Question: Question set #4 (15 points) Using the Carhart (1997) four-factor model, you analyze the performance of the portfolio formed by sports sentiment. You include firms

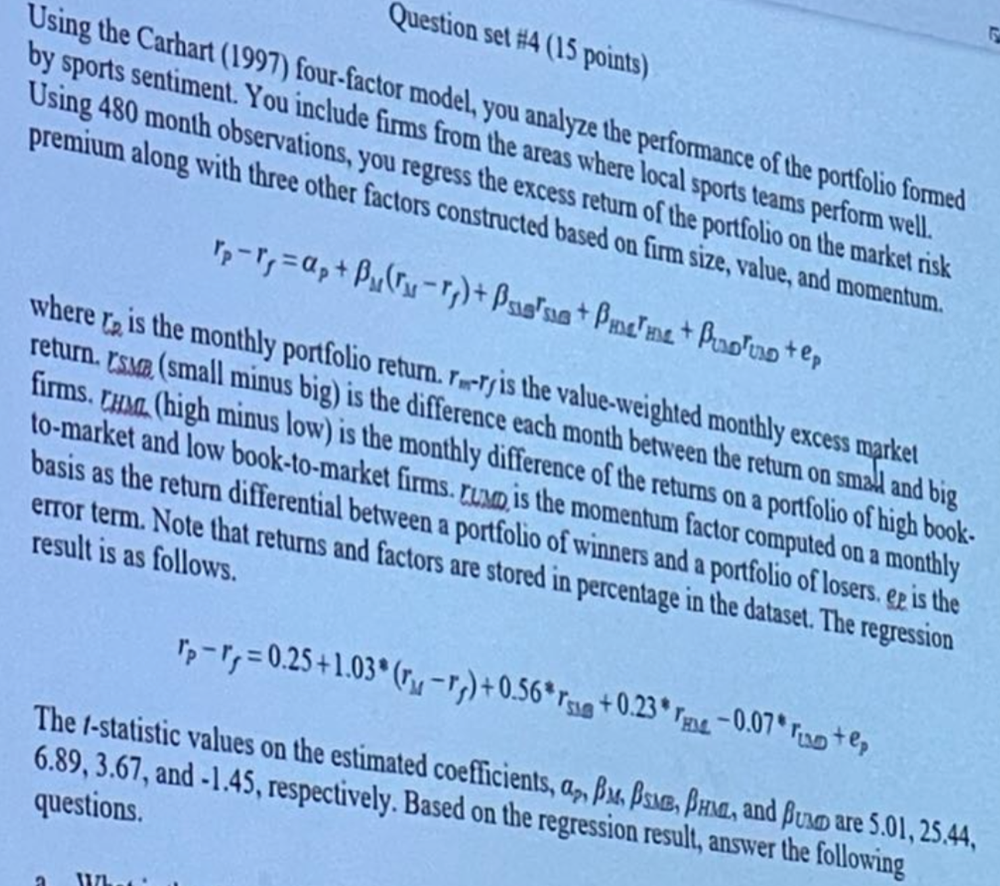

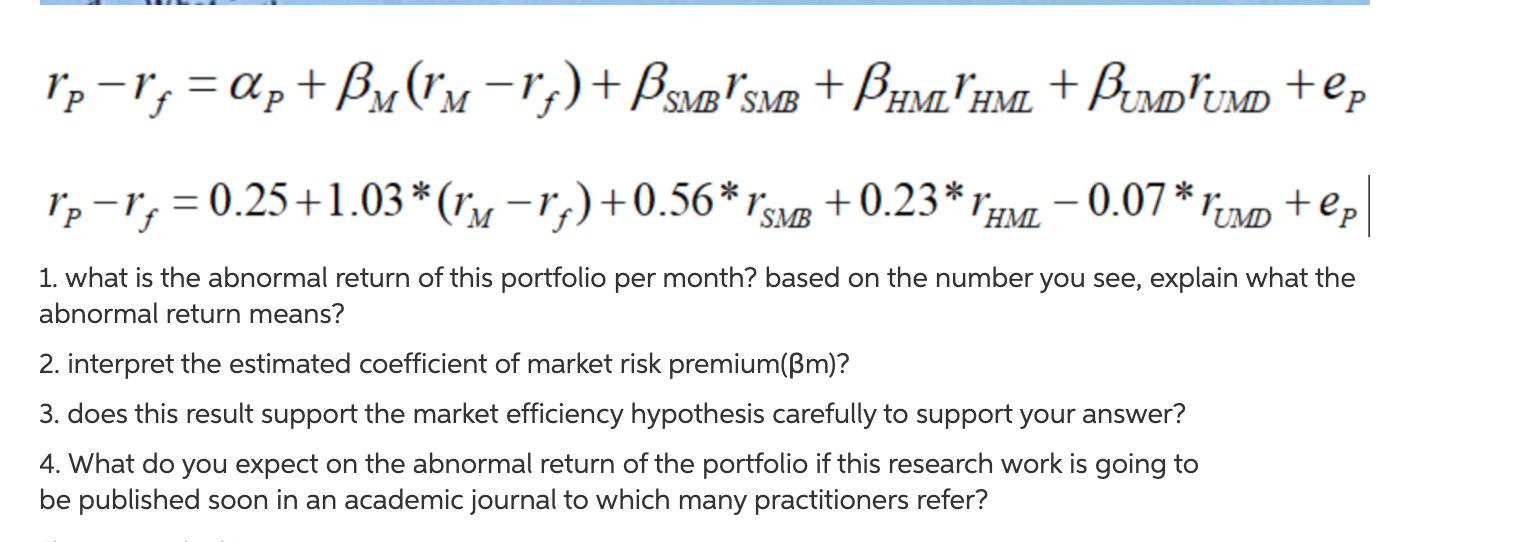

Question set #4 (15 points) Using the Carhart (1997) four-factor model, you analyze the performance of the portfolio formed by sports sentiment. You include firms from the areas where local sports teams perform well. Using 480 month observations, you regress the excess return of the portfolio on the market risk premium along with three other factors constructed based on firm size, value, and momentum. 1p-r;=up+ Puy-1)+ Bugise + Banene + PinoPuro tep where re is the monthly portfolio return. r--r is the value-weighted monthly excess market return. (sme (small minus big) is the difference each month between the retum on small and big firms. Tuma (high minus low) is the monthly difference of the returns on a portfolio of high book- to-market and low book-to-market firms. Tum is the momentum factor computed on a monthly basis as the return differential between a portfolio of winners and a portfolio of losers, ep is the error term. Note that returns and factors are stored in percentage in the dataset. The regression result is as follows. ro-r;=0.25 +1.03*(ry-)+0.56* rss +0.23*-0.07*40 + The t-statistic values on the estimated coefficients, ap, Pussie, Bam, and Buso are 5.01, 25.44, 6.89, 3.67, and -1.45, respectively. Based on the regression result, answer the following questions a WIL rp-r; = Op + Bx (-ry) + PSMBSMB + BumHM + Puro'umo + ep rp-r= 0.25+1.03 * ("x -ry)+0.56* rsm +0.23* rum 0.07* rum +ep 1. what is the abnormal return of this portfolio per month? based on the number you see, explain what the abnormal return means? 2. interpret the estimated coefficient of market risk premium(Bm)? 3. does this result support the market efficiency hypothesis carefully to support your answer? 4. What do you expect on he abnormal return of the portfolio if this res rch work is going to be published soon in an academic journal to which many practitioners refer? Question set #4 (15 points) Using the Carhart (1997) four-factor model, you analyze the performance of the portfolio formed by sports sentiment. You include firms from the areas where local sports teams perform well. Using 480 month observations, you regress the excess return of the portfolio on the market risk premium along with three other factors constructed based on firm size, value, and momentum. 1p-r;=up+ Puy-1)+ Bugise + Banene + PinoPuro tep where re is the monthly portfolio return. r--r is the value-weighted monthly excess market return. (sme (small minus big) is the difference each month between the retum on small and big firms. Tuma (high minus low) is the monthly difference of the returns on a portfolio of high book- to-market and low book-to-market firms. Tum is the momentum factor computed on a monthly basis as the return differential between a portfolio of winners and a portfolio of losers, ep is the error term. Note that returns and factors are stored in percentage in the dataset. The regression result is as follows. ro-r;=0.25 +1.03*(ry-)+0.56* rss +0.23*-0.07*40 + The t-statistic values on the estimated coefficients, ap, Pussie, Bam, and Buso are 5.01, 25.44, 6.89, 3.67, and -1.45, respectively. Based on the regression result, answer the following questions a WIL rp-r; = Op + Bx (-ry) + PSMBSMB + BumHM + Puro'umo + ep rp-r= 0.25+1.03 * ("x -ry)+0.56* rsm +0.23* rum 0.07* rum +ep 1. what is the abnormal return of this portfolio per month? based on the number you see, explain what the abnormal return means? 2. interpret the estimated coefficient of market risk premium(Bm)? 3. does this result support the market efficiency hypothesis carefully to support your answer? 4. What do you expect on he abnormal return of the portfolio if this res rch work is going to be published soon in an academic journal to which many practitioners refer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts