Question: Question: Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,300,000 one year ago; the new

Question:

Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,300,000 one year ago; the new one will cost $1,560,000. The new machine will be in CCA Class 10 (30%). It will probably be worth about $300,000 after five years.

The old computer belongs to CCA Class 10 (30%). If we don't replace it now, we will have to replace it in two years. We can sell it now for $420,000; in two years, it will probably be worth $120,000. The new machine will save us $290,000 per year in maintenance costs. The tax rate is 38% and the discount rate is 12%.

a-1. Calculate the EAC for old and new computer. (Negative answers should be indicated by a minus sign. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.)

EACNew computer$ Old computer$

a-2. What is the NPV of the decision to replace the computer now? (Negative answers should be indicated by a minus sign. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.)

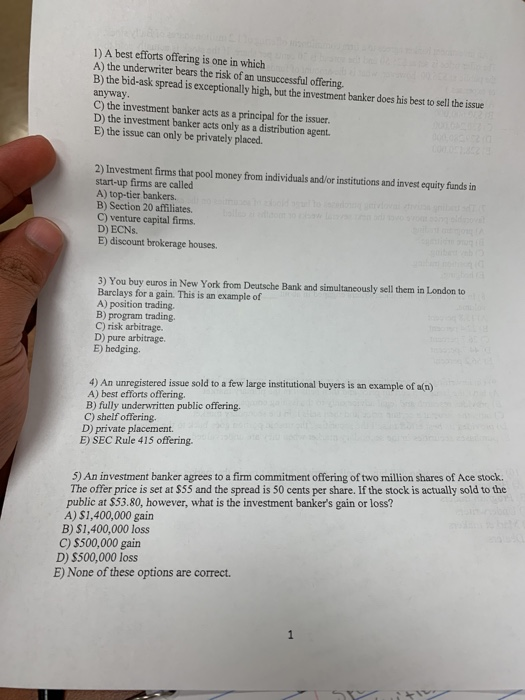

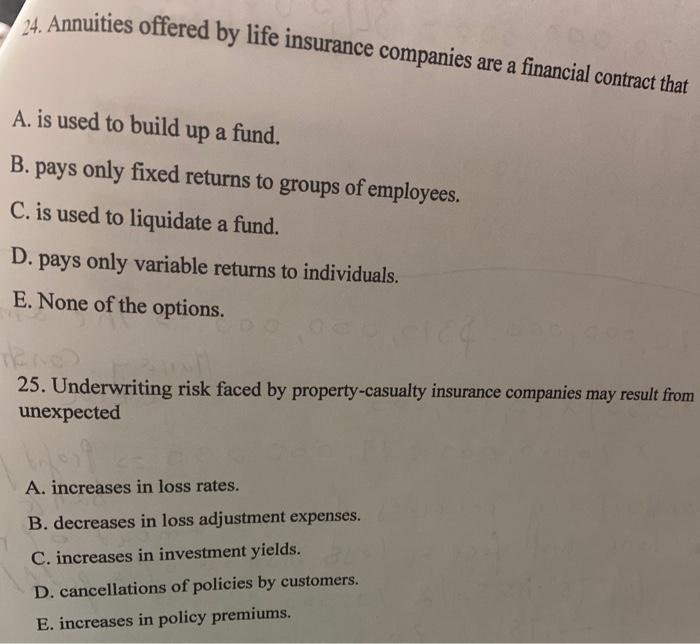

1) A best efforts offering is one in which A) the underwriter bears the risk of an unsuccessful offering. anyway. B) the bid-ask spread is exceptionally high, but the investment banker does his best to sell the issue C) the investment banker acts as a principal for the issuer. D) the investment banker acts only as a distribution agent. E) the issue can only be privately placed. 2) Investment firms that pool money from individuals and/or institutions and invest equity funds in start-up firms are called A) top-tier bankers. B) Section 20 affiliates. balles aredicout to ra C) venture capital firms. D) ECNS. E) discount brokerage houses. 3) You buy euros in New York from Deutsche Bank and simultaneously sell them in London to Barclays for a gain. This is an example of A) position trading. B) program trading. C) risk arbitrage. D) pure arbitrage. E) hedging. 4) An unregistered issue sold to a few large institutional buyers is an example of a(n) A) best efforts offering. B) fully underwritten public offering. C) shelf offering. D) private placement. E) SEC Rule 415 offering. 5) An investment banker agrees to a firm commitment offering of two million shares of Ace stock. The offer price is set at $55 and the spread is 50 cents per share. If the stock is actually sold to the public at $53.80, however, what is the investment banker's gain or loss? A) $1,400,000 gain B) $1,400,000 loss C) $500,000 gain D) $500,000 loss E) None of these options are correct.24. Annuities offered by life insurance companies are a financial contract that A. is used to build up a fund. B. pays only fixed returns to groups of employees. C. is used to liquidate a fund. D. pays only variable returns to individuals. E. None of the options. 25. Underwriting risk faced by property-casualty insurance companies may result from unexpected A. increases in loss rates. B. decreases in loss adjustment expenses. C. increases in investment yields. D. cancellations of policies by customers. E. increases in policy premiums