Question: QUESTION START Milano Co. is considering two mutually exclusive projects with the same cost of capital of 13%. The estimated net cash flows are as

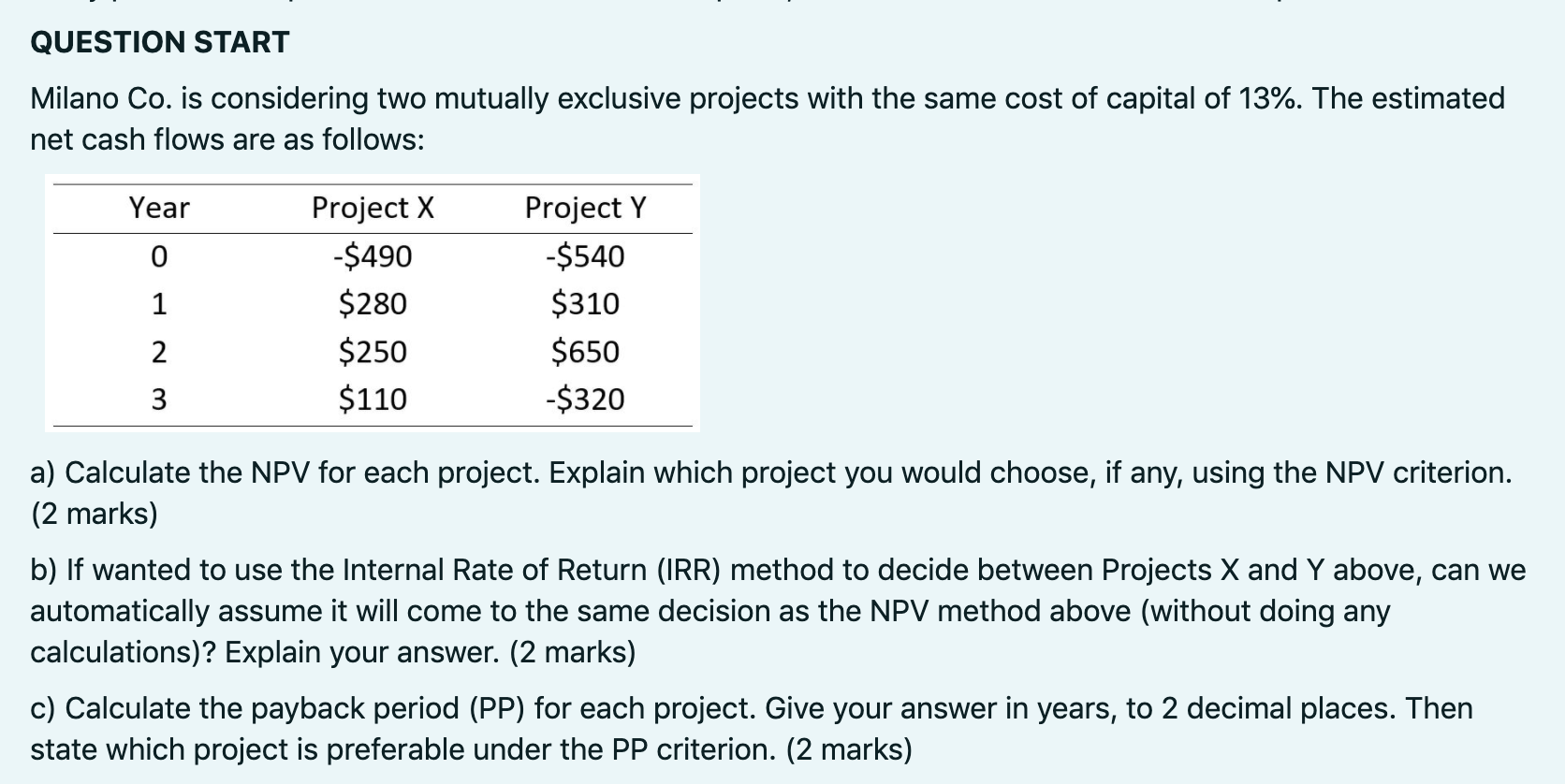

QUESTION START Milano Co. is considering two mutually exclusive projects with the same cost of capital of 13%. The estimated net cash flows are as follows: Year 0 1 Project X -$490 $280 $250 $110 Project Y -$540 $310 $650 -$320 2 3 a) Calculate the NPV for each project. Explain which project you would choose, if any, using the NPV criterion. (2 marks) b) If wanted to use the Internal Rate of Return (IRR) method to decide between Projects X and Y above, can we automatically assume it will come to the same decision as the NPV method above (without doing any calculations)? Explain your answer. (2 marks) c) Calculate the payback period (PP) for each project. Give your answer in years, to 2 decimal places. Then state which project is preferable under the PP criterion. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts