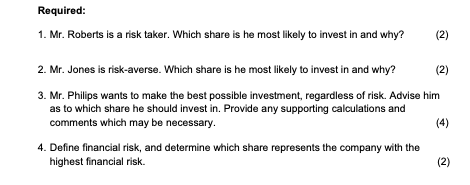

Question: QUESTION THREE [10] Share Std Deviation Avg Return D:E Ratio A 10% 11% 0.8 B 12% 11% 0.9 15% 14% 1.2 Required: 1. Mr. Roberts

![QUESTION THREE [10] Share Std Deviation Avg Return D:E Ratio A](https://s3.amazonaws.com/si.experts.images/answers/2024/07/669e69034d50b_603669e6903009a7.jpg)

QUESTION THREE [10] Share Std Deviation Avg Return D:E Ratio A 10% 11% 0.8 B 12% 11% 0.9 15% 14% 1.2 Required: 1. Mr. Roberts is a risk taker. Which share is he most likely to invest in and why? (2) 2. Mr. Jones is risk-averse. Which share is he most likely to invest in and why? (2) 3. Mr. Philips wants to make the best possible investment, regardless of risk. Advise him as to which share he should invest in. Provide any supporting calculations and comments which may be necessary. (4) 4. Define financial risk, and determine which share represents the company with the highest financial risk. (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts