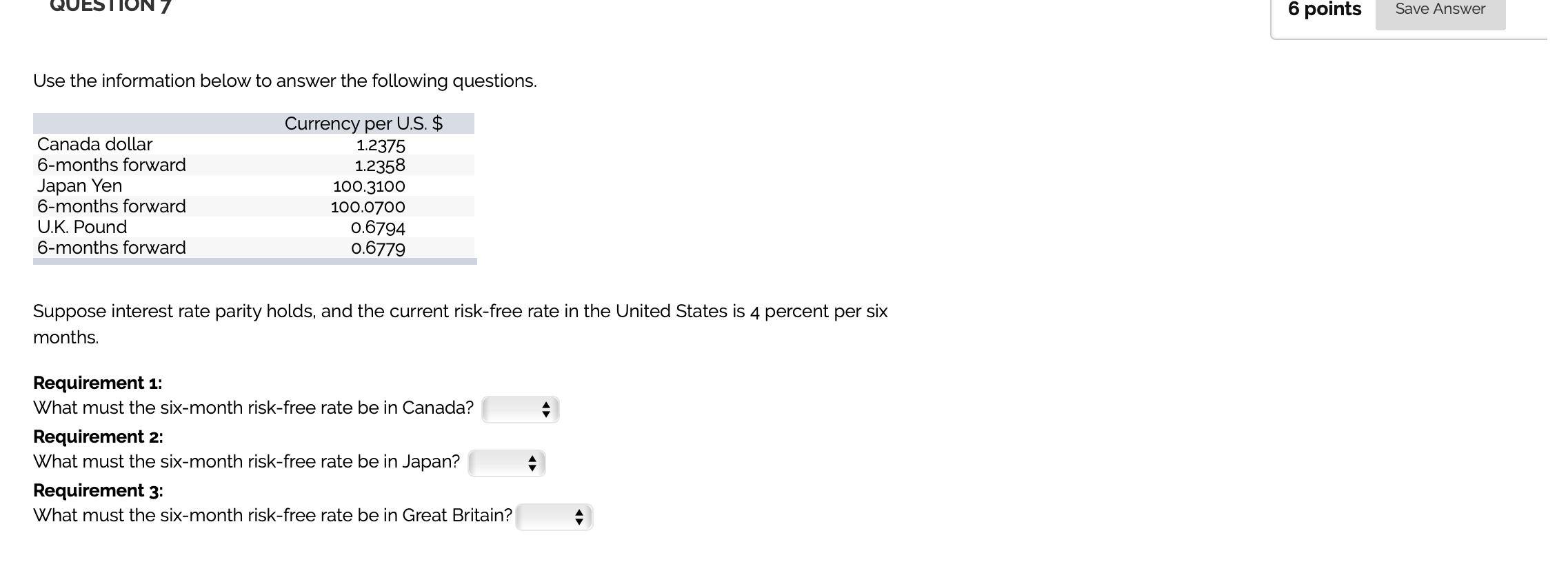

Question: QUESTION Save Answer Use the information below to answer the following questions. Canada dollar 6-months forward Japan Yen 6-months forward U.K. Pound 6-months forward Currency

QUESTION Save Answer Use the information below to answer the following questions. Canada dollar 6-months forward Japan Yen 6-months forward U.K. Pound 6-months forward Currency per U.S. $ 1.2375 1.2358 100.3100 100.0700 0.6794 0.6779 Suppose interest rate parity holds, and the current risk-free rate in the United States is 4 percent per six months. Requirement 1: What must the six-month risk-free rate be in Canada? Requirement 2: What must the six-month risk-free rate be in Japan? Requirement 3: What must the six-month risk-free rate be in Great Britain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts