Question: QUESTION :The table below provides information on two individual risky assets A, the market portfolio M and the risk-free assets F. Asset Expected Return Standard

QUESTION :The table below provides information on two individual risky assets A, the market portfolio M and the risk-free assets F.

| Asset | Expected Return | Standard deviation |

| A | 12% | 60% |

| M(market) | 8% | 15% |

| F(risk free) | 2% | 0% |

Calculate the following:

- Systematic risk of asset A

- Sharpe ratio and Treynor ratio of asset A.

- Suppose you want to construct a portfolio with expected return at 20% and have the following options:

- Invest in A and F

- Invest in M and F

-

Please compute the total risk (standard deviation) and systematic risk (beta) of the above two options.

Solution:

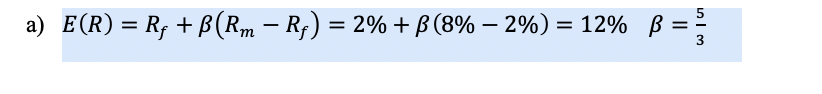

i just wanna ask how they calculated B= 5/3

i just wanna ask how they calculated B= 5/3

5 a) E(R) R +B(Rm - Rf) 2%B(8%-2%) 12% B 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts