Question: QUESTION The Sisneros Company is considering building a chili processing plant in Hatch, New Mexico . The plant is expected to produce 50,000 pounds of

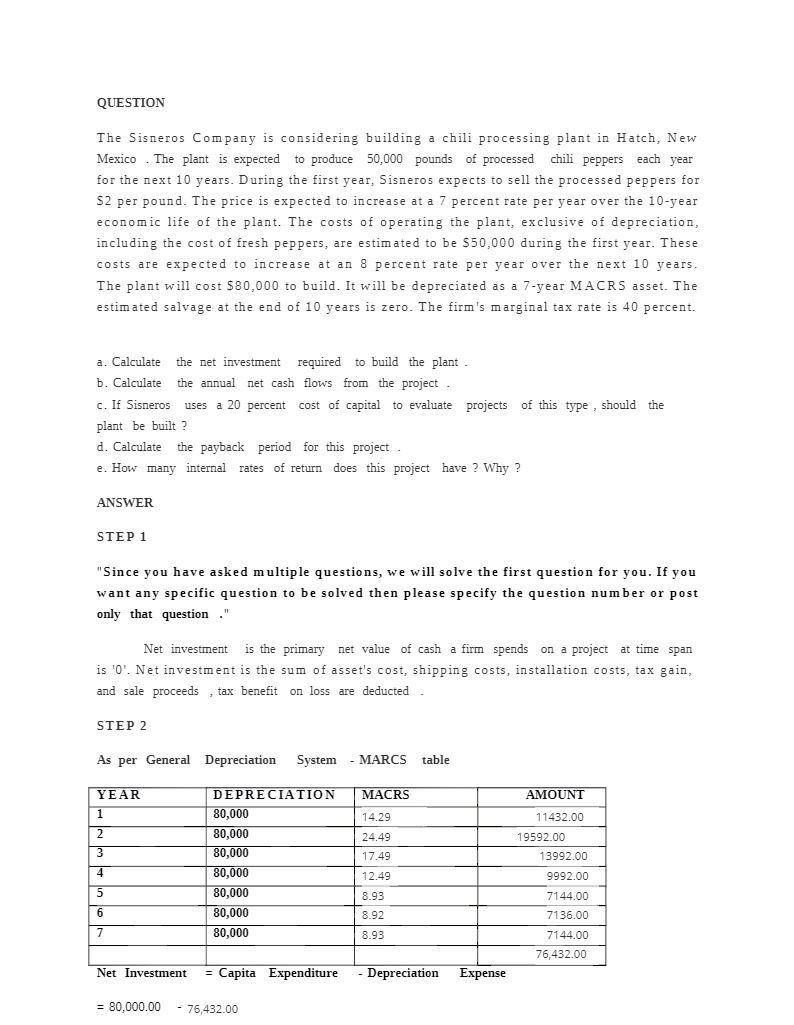

QUESTION The Sisneros Company is considering building a chili processing plant in Hatch, New Mexico . The plant is expected to produce 50,000 pounds of processed chili peppers each year for the next 10 years. During the first year, Sisneros expects to sell the processed peppers for $2 per pound. The price is expected to increase at a 7 percent rate per year over the 10-year economic life of the plant. The costs of operating the plant, exclusive of depreciation, including the cost of fresh peppers, are estimated to be $50,000 during the first year. These costs are expected to increase at an 8 percent rate per year over the next 10 years. The plant will cost $80,000 to build. It will be depreciated as a 7-year MACRS asset. The estimated salvage at the end of 10 years is zero. The firm's marginal tax rate is 40 percent. a. Calculate the net investment required to build the plant . b. Calculate the annual net cash flows from the project c. If Sisneros uses a 20 percent cost of capital to evaluate projects of this type , should the plant be built ? d. Calculate the payback period for this project . e. How many internal rates of return does this project have ? Why ? ANSWER STEP 1 "Since you have asked multiple questions, we will solve the first question for you. If you want any specific question to be solved then please specify the question number or post only that question Net investment is the primary net value of cash a firm spends on a project at time span is '0'. Net investment is the sum of asset's cost, shipping costs, installation costs, tax gain, and sale proceeds , tax benefit on loss are deducted STEP 2 As per General Depreciation System - MARCS table YEAR DEPRECIATION MACRS AMOUNT 1 80,000 4.29 11432.00 80,000 24.4 19592.00 80,000 17.49 3992.00 80,000 12.49 9992.00 5 80,000 8.93 7144.00 6 80,000 8.92 7136.00 80,000 8.93 7144.00 76,432.00 Net Investment = Capita Expenditure - Depreciation Expense = 80,000.00 - 76,432.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts