Question: Question: The client wants your help in determining the probability of achieving certain returns within the portfolio. a. Determine the probability of getting a positive

Question:

Question:

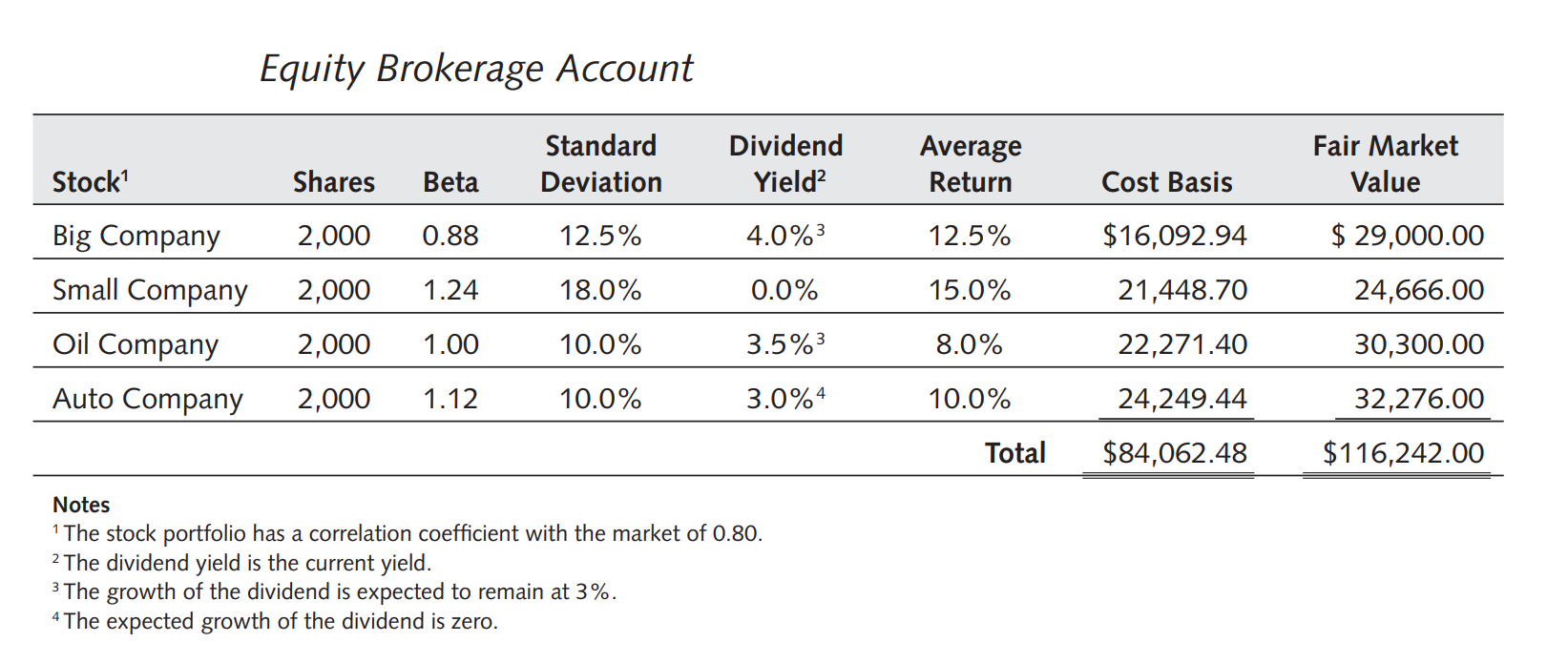

The client wants your help in determining the probability of achieving certain returns within the portfolio.

a. Determine the probability of getting a positive return for the Big Company.

b. Determine the probability of getting a return above 30% from Auto Company.

c. Determine the probability of earning a return between 15% and 33% for a Small Company.

How can I solve this question? Thanks.

Equity Brokerage Account Standard Deviation Dividend Yield? Average Return Fair Market Value Stock? Shares Beta Cost Basis 2,000 0.88 12.5% 4.0%3 12.5% $16,092.94 $ 29,000.00 2,000 1.24 18.0% 0.0% 15.0% 21,448.70 24,666.00 Big Company Small Company Oil Company Auto Company 2,000 1.00 10.0% 3.5%3 8.0% 22,271.40 30,300.00 2,000 1.12 10.0% 3.0%4 10.0% 24,249.44 32,276.00 Total $84,062.48 $116,242.00 Notes * The stock portfolio has a correlation coefficient with the market of 0.80. 2 The dividend yield is the current yield. 3 The growth of the dividend is expected to remain at 3%. 4 The expected growth of the dividend is zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts