bank has been in operation for only 60 months and has had some difficulty increasing its market share for deposits and loan products. Your assignment as the Marketing Manager is to review all aspects of the Consumer Decision Process and based on the following profile of the local market, write a detailed recommendation for management to launch a new and creative Savings and Loan Product. (Chapters 1-5) Your recommendation should include at least the following: 1. The traditional model of rational decision making and the likely decisions that will be considered in each step based on the profiles below. 2. What type of Pricing Strategy would you use and why? 3. What type of Advertising Strategy would you use and why? 4. Are there any likely Heuristic Decision Making activities taking place based on the profile of the target market 5. What is the Net Interest Earnings 6. What is the percentage of the Bank's Spread? How would the bank increase this spread? 7. What are the likely sources of Non Interest Income and given that last year's Nll was only $3 million, what are the downfalls of the 100% growth to $6 million? Profile of Local Market 1. Total Deposits in the Banking System $ 10 billion 2. Total Loans in the Banking System $7.4 billion 3. Reserve Requirements 20% Bank ABC Profile 1. Desired Market Demographic Profile - Young Professionals, potential first-time homeowners, 2. 25% growth in debit card products, 4% growth in credit card products 3. Moment of Truth Experiences - 4 out of 10 rating 4. Market Share Deposits 5%. Market Share Loans 5% - Objective to increase to 10% within 3 years. 5. Interest earnings: $ 1.040B Interest Expense $400 million 6. Non Interest Income $6 million 7. Modern Technology Offering, including debit cards, credit cards. 8. Mortgage Indemnity Insurance available up to 95% of lower of market value and/or construction costs. 9. Ease of Transaction experience 6 out of 10 rating 10. Cognitive Dissonance-low to mid level 11. Marketing budget - $500 K annually CASE ANALYSIS You are employed as the Marketing Manager for a new Commercial Bank in The Bahamas, Bank ABC. The Bank has been in operation for only 60 months and has had some difficulty increasing its market share for deposits and loan products. Your assignment as the Marketing Manager is to review all aspects of the Consumer Decision Process and based on the following profile of the local market, write a detailed recommendation for management to launch a new and creative Savings and Loan Product. (Chapters 1-5) Your recommendation should include at least the following: 1. The traditional model of rational decision making and the likely decisions that will be considered in each step based on the profiles below. 2. What type of Pricing Strategy would you use and why? 3. What type of Advertising Strategy would you use and why? 4. Are there any likely Heuristic Decision Making activities taking place based on the profile of the target market 5. What is the Net Interest Earnings 6. What is the percentage of the Bank's Spread? How would the bank increase this spread? 7. What are the likely sources of Non Interest Income and given that last year's Nll was only $3 million, what are the downfalls of the 100% growth to $6 million? Profile of Local Market 1. Total Deposits in the Banking System $ 10 billion 2. Total Loans in the Banking System $7.4 billion 3. Reserve Requirements 20% Bank ABC Profile 1. Desired Market Demographic Profile - Young Professionals, potential first-time homeowners, 2. 25% growth in debit card products, 4% growth in credit card products 3. Moment of Truth Experiences - 4 out of 10 rating 4. Market Share Deposits 5%. Market Share Loans 5% - Objective to increase to 10% within 3 years. 5. Interest earnings: $ 1.040B Interest Expense $400 million 6. Non Interest Income $6 million 7. Modern Technology Offering, including debit cards, credit cards. 8. Mortgage Indemnity Insurance available up to 95% of lower of market value and/or construction costs. 9. Ease of Transaction experience 6 out of 10 rating 10. Cognitive Dissonance-low to mid level 11. Marketing budget - $500 K annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts