Question: Question text Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100 000 to finance the development of new products. IS can borrow fixed-interest-rate

Question text

Investment Solution (IS) and ExpressIT (EIT) both need to borrow $100 000 to finance the development of new products. IS can borrow fixed-interest-rate funds at 9 percent or variable-rate funds at the LIBOR plus 1.5% in the debt market. EIT, being less creditworthy, incurs higher costs of borrowing which are a fixed rate of 11 percent and a variable rate of LIBOR plus 2.5%.

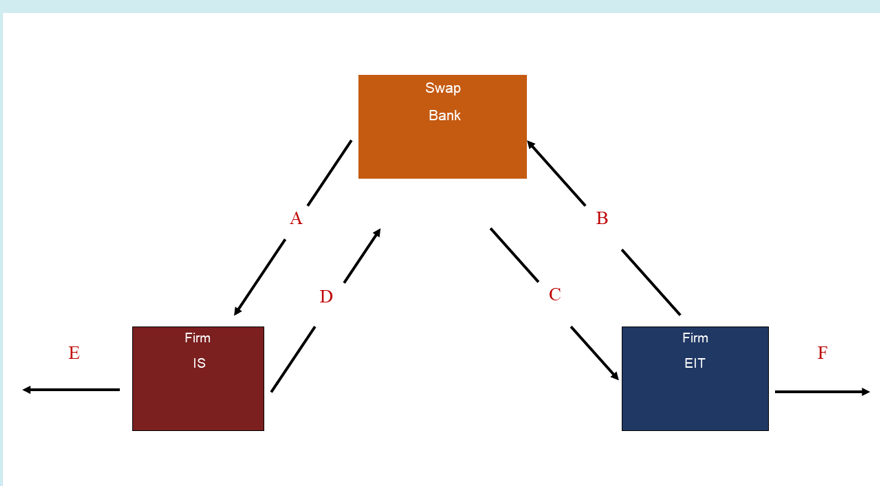

Design a swap and calculate the amount of saving on the net cost of borrowing if BankCredit offers an interest swap contract with each IS and EIT, given that BankCredit retains a 20bp between the rates at which it deals equally with them.

Label the graph below and show all calculations leading to your conclusions.

CoursHeroTranscribedText

E Firm IS A Swap Bank C B Firm F EIT

Step by Step Solution

There are 3 Steps involved in it

To design a swap and calculate the net savings for Investment Solution IS and ExpressIT EIT we will leverage their comparative advantages in different ... View full answer

Get step-by-step solutions from verified subject matter experts