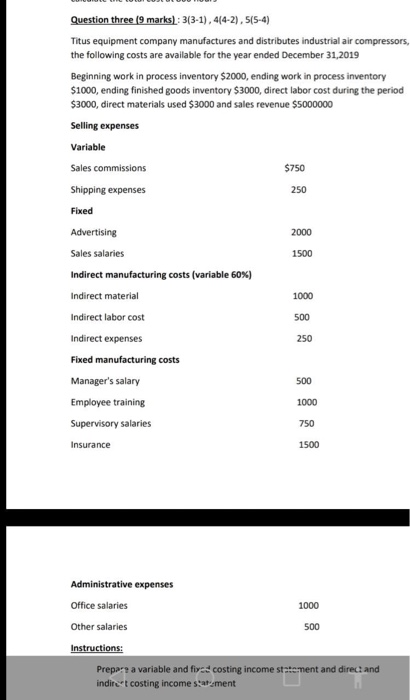

Question: Question three (9 marks) : 3(3-1), 4(4-2), 5(5-4) Titus equipment company manufactures and distributes industrial air compressors, the following costs are available for the year

Question three (9 marks) : 3(3-1), 4(4-2), 5(5-4) Titus equipment company manufactures and distributes industrial air compressors, the following costs are available for the year ended December 31,2019 Beginning work in process inventory $2000, ending work in process inventory $1000, ending finished goods inventory $3000, direct labor cost during the period $3000, direct materials used $3000 and sales revenue $5000000 Selling expenses Variable Sales commissions $750 Shipping expenses 250 Fixed 2000 1500 1000 500 Advertising Sales salaries Indirect manufacturing costs (variable 60%) Indirect material Indirect labor cost Indirect expenses Fixed manufacturing costs Manager's salary Employee training Supervisory salaries 250 500 1000 750 Insurance 1500 Administrative expenses Office salaries Other salaries 1000 500 Instructions: Prepare a variable and five costing income statement and direct and indiret costing income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts