Question: Question: Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,300,000 one year ago; the new

Question:

Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1,300,000 one year ago; the new one will cost $1,560,000. The new machine will be in CCA Class 10 (30%). It will probably be worth about $300,000 after five years.

The old computer belongs to CCA Class 10 (30%). If we don't replace it now, we will have to replace it in two years. We can sell it now for $420,000; in two years, it will probably be worth $120,000. The new machine will save us $290,000 per year in maintenance costs. The tax rate is 38% and the discount rate is 12%.

a-1. Calculate the EAC for old and new computer. (Negative answers should be indicated by a minus sign. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.)

EACNew computer$ Old computer$

a-2. What is the NPV of the decision to replace the computer now? (Negative answers should be indicated by a minus sign. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.)

NPV$

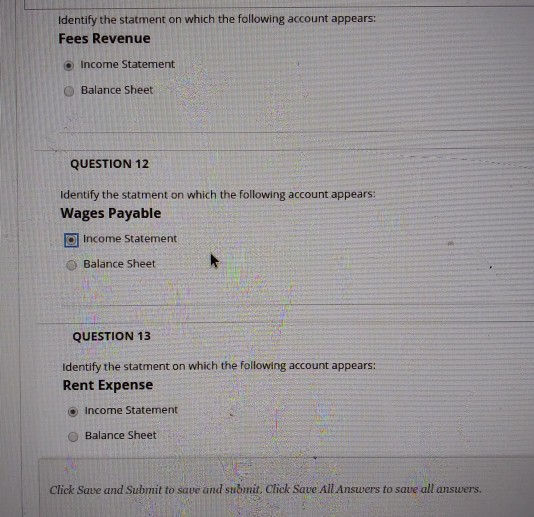

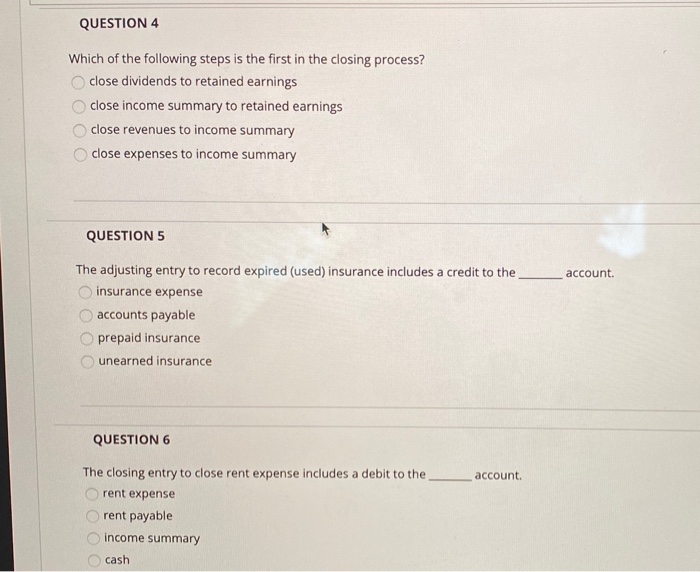

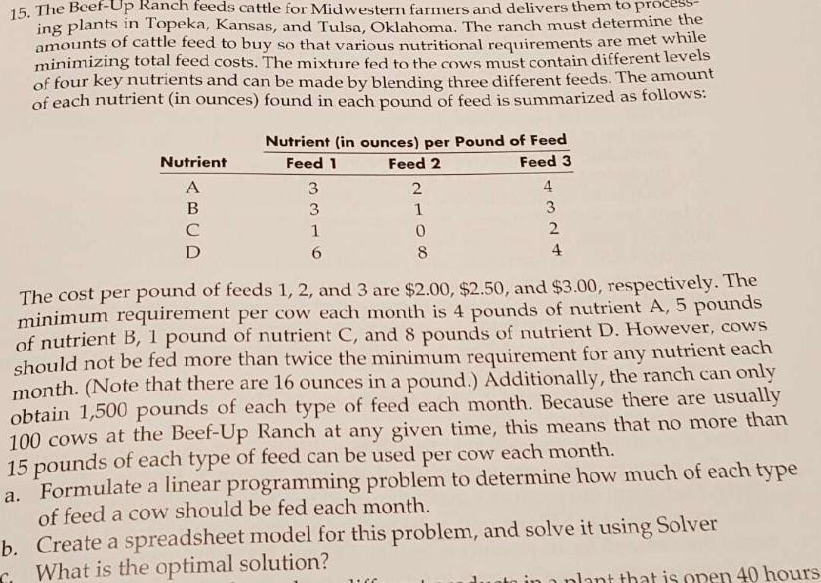

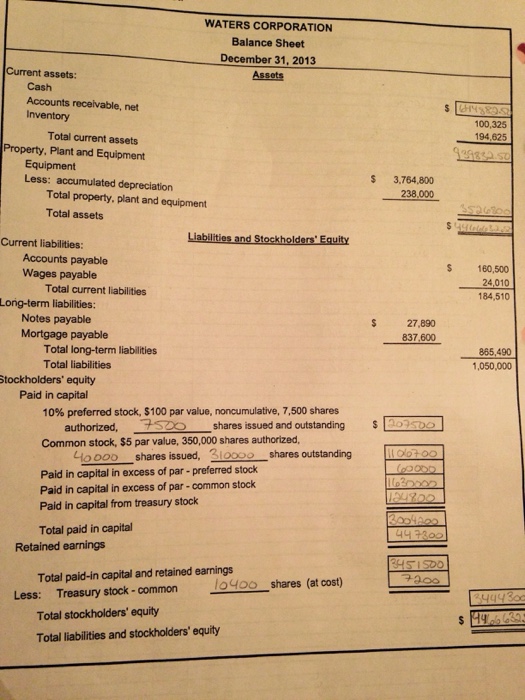

Identify the statment on which the following account appears: Fees Revenue Income Statement Balance Sheet QUESTION 12 Identify the statment on which the following account appears: Wages Payable Income Statement Balance Sheet QUESTION 13 Identify the statment on which the following account appears: Rent Expense Income Statement Balance Sheet Click Save and Submit to save and submit. Click Save All Answers to save all answers.QUESTION 4 Which of the following steps is the first in the closing process? close dividends to retained earnings close income summary to retained earnings close revenues to income summary close expenses to income summary QUESTION 5 The adjusting entry to record expired (used) insurance includes a credit to the account. insurance expense O accounts payable O prepaid insurance unearned insurance QUESTION 6 The closing entry to close rent expense includes a debit to the account. rent expense rent payable income summary cash15. The Beef-Up Ranch feeds cattle for Midwestern farmers and delivers them to process ing plants in Topeka, Kansas, and Tulsa, Oklahoma. The ranch must determine the amounts of cattle feed to buy so that various nutritional requirements are met while minimizing total feed costs. The mixture fed to the cows must contain different levels of four key nutrients and can be made by blending three different feeds. The amount of each nutrient (in ounces) found in each pound of feed is summarized as follows: Nutrient (in ounces) per Pound of Feed Nutrient Feed 1 Feed 2 Feed 3 A B C D The cost per pound of feeds 1, 2, and 3 are $2.00, $2.50, and $3.00, respectively. The minimum requirement per cow each month is 4 pounds of nutrient A, 5 pounds of nutrient B, 1 pound of nutrient C, and 8 pounds of nutrient D. However, cows should not be fed more than twice the minimum requirement for any nutrient each month. (Note that there are 16 ounces in a pound.) Additionally, the ranch can only obtain 1,500 pounds of each type of feed each month. Because there are usually 100 cows at the Beef-Up Ranch at any given time, this means that no more than 15 pounds of each type of feed can be used per cow each month. a. Formulate a linear programming problem to determine how much of each type of feed a cow should be fed each month. b. Create a spreadsheet model for this problem, and solve it using Solver What is the optimal solution? open 40 hoursWATERS CORPORATION Balance Sheet December 31, 2013 Current assets: Assets Cash Accounts receivable, net Inventory 100,325 194,625 Total current assets Property, Plant and Equipment Equipment 3.764,800 Less: accumulated depreciation 238.000 Total property, plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable 160,500 Wages payable 24,010 Total current liabilities 184,510 Long-term liabilities: Notes payable S 27 890 Mortgage payable 837.600 Total long-term liabilities 865,490 Total liabilities 1,050,000 Stockholders' equity Paid in capital 10% preferred stock, $100 par value, noncumulative, 7,500 shares S 1075bo authorized, 7500 shares issued and outstanding Common stock, $5 par value, 350,000 shares authorized 40 000 shares issued, 31oooo shares outstanding 10 0700 Paid in capital in excess of par - preferred stock Paid in capital in excess of par - common stock Paid in capital from treasury stock 3004820 Total paid in capital 44 7300 Retained earnings 345 1500 Total paid-in capital and retained earnings 10400 shares (at cost) 7200 Less: Treasury stock - common 344430 Total stockholders' equity 5 144 6 635 Total liabilities and stockholders' equityWATERS CORPORATION Balance Sheet December 31, 2013 Current assets: Assets Cash Accounts receivable, net Inventory 100,325 194,625 Total current assets Property, Plant and Equipment Equipment 3.764,800 Less: accumulated depreciation 238.000 Total property, plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable 160,500 Wages payable 24,010 Total current liabilities 184,510 Long-term liabilities: Notes payable S 27 890 Mortgage payable 837.600 Total long-term liabilities 865,490 Total liabilities 1,050,000 Stockholders' equity Paid in capital 10% preferred stock, $100 par value, noncumulative, 7,500 shares S 1075bo authorized, 7500 shares issued and outstanding Common stock, $5 par value, 350,000 shares authorized 40 000 shares issued, 31oooo shares outstanding 10 0700 Paid in capital in excess of par - preferred stock Paid in capital in excess of par - common stock Paid in capital from treasury stock 3004820 Total paid in capital 44 7300 Retained earnings 345 1500 Total paid-in capital and retained earnings 10400 shares (at cost) 7200 Less: Treasury stock - common 344430 Total stockholders' equity 5 144 6 635 Total liabilities and stockholders' equity