Question: QUESTION THREE ( 4 0 MARKS ) You have recently been appointed as the management accountant of Sophvon ( Pty ) Ltd , a small

QUESTION THREE MARKS

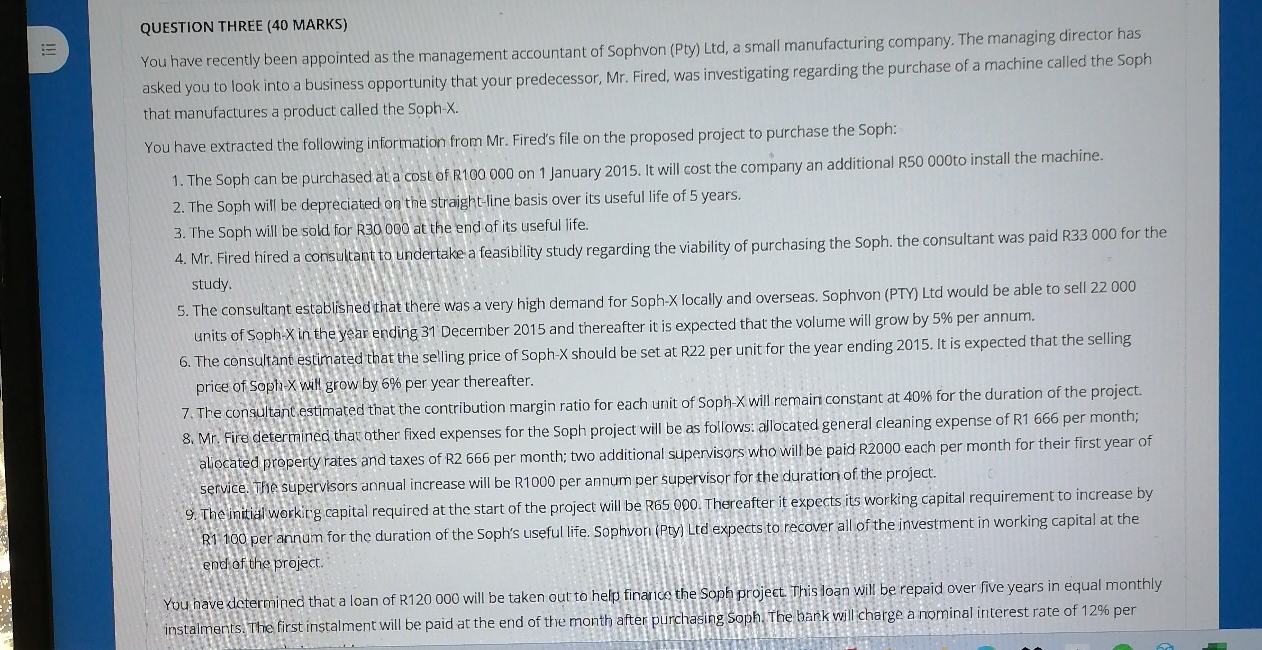

You have recently been appointed as the management accountant of Sophvon Pty Ltd a small manufacturing company. The managing director has asked you to look into a business opportunity that your predecessor, Mr Fired, was investigating regarding the purchase of a machine called the Soph that manufactures a product called the SophX

You have extracted the following information from Mr Fired's file on the proposed project to purchase the Soph:

The Soph can be purchased at a cost of R on January It will cost the company an additional R to install the machine.

The Soph will be depreciated on the straightline basis over its useful life of years.

The Soph will be sold for R at the end of its useful life.

Mr Fired hired a consultant to undertake a feasibility study regarding the viability of purchasing the Soph. the consultant was paid R for the study.

The consultant established that there was a very high demand for SophX locally and overseas. Sophvon PTY Ltd would be able to sell units of Soph in the Year ending December and thereafter it is expected that the volume will grow by per annum.

The consultant estimated that the selling price of SophX should be set at R per unit for the year ending It is expected that the selling price of SophX will grow by per year thereafter.

The consultant estimated that the contribution margin ratio for each unit of SophX will remain constant at for the duration of the project.

Mr Fire determined that other fixed expenses for the Soph project will be as follows: allocated general cleaning expense of R per month; aliocated property rates and taxes of R per month; two additional supervisors who will be paid R each per month for their first year of service. The supervisors annual increase will be R per annum per supervisor for the duration of the project.

The initial working capital required at the start of the project will be R Thereafter it expects its working capital requirement to increase by R per annum for the duration of the Soph's useful life. SophvorPty Ltd expects to recover all of the investment in working capital at the end of the project.

You have determined that a loan of R will be taken out to help finarice the Soph project. This loan will be repaid over five years in equal monthly instalments. The first instalment will be paid at the end of the month after purchasing Soph. The bark will charge a nominal interest rate of per

ADDITIONAL INFORMATION

Time left ::

Taxation should be ignored.

All the cashflows are assumed to occur at the end of the year, unless otherwise stated.

The company only accepts projects with a payback period less than years.

Sophvon PTY Ltds cost of capital is per annum.

REQUIRED

Calculate the monthlx repayments for the loan that will be taken out to help finance the Soph project. marks

Using Net Present Value analysis, determine whether Sophvon Pty Ltd should purchase the Soph on the January do not include reasons why you have exclude an outs from your calculations. marks

Briefly explain why you a befe extladed any amounts from the Net present value analysis under requirement above. marks

Using the paylack methed any age tash flow tetum and the internal rate of return methods advise the managing director of Sophvon Pty Ltd whether to invest in the dph mo inarks

For the purpose on this tequirentent and you must as sume the project's internal rate of return is and the net cash flows that result from purchasing the eph are:

YEAR OuR QCO punchase of Soph

YEAR : R

MEAR ZNA

YEAR B R

KEART : P:

YEAR

SHOWALL WORKNAGS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock