Question: QUESTION THREE (25 Marks) 3.1 Consider two projects whose cash inflows are not even. Assume that the project costs R205 000. The net cash inflows

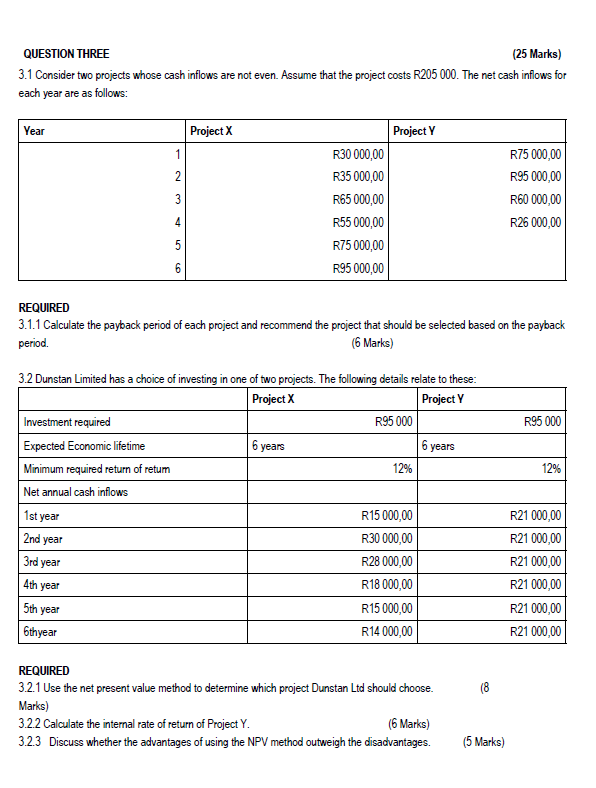

QUESTION THREE (25 Marks) 3.1 Consider two projects whose cash inflows are not even. Assume that the project costs R205 000. The net cash inflows for each year are as follows: REQUIRED 3.1.1 Calculate the payback period of each project and recommend the project that should be selected based on the payback period. (6 Marks) 3.2 Dunstan Limited has a choice of investing in one of two projects. The following details relate to these: REQUIRED 3.2.1 Use the net present value method to determine which project Dunstan Ltd should choose. \\( (8 \\) Marks) 3.2.2 Calculate the internal rate of return of Project \\( Y \\). (6 Marks) 3.2.3 Discuss whether the advantages of using the NPV method outweigh the disadvantages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts