Question: Question Three 8 points Save FastDrive operates two divisions, a Rental Division that rents to individuals and an Anaconda Division that transports goods from one

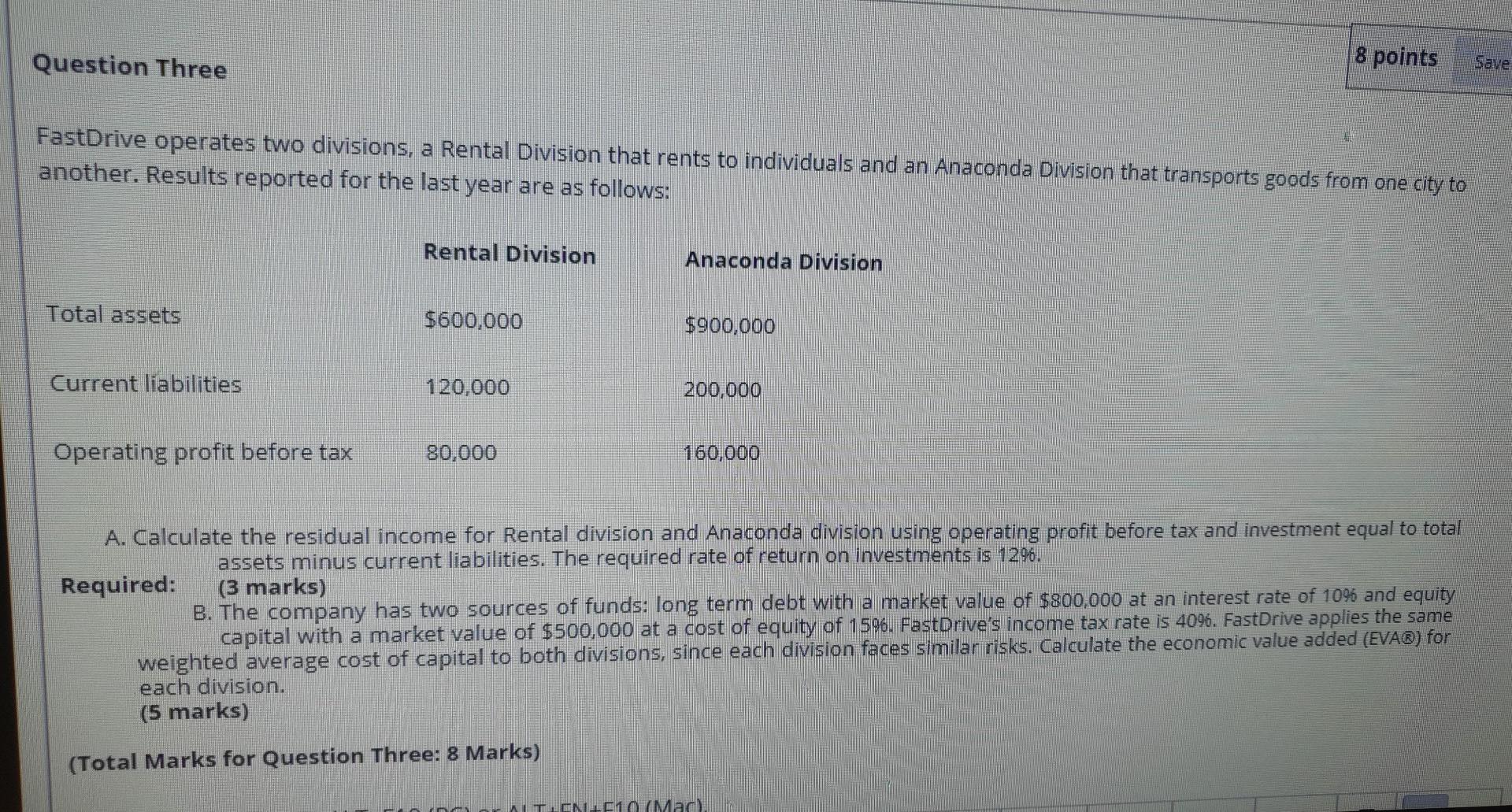

Question Three 8 points Save FastDrive operates two divisions, a Rental Division that rents to individuals and an Anaconda Division that transports goods from one city to another. Results reported for the last year are as follows: Rental Division Anaconda Division Total assets $600,000 $900,000 Current liabilities 120,000 200,000 Operating profit before tax 80,000 160,000 A. Calculate the residual income for Rental division and Anaconda division using operating profit before tax and investment equal to total assets minus current liabilities. The required rate of return on investments is 129. Required: (3 marks) B. The company has two sources of funds: long term debt with a market value of $800,000 at an interest rate of 1096 and equity capital with a market value of $500,000 at a cost of equity of 15%. FastDrive's income tax rate is 4096. FastDrive applies the same weighted average cost of capital to both divisions, since each division faces similar risks. Calculate the economic value added (EVA) for each division. (5 marks) (Total Marks for Question Three: 8 Marks) CN-E1 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts