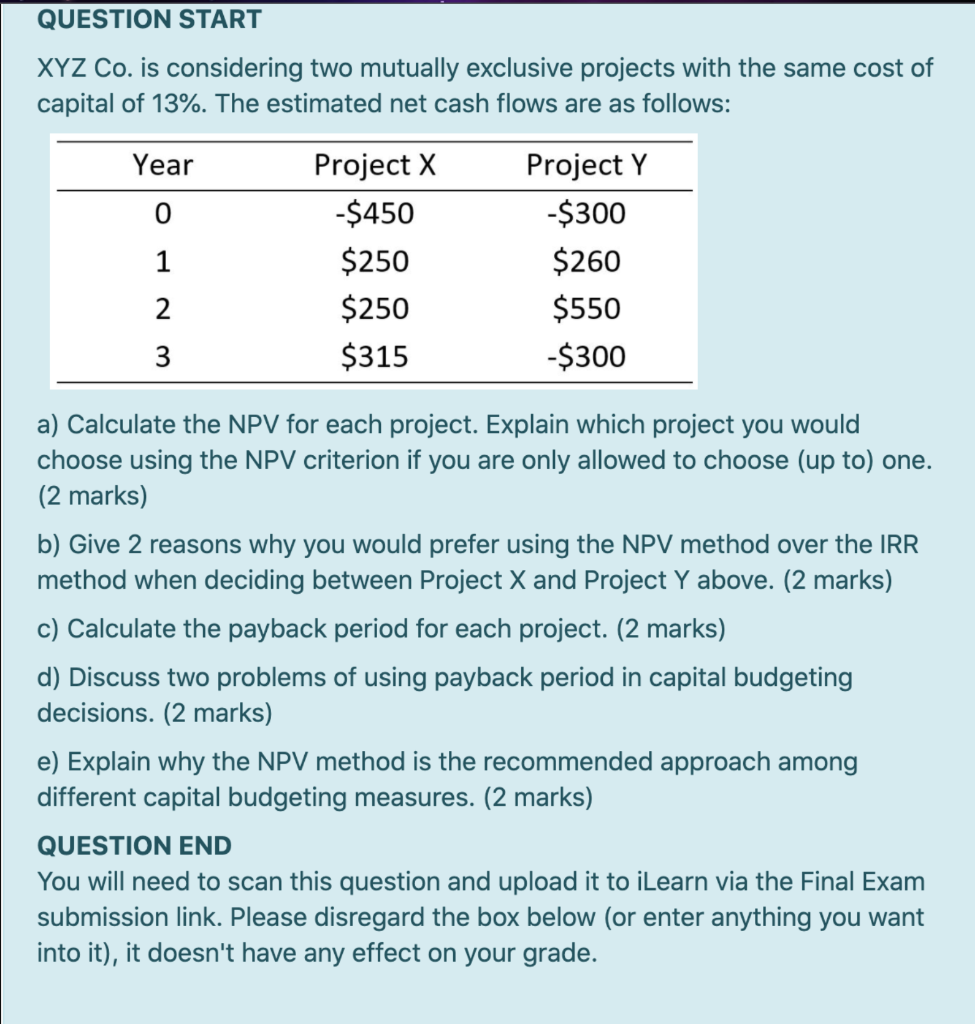

Question: QUESTION START XYZ Co. is considering two mutually exclusive projects with the same cost of capital of 13%. The estimated net cash flows are as

QUESTION START XYZ Co. is considering two mutually exclusive projects with the same cost of capital of 13%. The estimated net cash flows are as follows: Year 0 1 Project X -$450 $250 $250 $315 Project Y -$300 $260 $550 -$300 2 3 a) Calculate the NPV for each project. Explain which project you would choose using the NPV criterion if you are only allowed to choose (up to) one. (2 marks) b) Give 2 reasons why you would prefer using the NPV method over the IRR method when deciding between Project X and Project Y above. (2 marks) c) Calculate the payback period for each project. (2 marks) d) Discuss two problems of using payback period in capital budgeting decisions. (2 marks) e) Explain why the NPV method is the recommended approach among different capital budgeting measures. (2 marks) QUESTION END You will need to scan this question and upload it to iLearn via the Final Exam submission link. Please disregard the box below (or enter anything you want into it), it doesn't have any effect on your grade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts