Question: QUESTION The data presented here is for questions 8, 9, and 10. The idea is to calculate the WACC for Caterpillar. To give you partial

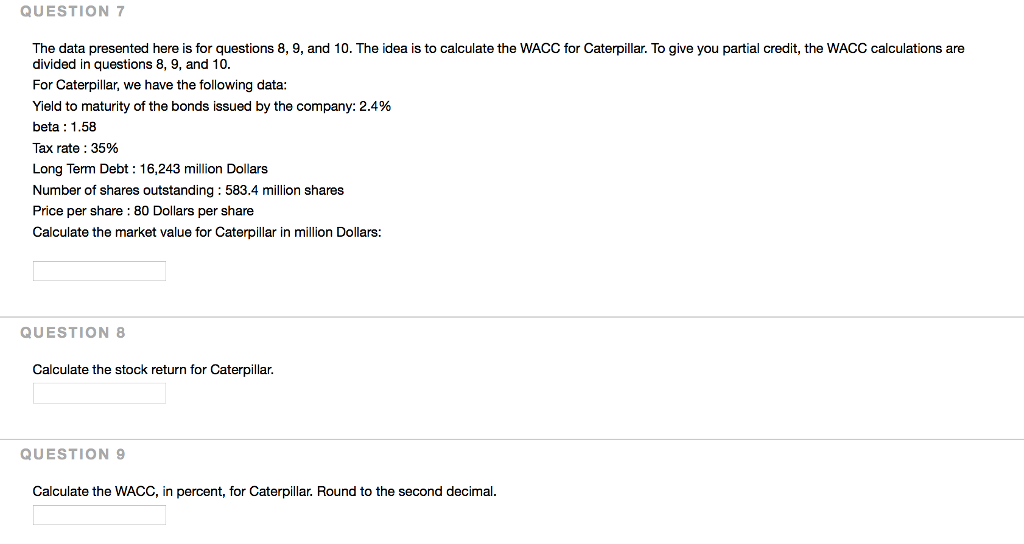

QUESTION The data presented here is for questions 8, 9, and 10. The idea is to calculate the WACC for Caterpillar. To give you partial credit, the WACC calculations are divided in questions 8, 9, and 10. For Caterpillar, we have the following data: Yield to maturity of the bonds issued by the company: 2.4% beta 1.58 Tax rate : 35% Long Term Debt: 16,243 million Dollars Number of shares outstanding: 583.4 million shares Price per share : 80 Dollars per share Calculate the market value for Caterpillar in million Dollars QUESTION 8 Calculate the stock return for Caterpillar. QUESTION 9 Calculate the WACC, in percent, for Caterpillar. Round to the second decimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts