Question: Question The date is 20 September and LIBOR reference rate) is currently 0.85% UCI Plc, have been assessing their cash flow requirement and know that

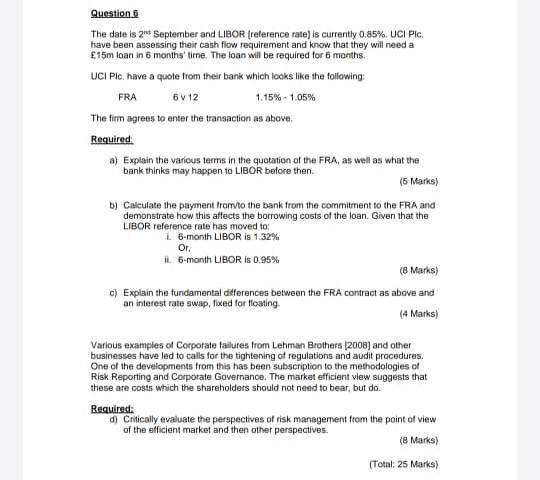

Question The date is 20 September and LIBOR reference rate) is currently 0.85% UCI Plc, have been assessing their cash flow requirement and know that they will need a 15m loan in 6 months' time. The loan will be required for 6 months. UCI Plc. have a quote from their bank which looks like the following: FRA 6v12 1.15% -1,05% The firm agrees to enter the transaction as above. Required a) Explain the various terms in the quotation of the FRA, as well as what the bank thinks may happen to LIBOR before then (5 Marks) b) Calculate the payment from to the bank from the commitment to the FRA and demonstrate how this affects the borrowing costs of the loan. Given that the LIBOR reference rate has moved to 16-month LIBOR is 1.32% Or. IL 6-month LIBOR is 0.95% (8 Marks) c) Explain the fundamental differences between the FRA contract as above and an interest rate swap, fixed for floating (4 Marks) Various examples of Corporate failures from Lehman Brothers (2008) and other businesses have led to calls for the tightening of regulations and audit procedures. One of the developments from this has been subscription to the methodologies of Risk Reporting and Corporate Governance. The market efficient view suggests that these are costs which the shareholders should not need to bear, but do. Required: d) Critically evaluate the perspectives of risk management from the point of view of the efficient market and then other perspectives. (8 Marks) (Total: 25 Marks) Question The date is 20 September and LIBOR reference rate) is currently 0.85% UCI Plc, have been assessing their cash flow requirement and know that they will need a 15m loan in 6 months' time. The loan will be required for 6 months. UCI Plc. have a quote from their bank which looks like the following: FRA 6v12 1.15% -1,05% The firm agrees to enter the transaction as above. Required a) Explain the various terms in the quotation of the FRA, as well as what the bank thinks may happen to LIBOR before then (5 Marks) b) Calculate the payment from to the bank from the commitment to the FRA and demonstrate how this affects the borrowing costs of the loan. Given that the LIBOR reference rate has moved to 16-month LIBOR is 1.32% Or. IL 6-month LIBOR is 0.95% (8 Marks) c) Explain the fundamental differences between the FRA contract as above and an interest rate swap, fixed for floating (4 Marks) Various examples of Corporate failures from Lehman Brothers (2008) and other businesses have led to calls for the tightening of regulations and audit procedures. One of the developments from this has been subscription to the methodologies of Risk Reporting and Corporate Governance. The market efficient view suggests that these are costs which the shareholders should not need to bear, but do. Required: d) Critically evaluate the perspectives of risk management from the point of view of the efficient market and then other perspectives. (8 Marks) (Total: 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts