Question: QUESTION THREE (17 Marks) On 1 July 2019 Prometheus Ltd acquired 90% of the shares of Unbound Ltd for $326 430. At this date the

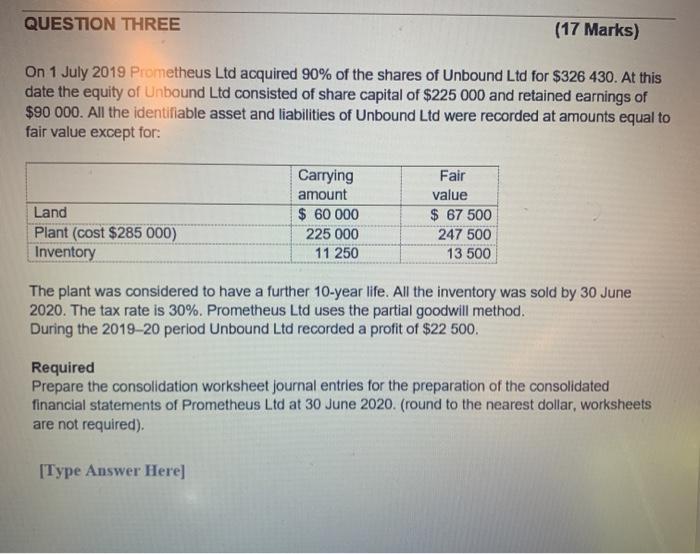

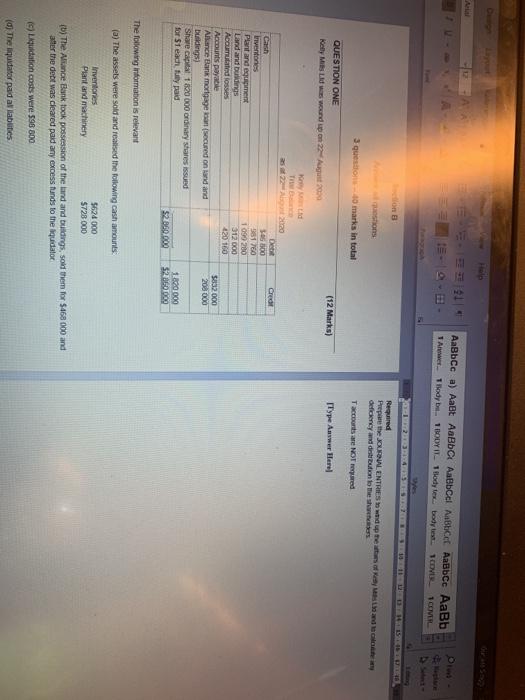

QUESTION THREE (17 Marks) On 1 July 2019 Prometheus Ltd acquired 90% of the shares of Unbound Ltd for $326 430. At this date the equity of Unbound Ltd consisted of share capital of $225 000 and retained earnings of $90 000. All the identifiable asset and liabilities of Unbound Ltd were recorded at amounts equal to fair value except for: Land Plant (cost $285 000) Inventory Carrying amount $ 60 000 225 000 11 250 Fair value $ 67 500 247 500 13 500 The plant was considered to have a further 10-year life. All the inventory was sold by 30 June 2020. The tax rate is 30%. Prometheus Ltd uses the partial goodwill method. During the 2019-20 period Unbound Ltd recorded a profit of $22 500. Required Prepare the consolidation worksheet Journal entries for the preparation of the consolidated financial statements of Prometheus Ltd at 30 June 2020. (round to the nearest dollar, worksheets are not required) [Type Answer Here] ) l ht 1 Awe Thodyb. 1 BODY L 1 Bodyte body OMR 1 Required Prepare the JOURNAL ENTRIES Swed up the sand deficiency and destrution to the share 3 question marks in total Taccontare NOT red QUESTION ONE Kelly MLS wound on 22 August 2009 (12 Marks) Type Anwwer level Ky Crede Cash Inventones Plant and equipment Land and buildings Accumulated fosses Accounts payable Allance Bank mortgage in (secured on and and buildings Share capital 1820 000 ordinary shares issued for $1 each fly paid De 305 300 381750 1090 280 312000 420 160 $32.000 200 000 $2860.000 1.620.000 200000 The following information is relevant (a) The assets were sold and realised the following cash amounts Inventaries Plant and machinery 5624 000 5728 000 (1) The Alunce Bank took possession of the land and buildings, sold them for $468 000 and ater the debt was cleared paid any excess funds to the liquidator (5) Liquidation costs were 598 800 (0) The liquidator pad al llaties QUESTION THREE (17 Marks) On 1 July 2019 Prometheus Ltd acquired 90% of the shares of Unbound Ltd for $326 430. At this date the equity of Unbound Ltd consisted of share capital of $225 000 and retained earnings of $90 000. All the identifiable asset and liabilities of Unbound Ltd were recorded at amounts equal to fair value except for: Land Plant (cost $285 000) Inventory Carrying amount $ 60 000 225 000 11 250 Fair value $ 67 500 247 500 13 500 The plant was considered to have a further 10-year life. All the inventory was sold by 30 June 2020. The tax rate is 30%. Prometheus Ltd uses the partial goodwill method. During the 2019-20 period Unbound Ltd recorded a profit of $22 500. Required Prepare the consolidation worksheet Journal entries for the preparation of the consolidated financial statements of Prometheus Ltd at 30 June 2020. (round to the nearest dollar, worksheets are not required) [Type Answer Here] ) l ht 1 Awe Thodyb. 1 BODY L 1 Bodyte body OMR 1 Required Prepare the JOURNAL ENTRIES Swed up the sand deficiency and destrution to the share 3 question marks in total Taccontare NOT red QUESTION ONE Kelly MLS wound on 22 August 2009 (12 Marks) Type Anwwer level Ky Crede Cash Inventones Plant and equipment Land and buildings Accumulated fosses Accounts payable Allance Bank mortgage in (secured on and and buildings Share capital 1820 000 ordinary shares issued for $1 each fly paid De 305 300 381750 1090 280 312000 420 160 $32.000 200 000 $2860.000 1.620.000 200000 The following information is relevant (a) The assets were sold and realised the following cash amounts Inventaries Plant and machinery 5624 000 5728 000 (1) The Alunce Bank took possession of the land and buildings, sold them for $468 000 and ater the debt was cleared paid any excess funds to the liquidator (5) Liquidation costs were 598 800 (0) The liquidator pad al llaties

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts