Question: Question There must be something wrong with these financial statements! exclaimed Ezra Hart, president of Olivers Inc. (Olivers or the Company). They just don't make

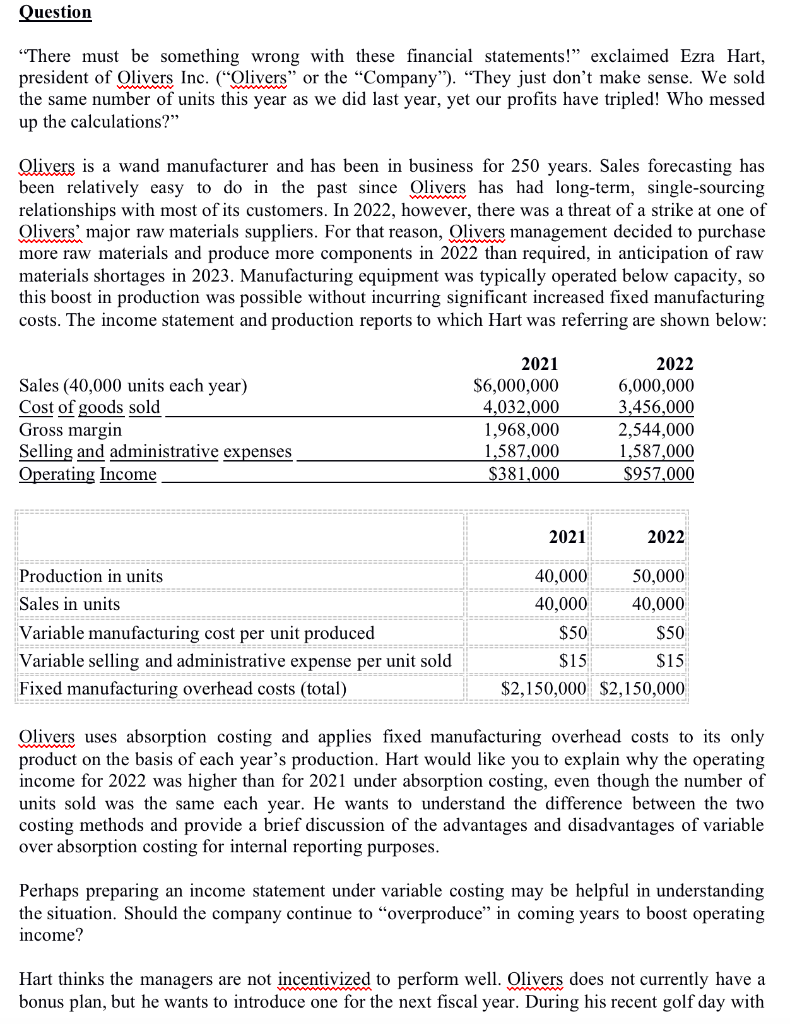

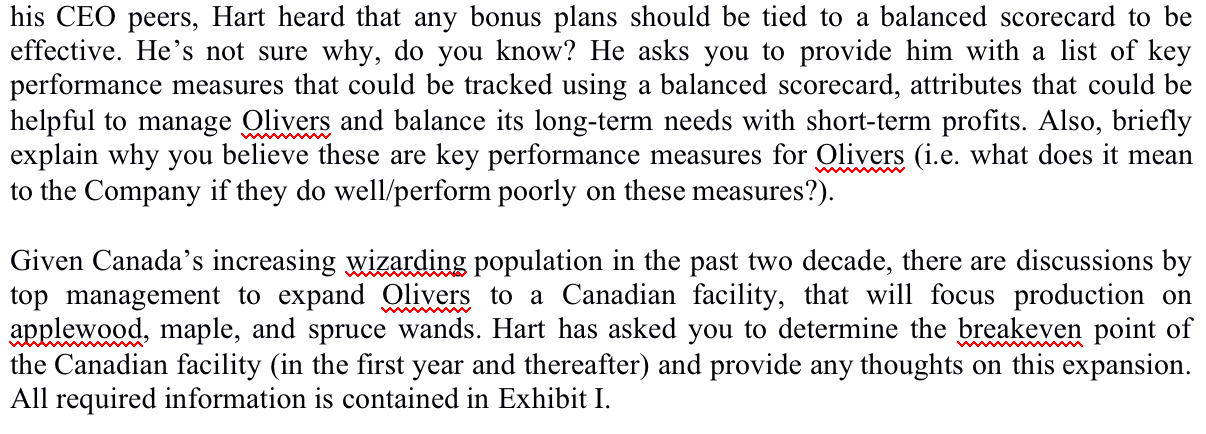

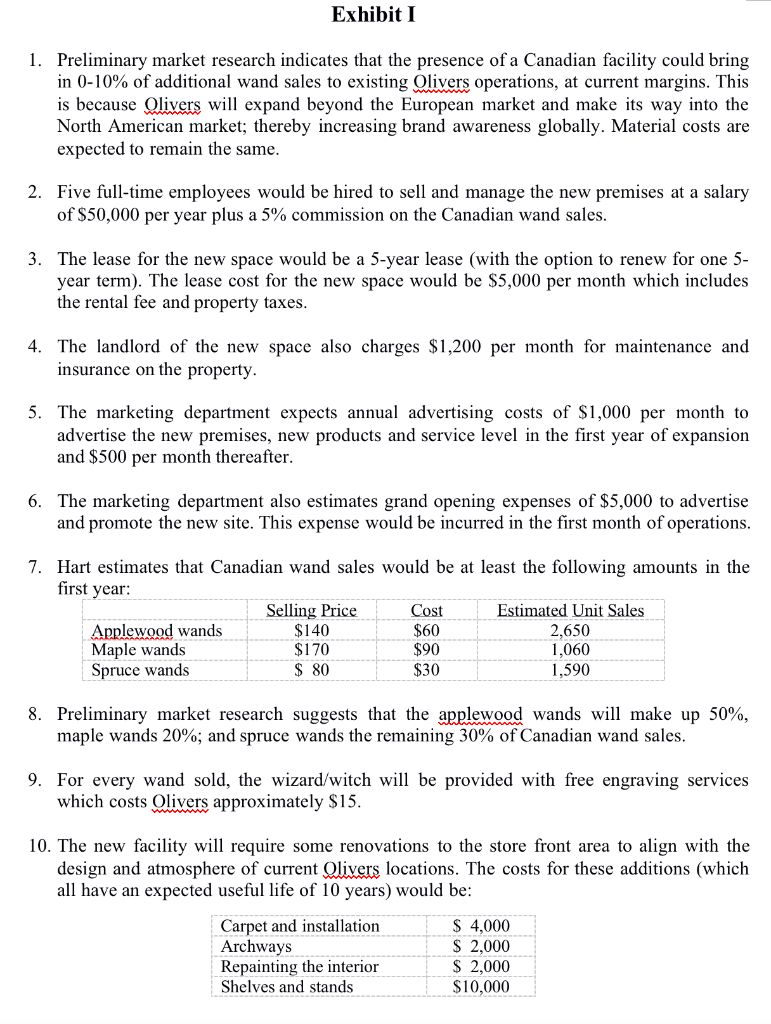

Question "There must be something wrong with these financial statements!" exclaimed Ezra Hart, president of Olivers Inc. ("Olivers" or the "Company"). "They just don't make sense. We sold the same number of units this year as we did last year, yet our profits have tripled! Who messed up the calculations?" Olivers is a wand manufacturer and has been in business for 250 years. Sales forecasting has been relatively easy to do in the past since Olivers has had long-term, single-sourcing relationships with most of its customers. In 2022, however, there was a threat of a strike at one of Olivers' major raw materials suppliers. For that reason, Olivers management decided to purchase more raw materials and produce more components in 2022 than required, in anticipation of raw materials shortages in 2023. Manufacturing equipment was typically operated below capacity, so this boost in production was possible without incurring significant increased fixed manufacturing costs. The income statement and production reports to which Hart was referring are shown below: Olivers uses absorption costing and applies fixed manufacturing overhead costs to its only product on the basis of each year's production. Hart would like you to explain why the operating income for 2022 was higher than for 2021 under absorption costing, even though the number of units sold was the same each year. He wants to understand the difference between the two costing methods and provide a brief discussion of the advantages and disadvantages of variable over absorption costing for internal reporting purposes. Perhaps preparing an income statement under variable costing may be helpful in understanding the situation. Should the company continue to "overproduce" in coming years to boost operating income? Hart thinks the managers are not incentivized to perform well. Olivers does not currently have a bonus plan, but he wants to introduce one for the next fiscal year. During his recent golf day with his CEO peers, Hart heard that any bonus plans should be tied to a balanced scorecard to be effective. He's not sure why, do you know? He asks you to provide him with a list of key performance measures that could be tracked using a balanced scorecard, attributes that could be helpful to manage Olivers and balance its long-term needs with short-term profits. Also, briefly explain why you believe these are key performance measures for Olivers (i.e. what does it mean to the Company if they do well/perform poorly on these measures?). Given Canada's increasing wizarding population in the past two decade, there are discussions by top management to expand Olivers to a Canadian facility, that will focus production on applewood, maple, and spruce wands. Hart has asked you to determine the breakeven point of the Canadian facility (in the first year and thereafter) and provide any thoughts on this expansion. All required information is contained in Exhibit I. 1. Preliminary market research indicates that the presence of a Canadian facility could bring in 010% of additional wand sales to existing Olivers operations, at current margins. This is because Olivers will expand beyond the European market and make its way into the North American market; thereby increasing brand awareness globally. Material costs are expected to remain the same. 2. Five full-time employees would be hired to sell and manage the new premises at a salary of $50,000 per year plus a 5\% commission on the Canadian wand sales. 3. The lease for the new space would be a 5 -year lease (with the option to renew for one 5year term). The lease cost for the new space would be $5,000 per month which includes the rental fee and property taxes. 4. The landlord of the new space also charges $1,200 per month for maintenance and insurance on the property. 5. The marketing department expects annual advertising costs of $1,000 per month to advertise the new premises, new products and service level in the first year of expansion and $500 per month thereafter. 6. The marketing department also estimates grand opening expenses of $5,000 to advertise and promote the new site. This expense would be incurred in the first month of operations. 7. Hart estimates that Canadian wand sales would be at least the following amounts in the first vear: 8. Preliminary market research suggests that the applewood wands will make up 50%, maple wands 20%; and spruce wands the remaining 30% of Canadian wand sales. 9. For every wand sold, the wizard/witch will be provided with free engraving services which costs Olivers approximately $15. 10. The new facility will require some renovations to the store front area to align with the design and atmosphere of current Qlivers locations. The costs for these additions (which all have an expected useful life of 10 years) would be: As the CFO of Olivers, write a memo to Hart containing the following: 1. Explain why the operating income for 2022 was higher than for 2021 under absorption costing; 2. Create a balanced scorecard for the proposed bonus plan; and 3. Calculate the breakeven points and comment on the overall Canadian expansion plan. Question "There must be something wrong with these financial statements!" exclaimed Ezra Hart, president of Olivers Inc. ("Olivers" or the "Company"). "They just don't make sense. We sold the same number of units this year as we did last year, yet our profits have tripled! Who messed up the calculations?" Olivers is a wand manufacturer and has been in business for 250 years. Sales forecasting has been relatively easy to do in the past since Olivers has had long-term, single-sourcing relationships with most of its customers. In 2022, however, there was a threat of a strike at one of Olivers' major raw materials suppliers. For that reason, Olivers management decided to purchase more raw materials and produce more components in 2022 than required, in anticipation of raw materials shortages in 2023. Manufacturing equipment was typically operated below capacity, so this boost in production was possible without incurring significant increased fixed manufacturing costs. The income statement and production reports to which Hart was referring are shown below: Olivers uses absorption costing and applies fixed manufacturing overhead costs to its only product on the basis of each year's production. Hart would like you to explain why the operating income for 2022 was higher than for 2021 under absorption costing, even though the number of units sold was the same each year. He wants to understand the difference between the two costing methods and provide a brief discussion of the advantages and disadvantages of variable over absorption costing for internal reporting purposes. Perhaps preparing an income statement under variable costing may be helpful in understanding the situation. Should the company continue to "overproduce" in coming years to boost operating income? Hart thinks the managers are not incentivized to perform well. Olivers does not currently have a bonus plan, but he wants to introduce one for the next fiscal year. During his recent golf day with his CEO peers, Hart heard that any bonus plans should be tied to a balanced scorecard to be effective. He's not sure why, do you know? He asks you to provide him with a list of key performance measures that could be tracked using a balanced scorecard, attributes that could be helpful to manage Olivers and balance its long-term needs with short-term profits. Also, briefly explain why you believe these are key performance measures for Olivers (i.e. what does it mean to the Company if they do well/perform poorly on these measures?). Given Canada's increasing wizarding population in the past two decade, there are discussions by top management to expand Olivers to a Canadian facility, that will focus production on applewood, maple, and spruce wands. Hart has asked you to determine the breakeven point of the Canadian facility (in the first year and thereafter) and provide any thoughts on this expansion. All required information is contained in Exhibit I. 1. Preliminary market research indicates that the presence of a Canadian facility could bring in 010% of additional wand sales to existing Olivers operations, at current margins. This is because Olivers will expand beyond the European market and make its way into the North American market; thereby increasing brand awareness globally. Material costs are expected to remain the same. 2. Five full-time employees would be hired to sell and manage the new premises at a salary of $50,000 per year plus a 5\% commission on the Canadian wand sales. 3. The lease for the new space would be a 5 -year lease (with the option to renew for one 5year term). The lease cost for the new space would be $5,000 per month which includes the rental fee and property taxes. 4. The landlord of the new space also charges $1,200 per month for maintenance and insurance on the property. 5. The marketing department expects annual advertising costs of $1,000 per month to advertise the new premises, new products and service level in the first year of expansion and $500 per month thereafter. 6. The marketing department also estimates grand opening expenses of $5,000 to advertise and promote the new site. This expense would be incurred in the first month of operations. 7. Hart estimates that Canadian wand sales would be at least the following amounts in the first vear: 8. Preliminary market research suggests that the applewood wands will make up 50%, maple wands 20%; and spruce wands the remaining 30% of Canadian wand sales. 9. For every wand sold, the wizard/witch will be provided with free engraving services which costs Olivers approximately $15. 10. The new facility will require some renovations to the store front area to align with the design and atmosphere of current Qlivers locations. The costs for these additions (which all have an expected useful life of 10 years) would be: As the CFO of Olivers, write a memo to Hart containing the following: 1. Explain why the operating income for 2022 was higher than for 2021 under absorption costing; 2. Create a balanced scorecard for the proposed bonus plan; and 3. Calculate the breakeven points and comment on the overall Canadian expansion plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts