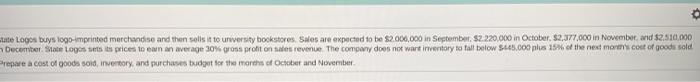

Question: question split in half with 2nd and 3rd pic to be more clear te Logos buys logo-imprinted merchandise and then solls it to university bookstores,

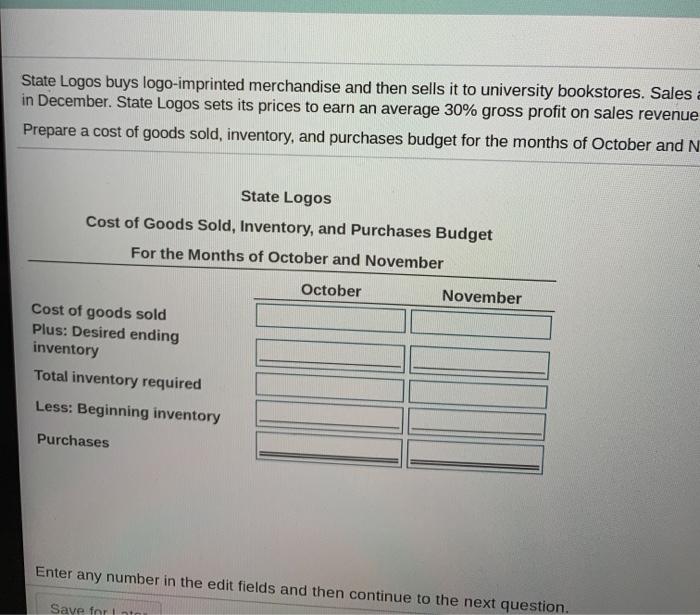

te Logos buys logo-imprinted merchandise and then solls it to university bookstores, Sales are expected to be $2.000,000 in September, $2.220,000 in October, 52,377.000 in November aid $2,500,000 December State Logos sets its prices to earn an average 30% gross profit on sales revenue The company does not want inventory to fall below 145.000 plus 15% of the next mom's cost of goods sold Prepare a cost of goods sold inventory, and purchases budget for the month of Octobrand November State Logos buys logo-imprinted merchandise and then sells it to university bookstores. Sales in December. State Logos sets its prices to earn an average 30% gross profit on sales revenue Prepare a cost of goods sold, inventory, and purchases budget for the months of October and N State Logos Cost of Goods Sold, Inventory, and Purchases Budget For the Months of October and November October November Cost of goods sold Plus: Desired ending inventory Total inventory required Less: Beginning inventory Purchases Enter any number in the edit fields and then continue to the next question. Save for 30 stores. Sales are expected to be $2,006,000 in September, $2,220,000 in October, $2,377,000 in November, and $2,510,000 sales revenue. The company does not want inventory to fall below $445,000 plus 15% of the next month's cost of goods sold. October and November

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts